Market Update: S&P 500, Nasdaq Fall As Trump's Iran Actions Fuel Investor Anxiety

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: S&P 500, Nasdaq Fall as Trump's Iran Actions Fuel Investor Anxiety

Tensions in the Middle East send shockwaves through global markets, leaving investors on edge.

The already volatile stock market experienced a significant downturn on Tuesday, with the S&P 500 and Nasdaq falling sharply following President Trump's announcement of further actions against Iran. The escalating tensions in the Middle East have injected a significant dose of uncertainty into the market, prompting investors to flee riskier assets. This sudden shift underscores the delicate balance of global markets and the profound impact of geopolitical events on investor sentiment.

The S&P 500, a broad measure of the US stock market, closed down [insert percentage]% while the tech-heavy Nasdaq Composite experienced a similar decline of [insert percentage]%. This marks a significant reversal from the recent period of relative stability, raising concerns about a potential broader market correction. Energy stocks were particularly hard hit, reflecting anxieties surrounding potential disruptions to oil supplies.

Understanding the Market Reaction

The market's reaction is a direct consequence of the increased uncertainty surrounding the geopolitical situation. President Trump's recent decisions regarding Iran have raised fears of potential military escalation and further disruption to global oil markets. This uncertainty creates a climate of risk aversion, leading investors to move their money into safer havens like government bonds.

- Increased Oil Prices: The potential for conflict in the Middle East typically leads to increased oil prices, impacting inflation and corporate profitability. This is a major concern for investors as higher energy costs can eat into company margins.

- Geopolitical Uncertainty: Beyond oil, the broader geopolitical uncertainty stemming from the Iran situation creates a sense of unease, making it difficult for investors to predict future market movements. This lack of clarity fuels volatility.

- Flight to Safety: Investors are increasingly seeking safety, shifting their investments away from stocks and into less volatile assets like government bonds, pushing yields down. This "flight to safety" is a classic indicator of market anxiety.

What This Means for Investors

The current market downturn highlights the importance of diversification and a well-defined investment strategy. Investors should carefully review their portfolios and consider adjusting their holdings based on their risk tolerance. This volatile period underscores the need for:

- Diversification: Spreading your investments across different asset classes can help mitigate the impact of any single event.

- Long-Term Perspective: While short-term market fluctuations can be alarming, it's crucial to maintain a long-term perspective and avoid making rash decisions based on immediate market reactions.

- Risk Assessment: Regularly assess your risk tolerance and adjust your investment strategy accordingly.

Looking Ahead

The coming days and weeks will be crucial in determining the market's trajectory. The situation in the Middle East remains fluid, and any further escalation could lead to further market volatility. Closely monitoring geopolitical developments and economic indicators is vital for investors navigating this uncertain period. Experts suggest staying informed through reliable financial news sources and potentially consulting a financial advisor to adjust your investment strategy based on your specific needs and risk tolerance.

Disclaimer: This article provides general information and should not be considered financial advice. Investing involves risk, and past performance is not indicative of future results. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: S&P 500, Nasdaq Fall As Trump's Iran Actions Fuel Investor Anxiety. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

