Market Reversal: S&P 500 Recovers 2023 Losses On Nvidia Strength

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reversal: S&P 500 Recovers 2023 Losses on Nvidia Strength

The S&P 500 has staged a remarkable comeback, erasing all its losses for 2023, fueled largely by the stellar performance of tech giant Nvidia. This unexpected market reversal has sent shockwaves through Wall Street, leaving investors scrambling to understand the driving forces behind this dramatic shift. But is this a sustainable trend, or just a temporary blip in a longer-term market correction?

Nvidia's Meteoric Rise: The Catalyst for Market Reversal

Nvidia's exceptional second-quarter earnings report, significantly exceeding analysts' expectations, acted as a powerful catalyst. The company's dominance in the artificial intelligence (AI) sector, particularly with its high-demand graphics processing units (GPUs), propelled its stock price to record highs. This surge in Nvidia's value injected significant positive momentum into the broader market, pulling the S&P 500 along with it. The sheer magnitude of Nvidia's growth overshadowed concerns about rising interest rates and persistent inflation, temporarily calming investor anxieties.

Beyond Nvidia: Other Contributing Factors

While Nvidia's performance played a pivotal role, other factors contributed to this market reversal:

- Stronger-than-expected economic data: Recent economic indicators, such as improved consumer spending and a resilient labor market, have fueled optimism about the economy's resilience. This has helped boost investor confidence.

- Easing inflation concerns: Although inflation remains a concern, recent data suggests a potential slowdown, leading some analysts to believe the Federal Reserve may be nearing the end of its interest rate hiking cycle. This prospect has calmed fears of a prolonged economic downturn.

- Increased investor appetite for risk: The positive economic signals and Nvidia's success have emboldened investors to take on more risk, leading to increased investment in the stock market.

Is This a Sustainable Trend? Analyzing the Market's Future

While the market's recovery is undeniably impressive, it's crucial to approach this bullish sentiment with caution. The reliance on a single company, however dominant, to drive such a significant market turnaround raises concerns about potential vulnerability. Several factors could still negatively impact the market:

- Geopolitical instability: Ongoing geopolitical tensions and uncertainties remain significant risks that could trigger market volatility.

- Persistent inflation: Even with signs of slowing inflation, the persistent pressure on prices could still impact consumer spending and corporate profits.

- Interest rate hikes: The Federal Reserve's future actions regarding interest rates remain uncertain, and further rate hikes could dampen market enthusiasm.

What Investors Should Do Now:

The current market situation presents both opportunities and challenges for investors. It's vital to maintain a diversified portfolio, avoiding overexposure to any single sector or company. Thorough due diligence and a long-term investment strategy are crucial in navigating the current market landscape. Considering consulting with a financial advisor to develop a personalized investment plan tailored to your risk tolerance and financial goals is highly recommended.

Keywords: S&P 500, Market Reversal, Nvidia, Stock Market, AI, Artificial Intelligence, GPU, Earnings Report, Economic Data, Inflation, Interest Rates, Investment Strategy, Market Volatility, Financial Advisor

Internal Links (Hypothetical - replace with actual links to relevant articles on your site):

- [Link to article about AI investment opportunities]

- [Link to article on managing investment risk]

External Links (Hypothetical - Replace with relevant links):

- [Link to S&P 500 index data]

- [Link to Nvidia's investor relations page]

Call to Action (subtle): Stay informed about the latest market developments by subscribing to our newsletter for regular updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reversal: S&P 500 Recovers 2023 Losses On Nvidia Strength. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Saudi Arabia Receives 18 000 Nvidia Ai Chips Implications For Ai Development

