Market Update: S&P 500 And Nasdaq Lower As Investors Weigh Fed Policy And Geopolitical Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: S&P 500 and Nasdaq Dip as Investors Wrestle with Fed Policy and Geopolitical Uncertainty

Stocks experienced a downturn today, with the S&P 500 and Nasdaq Composite falling as investors grapple with the ongoing uncertainty surrounding Federal Reserve monetary policy and escalating geopolitical risks. The market's reaction underscores the delicate balance between economic growth and inflation, leaving many wondering what the future holds for equities.

The S&P 500 closed down [Insert Percentage]% at [Insert Closing Value], while the tech-heavy Nasdaq Composite fell [Insert Percentage]% to [Insert Closing Value]. This decline follows a period of relative market stability, highlighting the sensitivity of investor sentiment to both domestic and international developments.

The Fed's Tightrope Walk:

The Federal Reserve's recent interest rate hikes, aimed at curbing inflation, are a primary driver of market volatility. Investors are anxiously awaiting further indications of the Fed's future policy trajectory. Will they maintain their aggressive stance, potentially triggering a recession? Or will they pivot towards a more dovish approach, risking a further surge in inflation? This uncertainty is fueling considerable market apprehension. Analysts are closely examining economic indicators like inflation data and employment figures to predict the Fed's next move. [Link to relevant article about Fed policy].

Geopolitical Headwinds:

Adding to the market's woes are rising geopolitical tensions. The ongoing conflict in [mention specific geopolitical event, e.g., Ukraine] continues to create economic ripple effects, impacting energy prices and global supply chains. This uncertainty creates a risk-off environment, prompting investors to seek safer havens and reducing their appetite for riskier assets like stocks. [Link to relevant news article on the geopolitical event].

Sector-Specific Performance:

The decline wasn't uniform across all sectors. Technology stocks, particularly sensitive to interest rate changes, bore the brunt of the sell-off. [Mention specific technology stocks and their performance]. Conversely, [mention sectors that performed relatively better and why]. This divergence highlights the varying levels of risk tolerance within different market segments.

What's Next for Investors?

The current market conditions present a challenge for investors. Navigating this period of uncertainty requires a careful and considered approach. Diversification remains key, as does a long-term investment strategy. Investors should consider their risk tolerance and adjust their portfolios accordingly. Consulting with a financial advisor can provide valuable guidance in making informed investment decisions during these volatile times. [Link to resource on investment strategies].

Key Takeaways:

- S&P 500 and Nasdaq experienced declines: Reflecting investor concerns.

- Fed policy uncertainty: Remains a major market driver.

- Geopolitical risks: Contribute to market volatility.

- Sector-specific performance varied: Highlighting market nuances.

- Diversification and long-term strategies: Are crucial for investors.

This market downturn serves as a reminder of the inherent risks associated with investing in equities. While the short-term outlook may appear uncertain, maintaining a long-term perspective and a well-diversified portfolio can help mitigate risk and potentially capitalize on future opportunities. Stay informed, stay adaptable, and consult with financial professionals for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: S&P 500 And Nasdaq Lower As Investors Weigh Fed Policy And Geopolitical Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cnn Sources Tulsi Gabbards Views Clash With Trumps Intel Team

Jun 21, 2025

Cnn Sources Tulsi Gabbards Views Clash With Trumps Intel Team

Jun 21, 2025 -

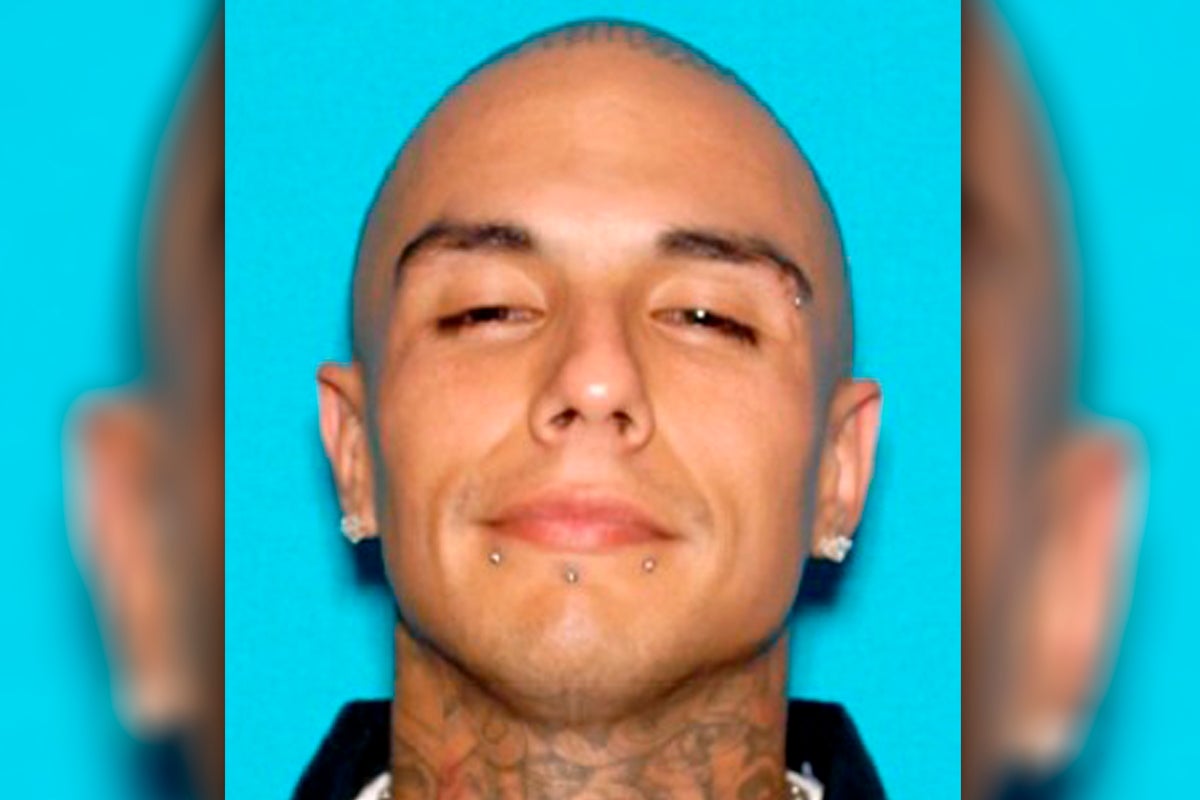

19 Mexican Mafia Members Face Murder Conspiracy Charges In Swifty Blue Case

Jun 21, 2025

19 Mexican Mafia Members Face Murder Conspiracy Charges In Swifty Blue Case

Jun 21, 2025 -

Major Bust 19 Mexican Mafia Associates Face Charges In Rappers Murder Plot

Jun 21, 2025

Major Bust 19 Mexican Mafia Associates Face Charges In Rappers Murder Plot

Jun 21, 2025 -

Rival Executives Bold Proposal Kyle Tucker In Red Sox Trade Deadline Deal

Jun 21, 2025

Rival Executives Bold Proposal Kyle Tucker In Red Sox Trade Deadline Deal

Jun 21, 2025 -

Jaws Impact How The Film Harmed Marine Conservation Efforts

Jun 21, 2025

Jaws Impact How The Film Harmed Marine Conservation Efforts

Jun 21, 2025