Market Reversal: S&P 500 Recovers 2023 Losses Thanks To Tech Sector

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reversal: S&P 500 Recovers 2023 Losses, Fueled by Tech Sector Surge

The S&P 500 has staged a remarkable comeback, erasing all its losses from earlier in 2023, a feat largely attributed to the explosive growth of the technology sector. This unexpected market reversal has left investors both surprised and optimistic, sparking debates about the future trajectory of the market. But what drove this significant shift, and what does it mean for the average investor?

Tech Giants Lead the Charge

The resurgence of the S&P 500 is undeniably linked to the stellar performance of tech giants like Apple, Microsoft, and Nvidia. These companies, fueled by strong AI-related investments and continued demand for their products and services, have seen their stock prices soar, pulling the overall market upward. The impressive performance of the tech sector is a clear indication of investor confidence in innovation and future growth potential within the industry. This surge in tech stocks represents a significant shift from the bearish sentiment that dominated the market earlier in the year.

Factors Contributing to the Market Reversal:

Several contributing factors have fueled this impressive market reversal beyond the tech boom:

- Easing Inflation Concerns: While inflation remains a concern, recent economic data suggests a potential cooling, leading to speculation that the Federal Reserve may slow its pace of interest rate hikes. This positive outlook has boosted investor sentiment.

- Strong Corporate Earnings: Many companies have reported stronger-than-expected earnings, demonstrating resilience in the face of economic headwinds. This positive news has reassured investors about the underlying strength of the economy.

- Improved Consumer Confidence: While still cautious, consumer confidence indicators have shown some improvement, suggesting increased spending and economic activity. This renewed consumer spending fuels business growth and market confidence.

- Geopolitical Stability (relative): While geopolitical uncertainties persist, the absence of major escalations in key global conflicts has provided a degree of stability, allowing investors to focus on domestic economic factors.

What Does This Mean for Investors?

This market rebound presents both opportunities and challenges for investors. While the current upward trend is encouraging, it's crucial to remember that market volatility is inherent. Investors should:

- Diversify their portfolios: Avoid over-reliance on any single sector, particularly the tech sector, given its recent dominance. Diversification mitigates risk and ensures a more balanced investment strategy.

- Maintain a long-term perspective: Short-term market fluctuations are common. Focus on your long-term financial goals rather than reacting to daily market movements.

- Consult a financial advisor: A professional can provide personalized advice based on your individual risk tolerance and financial goals.

Looking Ahead: Sustainability and Potential Risks

While the current market recovery is impressive, its sustainability remains uncertain. Several potential risks could impact future performance, including:

- Persistently High Inflation: If inflation remains stubbornly high, the Federal Reserve may continue aggressive interest rate hikes, potentially dampening economic growth and market performance.

- Geopolitical Unrest: Escalations in global conflicts could introduce significant market volatility.

- Recessionary Fears: Despite recent positive data, concerns about a potential recession persist.

Conclusion:

The S&P 500's recovery from its 2023 lows, largely driven by the tech sector's strong performance, offers a glimmer of hope for investors. However, it's crucial to approach this market reversal with a balanced perspective, acknowledging both the opportunities and inherent risks. Careful planning, diversification, and professional guidance are essential for navigating this dynamic market environment. Staying informed about economic indicators and geopolitical events will be crucial for making informed investment decisions. Remember to consult with a financial advisor before making any major investment changes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reversal: S&P 500 Recovers 2023 Losses Thanks To Tech Sector. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Flyers Rebuild Rick Tocchet Hired As Head Coach

May 14, 2025

Flyers Rebuild Rick Tocchet Hired As Head Coach

May 14, 2025 -

Sigue El Minuto A Minuto Villarreal Leganes La Liga Ea Sports

May 14, 2025

Sigue El Minuto A Minuto Villarreal Leganes La Liga Ea Sports

May 14, 2025 -

Thousands Facing Unemployment Seattle Tech Companys Massive Job Cuts

May 14, 2025

Thousands Facing Unemployment Seattle Tech Companys Massive Job Cuts

May 14, 2025 -

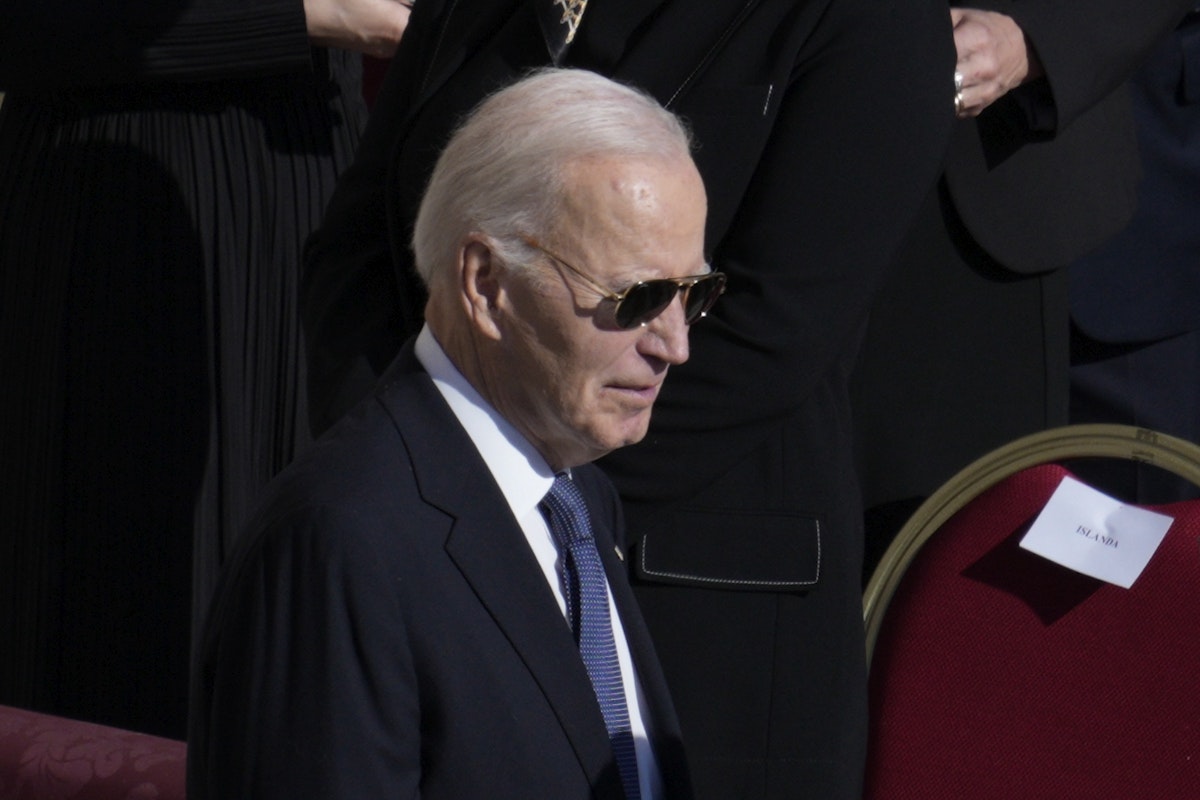

Biden Health Concerns Staffers Report Worsening Condition

May 14, 2025

Biden Health Concerns Staffers Report Worsening Condition

May 14, 2025 -

Boston Bruins Coaching Search Meet The Top Four Contenders

May 14, 2025

Boston Bruins Coaching Search Meet The Top Four Contenders

May 14, 2025