May 14, 2025

Saudi Arabia Receives 18 000 Nvidia Ai Chips Implications For Ai Development

May 14, 2025 -

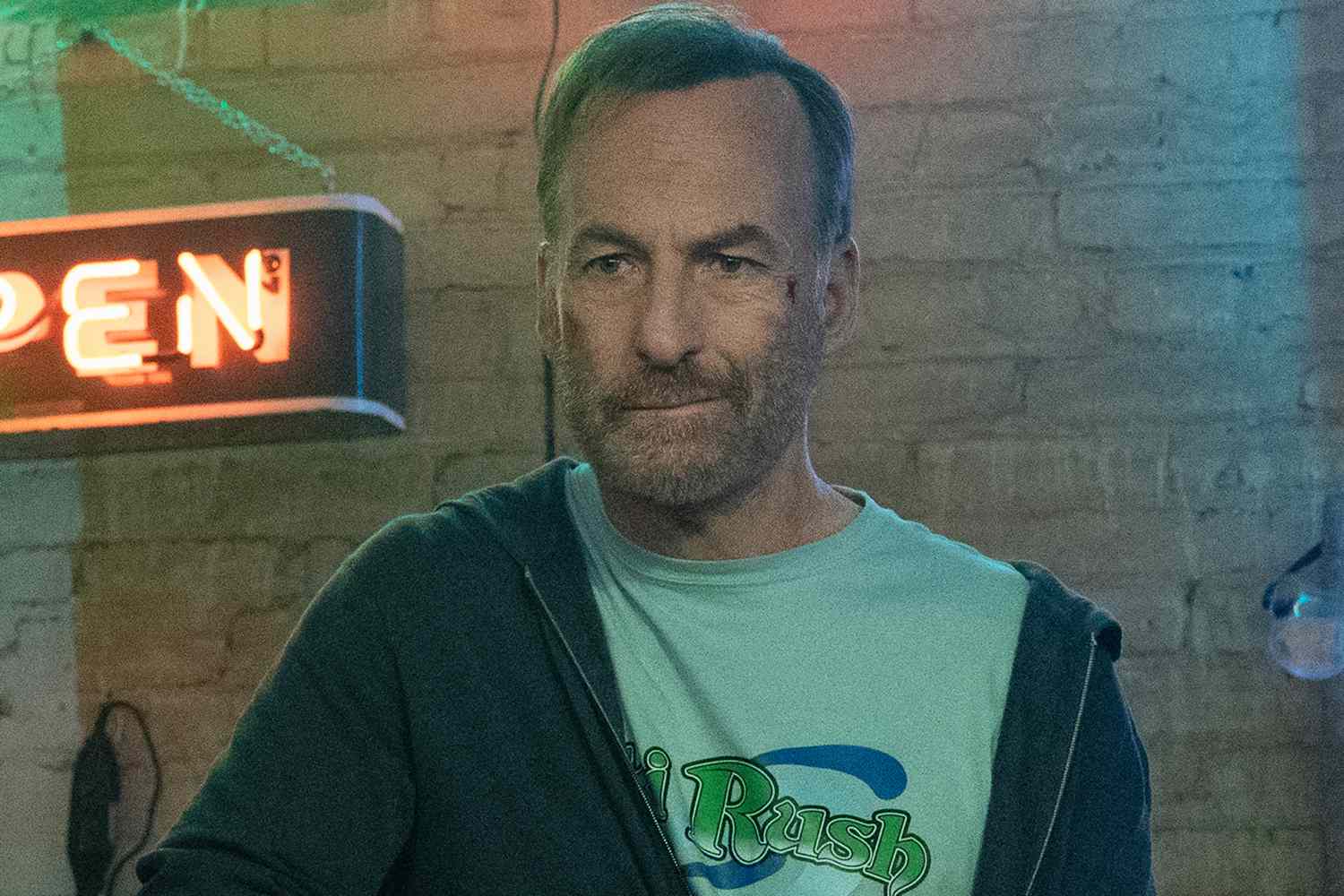

Nobody 2 Trailer Bob Odenkirks Unexpected Path To Violence

May 14, 2025

Nobody 2 Trailer Bob Odenkirks Unexpected Path To Violence

May 14, 2025 -

Tech Rally Lifts S And P 500 Nvidias Gains Erase Years Losses Live Market Report

May 14, 2025

Tech Rally Lifts S And P 500 Nvidias Gains Erase Years Losses Live Market Report

May 14, 2025 -

White House Insider Accounts Of Bidens Deteriorating Health

May 14, 2025

White House Insider Accounts Of Bidens Deteriorating Health

May 14, 2025 -

Mother Convicted Multiple Sexual Encounters With Minor Detailed

May 14, 2025

Mother Convicted Multiple Sexual Encounters With Minor Detailed

May 14, 2025