Market Surge: S&P 500 Recovers 2023 Losses On Nvidia-Led Tech Boom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Surge: S&P 500 Recovers 2023 Losses on Nvidia-Led Tech Boom

The S&P 500 has officially erased its 2023 losses, marking a stunning recovery fueled by the explosive growth of the technology sector, particularly the AI-powered surge led by Nvidia. This remarkable turnaround signifies a potential shift in market sentiment and underscores the immense influence of artificial intelligence on the global economy.

Nvidia's Stellar Performance Drives the Rally

Nvidia's phenomenal performance has been the undisputed catalyst for this market surge. The company's stock price has soared this year, driven by unprecedented demand for its high-performance GPUs, crucial components powering the burgeoning artificial intelligence industry. This performance has not only boosted Nvidia's own market capitalization but has also triggered a broader rally in the tech sector, pulling the S&P 500 along for the ride. Analysts attribute this to the ripple effect of Nvidia's success, impacting related companies involved in semiconductor manufacturing, AI software development, and cloud computing.

Beyond Nvidia: A Broader Tech Sector Rebound

While Nvidia's success is undeniable, the S&P 500's recovery is not solely attributable to a single company. Other tech giants have also seen significant growth, contributing to the overall market rebound. This broader tech sector resurgence signals a renewed investor confidence in the long-term potential of technological innovation. Factors contributing to this include:

- Increased AI investment: Major corporations across various sectors are investing heavily in AI technologies, driving demand for related hardware and software.

- Positive economic indicators: While inflation remains a concern, recent economic data points to a degree of resilience in the US economy, bolstering investor sentiment.

- Interest rate expectations: The Federal Reserve's recent pause on interest rate hikes has eased concerns about aggressive monetary tightening, fostering a more positive market environment.

What Does This Mean for Investors?

The S&P 500's recovery presents both opportunities and challenges for investors. While the current market sentiment is positive, it's crucial to approach investment decisions with caution. The tech sector's rapid growth could be subject to corrections, and diversifying investments remains a vital strategy for mitigating risk. Consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals.

Looking Ahead: Sustainability and Potential Challenges

The long-term sustainability of this market surge hinges on several factors. Continued innovation in the AI sector, stable economic growth, and responsible management of inflation will all play a crucial role in maintaining the positive momentum. However, potential headwinds remain, including:

- Geopolitical uncertainty: Global events can significantly impact market stability.

- Regulatory scrutiny: Increased regulatory oversight of the tech sector could impact growth.

- Supply chain disruptions: Ongoing supply chain challenges could hinder production and innovation.

Conclusion:

The S&P 500's recovery, largely driven by the Nvidia-led tech boom, is a significant development in the financial markets. While the future remains uncertain, this remarkable turnaround highlights the transformative power of artificial intelligence and the potential for continued growth in the technology sector. However, investors are urged to maintain a balanced perspective and consider the potential risks involved before making any investment decisions. Staying informed about market trends and consulting with financial professionals is crucial for navigating this dynamic market environment. Learn more about [link to relevant financial news website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Surge: S&P 500 Recovers 2023 Losses On Nvidia-Led Tech Boom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

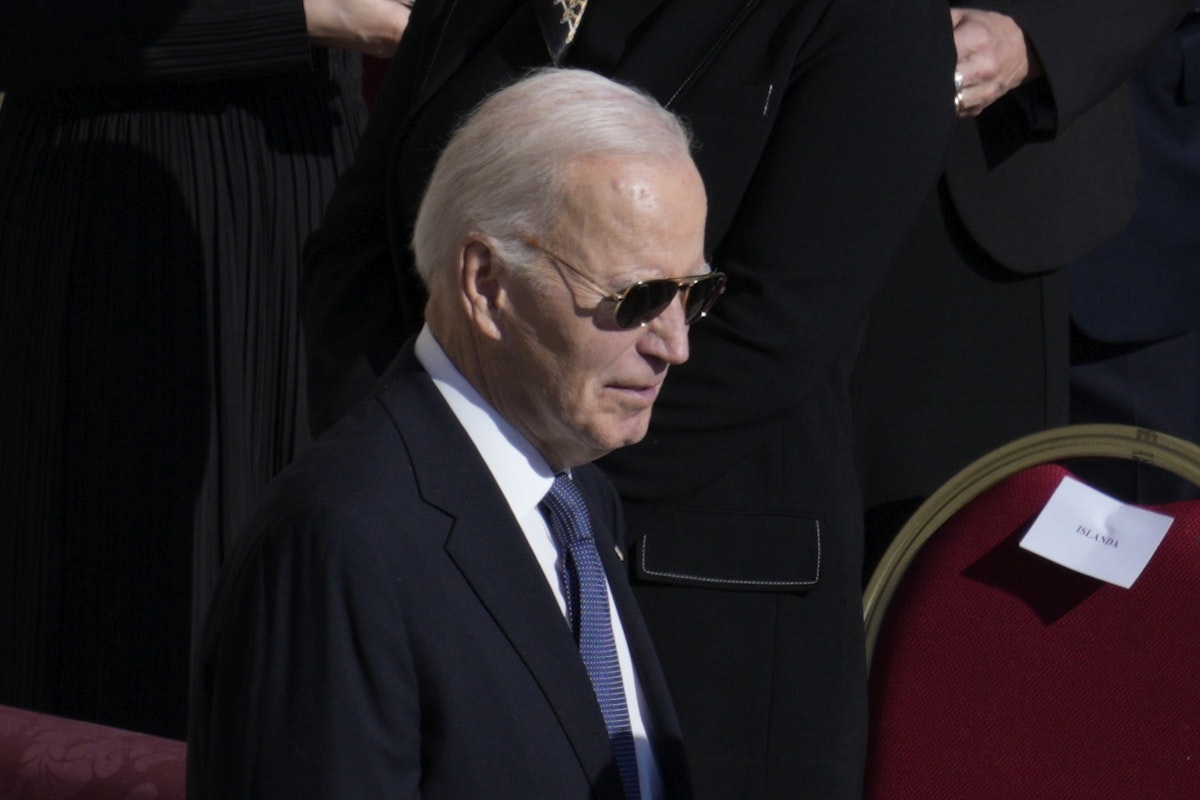

Reports Indicate Worsening Cognitive Decline In President Biden

May 14, 2025

Reports Indicate Worsening Cognitive Decline In President Biden

May 14, 2025 -

Tech Layoffs In Seattle Thousands Lose Jobs Amidst Economic Uncertainty

May 14, 2025

Tech Layoffs In Seattle Thousands Lose Jobs Amidst Economic Uncertainty

May 14, 2025 -

Mother Convicted Multiple Sexual Encounters With Minor Detailed

May 14, 2025

Mother Convicted Multiple Sexual Encounters With Minor Detailed

May 14, 2025 -

Trade War Update Us China Reach Agreement On Tariff Suspension

May 14, 2025

Trade War Update Us China Reach Agreement On Tariff Suspension

May 14, 2025 -

Jameer Nelson Promoted New Assistant Gm Role With Philadelphia 76ers

May 14, 2025

Jameer Nelson Promoted New Assistant Gm Role With Philadelphia 76ers

May 14, 2025