Market Update: S&P 500, Dow, And Nasdaq Rise, Ignoring Moody's Negative Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: S&P 500, Dow, and Nasdaq Ignore Moody's Downgrade, Rally Higher

Wall Street shrugs off Moody's negative outlook, with major indices enjoying a strong upward surge. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed higher on Tuesday, defying a pessimistic assessment from credit rating agency Moody's. This unexpected market resilience raises questions about the current economic climate and investor sentiment.

The rally comes on the heels of Moody's decision to downgrade the credit ratings of several small and mid-sized US banks, citing concerns about the potential for further economic slowdown and rising loan defaults. This action sent ripples through the financial sector earlier in the week, prompting fears of a broader market correction. However, Tuesday's trading session paints a different picture, showcasing the market's capacity to absorb negative news and maintain a positive trajectory.

A Closer Look at the Numbers:

- S&P 500: Closed up [Insert Percentage]% at [Insert Closing Value].

- Dow Jones Industrial Average: Closed up [Insert Percentage]% at [Insert Closing Value].

- Nasdaq Composite: Closed up [Insert Percentage]% at [Insert Closing Value].

This upward movement suggests a degree of investor confidence that may be at odds with Moody's cautious outlook. Several factors could be contributing to this apparent disconnect.

Reasons Behind the Market's Resilience:

-

Strong Corporate Earnings: Recent earnings reports from major corporations have, in many cases, exceeded expectations, bolstering investor optimism. This positive news flow may be outweighing the negative sentiment generated by Moody's downgrade. [Link to a reputable source on recent corporate earnings reports].

-

Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively robust in key sectors. This suggests continued economic activity, even in the face of potential headwinds. [Link to a relevant economic report on consumer spending].

-

Federal Reserve's Influence: While the Federal Reserve's monetary policy remains a key factor influencing market performance, recent statements haven't signaled an immediate shift toward significantly more aggressive interest rate hikes. This relative stability might be contributing to the market's resilience. [Link to a news article discussing recent Federal Reserve statements].

-

Market Sentiment and Speculation: It's also crucial to consider the role of market sentiment and speculation. Investors may be anticipating further positive news or simply betting against the negative forecast offered by Moody's. This underscores the inherently unpredictable nature of the stock market.

What This Means for Investors:

The market's response to Moody's downgrade highlights the complexity of predicting market movements. While Moody's assessment raises valid concerns about the banking sector and the broader economy, the market's upward trajectory suggests a level of resilience. However, investors should remain cautious and continue to monitor economic indicators closely. Diversification remains a key strategy for mitigating risk.

Disclaimer: This article provides general market commentary and does not constitute financial advice. Consult a qualified financial advisor before making any investment decisions.

Stay Informed:

For further insights into the market and the latest financial news, be sure to check back regularly for updates and subscribe to our newsletter [Link to Newsletter Signup]. Understanding the interplay of economic factors and investor sentiment is crucial for navigating the ever-changing world of finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: S&P 500, Dow, And Nasdaq Rise, Ignoring Moody's Negative Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Helldivers 2 Masters Of Ceremony Warbond Rewards Available May 15th

May 20, 2025

Helldivers 2 Masters Of Ceremony Warbond Rewards Available May 15th

May 20, 2025 -

Spains New Tourism Law 65 000 Illegal Holiday Rentals Affected

May 20, 2025

Spains New Tourism Law 65 000 Illegal Holiday Rentals Affected

May 20, 2025 -

Tom Aspinall Talks Stall Jon Jones Hints At Retirement Ufc Fans React

May 20, 2025

Tom Aspinall Talks Stall Jon Jones Hints At Retirement Ufc Fans React

May 20, 2025 -

The Future Of American Energy Assessing The Economic Impact Of Clean Energy Tax Policies

May 20, 2025

The Future Of American Energy Assessing The Economic Impact Of Clean Energy Tax Policies