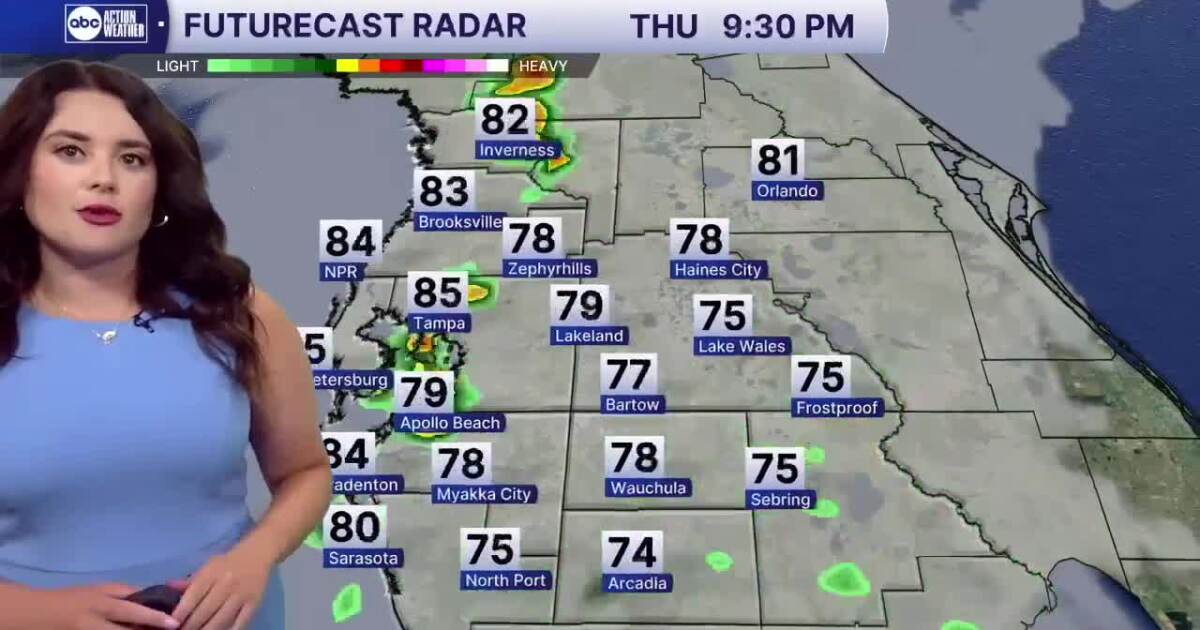

Muggy Conditions And Afternoon Showers Predicted In Todays Forecast

Jun 21, 2025

Muggy Conditions And Afternoon Showers Predicted In Todays Forecast

Jun 21, 2025 -

Stock Market Plunge S And P 500 And Nasdaq Drop On Fed Rate Hike Fears And Iran Tensions

Jun 21, 2025

Stock Market Plunge S And P 500 And Nasdaq Drop On Fed Rate Hike Fears And Iran Tensions

Jun 21, 2025 -

Afternoon Showers And High Humidity Predicted Check Todays Weather Forecast

Jun 21, 2025

Afternoon Showers And High Humidity Predicted Check Todays Weather Forecast

Jun 21, 2025 -

Why Are Nighttime Thunderstorms Common In Tampa Bay

Jun 21, 2025

Why Are Nighttime Thunderstorms Common In Tampa Bay

Jun 21, 2025 -

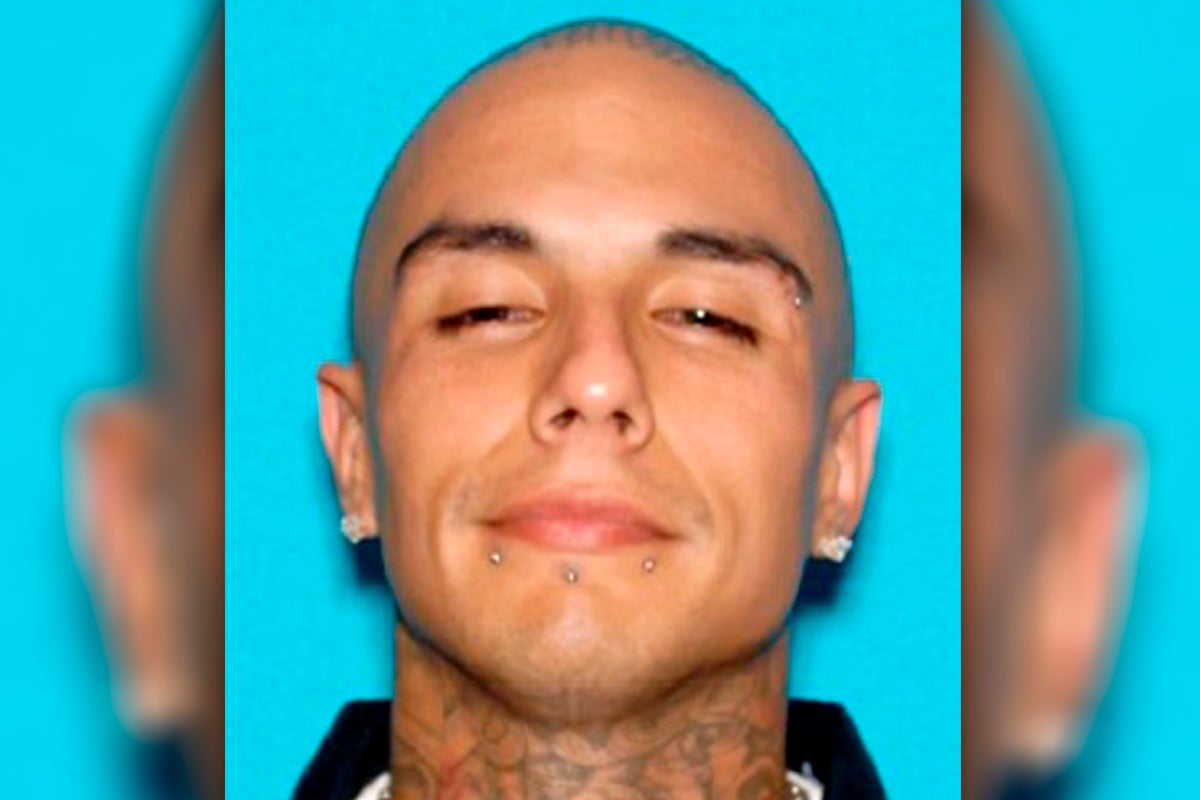

Mexican Mafia Plot To Kill Rapper 19 Associates Charged

Jun 21, 2025

Mexican Mafia Plot To Kill Rapper 19 Associates Charged

Jun 21, 2025