Market Volatility: S&P 500 And Nasdaq Losses Amidst Rising Interest Rates And Geopolitical Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: S&P 500 and Nasdaq Losses Amidst Rising Interest Rates and Geopolitical Risks

The stock market experienced a significant downturn this week, with the S&P 500 and Nasdaq Composite suffering notable losses. This volatility is largely attributed to a confluence of factors, primarily rising interest rates and escalating geopolitical risks. Investors are grappling with uncertainty, leading to a sell-off in equities across various sectors.

Rising Interest Rates: A Major Headwind

The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes continue to exert pressure on the market. Higher interest rates increase borrowing costs for businesses, impacting investment and potentially slowing economic growth. This, in turn, reduces the attractiveness of stocks, as bonds become more appealing with their higher yields. The recent interest rate increase, coupled with projections for further hikes in the coming months, has fueled investor anxiety and contributed significantly to the market's decline. Understanding the is crucial for navigating these turbulent times.

Geopolitical Instability Adds to the Pressure

Adding to the economic anxieties are escalating geopolitical tensions. The ongoing conflict in Ukraine, coupled with rising tensions in other regions, creates uncertainty and fuels risk aversion among investors. Geopolitical instability often leads to disruptions in global supply chains and increased energy prices, further impacting economic growth and market sentiment. This uncertainty is a major contributing factor to the current market volatility. Staying informed about is essential for informed investing.

S&P 500 and Nasdaq Losses: A Closer Look

The S&P 500, a broad market index, experienced a [percentage]% drop this week, while the Nasdaq Composite, heavily weighted in technology stocks, saw an even steeper decline of [percentage]%. This disparity highlights the sector-specific impact of rising interest rates, as growth stocks, often found in the tech sector, are particularly sensitive to changes in borrowing costs.

What Does This Mean for Investors?

The current market volatility presents both challenges and opportunities for investors. For long-term investors, this downturn could represent a buying opportunity, particularly for those with a high risk tolerance. However, it's crucial to remember that market timing is notoriously difficult, and short-term fluctuations are a normal part of the market cycle.

Here are some key considerations for investors:

- Diversification: Maintain a well-diversified portfolio across different asset classes to mitigate risk.

- Risk Tolerance: Assess your own risk tolerance and adjust your investment strategy accordingly.

- Long-Term Perspective: Focus on your long-term investment goals and avoid making impulsive decisions based on short-term market fluctuations.

- Professional Advice: Consider seeking advice from a qualified financial advisor to help navigate the complexities of the market.

Looking Ahead:

The coming weeks and months will likely continue to see market volatility as investors grapple with rising interest rates and geopolitical uncertainties. Keeping a close eye on economic indicators, interest rate decisions, and global events will be crucial for making informed investment decisions. Staying informed and adapting your strategy as needed is key to weathering this storm. Remember to consult with a financial professional before making any significant investment decisions.

Keywords: Market Volatility, S&P 500, Nasdaq, Interest Rates, Geopolitical Risks, Stock Market, Investment, Federal Reserve, Inflation, Economic Growth, Portfolio Diversification, Risk Tolerance, Financial Advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: S&P 500 And Nasdaq Losses Amidst Rising Interest Rates And Geopolitical Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Discrepancy Revealed Tulsi Gabbards Stance Vs Trumps Intelligence Network

Jun 21, 2025

Discrepancy Revealed Tulsi Gabbards Stance Vs Trumps Intelligence Network

Jun 21, 2025 -

Harry Kane Boca Juniors Fans And Club World Cup Challenge Await

Jun 21, 2025

Harry Kane Boca Juniors Fans And Club World Cup Challenge Await

Jun 21, 2025 -

Ryan Presslys Save Astros Snatch Victory From Pirates

Jun 21, 2025

Ryan Presslys Save Astros Snatch Victory From Pirates

Jun 21, 2025 -

Whats At Stake Examining Trumps Targeting Of Climate Experts This Summer

Jun 21, 2025

Whats At Stake Examining Trumps Targeting Of Climate Experts This Summer

Jun 21, 2025 -

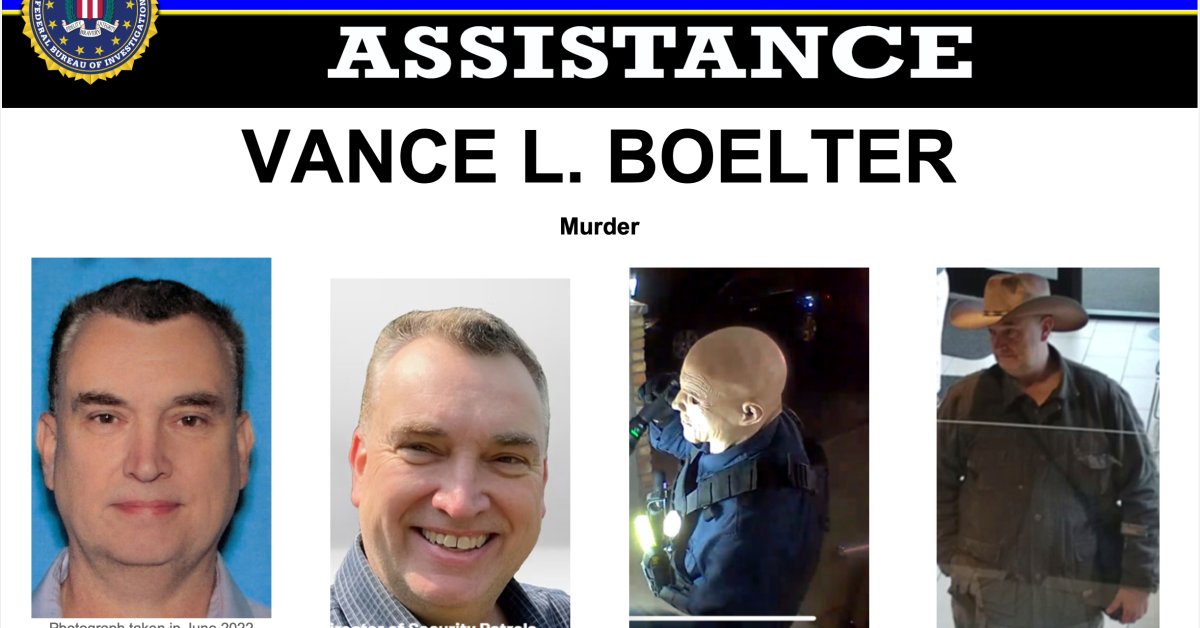

Who Is Vance L Boelter Details Emerge After Arrest In Minnesota Shooting Case

Jun 21, 2025

Who Is Vance L Boelter Details Emerge After Arrest In Minnesota Shooting Case

Jun 21, 2025