May 20, 2025 -

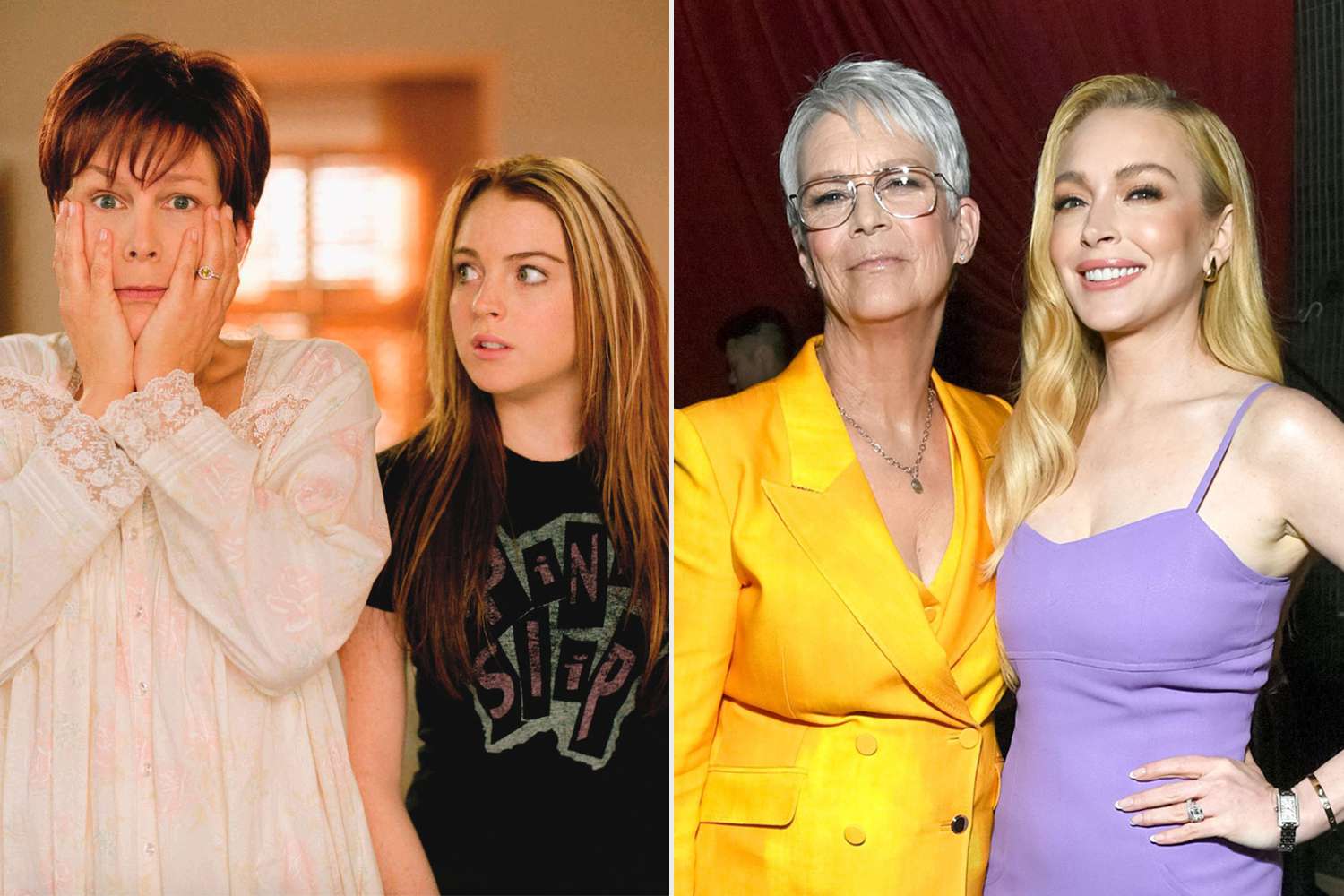

Freaky Friday Reunion Jamie Lee Curtis Talks About Her Relationship With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Talks About Her Relationship With Lindsay Lohan

May 20, 2025