Market Reversal: S&P 500 Gains Offset 2025 Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reversal: S&P 500 Gains Offset 2025 Losses – A Bullish Sign or Temporary Reprieve?

The stock market experienced a dramatic reversal this week, with the S&P 500 posting significant gains that unexpectedly offset projected losses for 2025. This surprising surge has left investors wondering: is this a genuine shift in market sentiment, or merely a temporary reprieve before further declines? The unexpected rally has sparked intense debate among analysts, prompting a closer examination of the underlying factors driving this remarkable turnaround.

Understanding the Market Reversal

The S&P 500's recent performance has defied many predictions. Earlier forecasts, considering factors like persistent inflation and rising interest rates, pointed towards substantial losses for the index by 2025. However, a confluence of events, including positive corporate earnings reports, easing inflation concerns, and renewed investor confidence, has fueled this unexpected rally. This reversal represents a significant shift from the bearish sentiment that dominated the market for much of the year.

Key Factors Contributing to the S&P 500's Gains

Several key factors contributed to the impressive gains:

- Stronger-than-expected corporate earnings: Many major corporations have exceeded analysts' expectations in recent earnings reports, boosting investor confidence and driving up stock prices. This positive performance signals a degree of resilience within the economy.

- Easing inflation concerns: Although inflation remains a concern, recent data suggests a potential slowing of the rate of increase, leading to speculation that the Federal Reserve may moderate its aggressive interest rate hikes. This easing of monetary policy could provide a boost to the market.

- Improved consumer sentiment: While still cautious, consumer sentiment has shown signs of improvement, suggesting increased willingness to spend, which could benefit corporate profits and overall market performance.

- Geopolitical stability (relatively): While geopolitical risks remain, a period of relative stability has contributed to a more optimistic market outlook. Reduced uncertainty often leads to increased investor confidence.

Is This a Sustainable Trend? Analyzing the Long-Term Outlook

While the recent gains are undeniably positive, it's crucial to maintain a cautious perspective. The market remains volatile, and several factors could still impact its future performance. These include:

- Persistently high inflation: Even if inflation is slowing, it remains significantly above the Federal Reserve's target rate. Further interest rate hikes could dampen economic growth and negatively impact the market.

- Global economic slowdown: The risk of a global recession remains a significant concern, potentially impacting corporate profits and investor sentiment.

- Geopolitical uncertainties: Unexpected geopolitical events could quickly reverse the current positive trend.

What This Means for Investors

The recent market reversal presents both opportunities and challenges for investors. While the gains are encouraging, it's essential to remember that the market is inherently unpredictable. Investors should:

- Maintain a diversified portfolio: Diversification remains crucial to mitigate risk across various asset classes.

- Consider your risk tolerance: Investors should carefully assess their risk tolerance before making any significant investment decisions.

- Consult with a financial advisor: Seeking professional advice can help investors navigate the complexities of the market and make informed decisions.

Conclusion: Cautious Optimism is Key

The S&P 500's recent gains, offsetting projected 2025 losses, are undoubtedly a positive development. However, it's premature to declare a complete market turnaround. Investors should approach the situation with cautious optimism, carefully considering the potential risks and opportunities while maintaining a long-term investment strategy. Further monitoring of economic indicators and geopolitical developments will be crucial in gauging the sustainability of this positive trend. Stay informed and make calculated decisions to navigate the ever-evolving landscape of the stock market. For more in-depth analysis of market trends, consider subscribing to our newsletter [link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reversal: S&P 500 Gains Offset 2025 Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

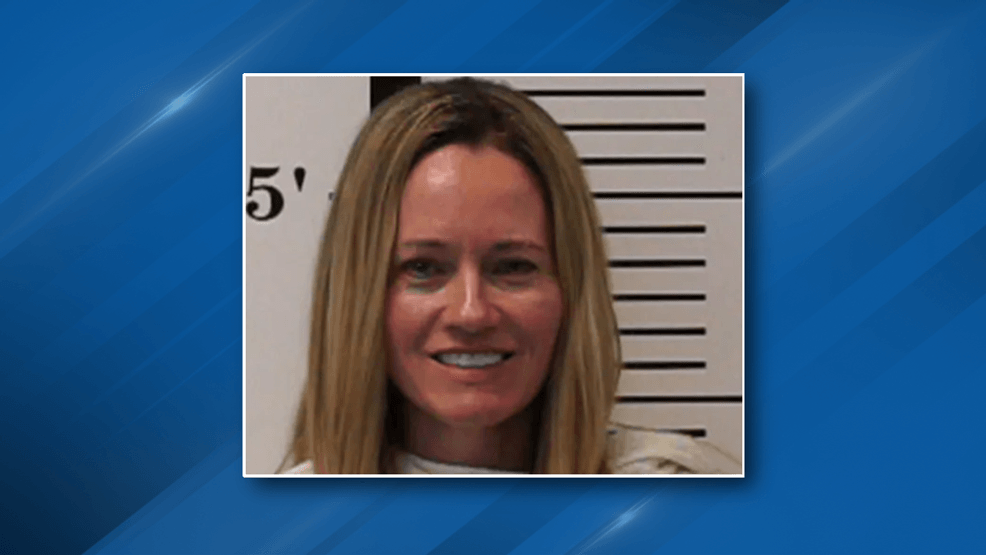

Child Molestation Case Texas Mother Receives Prison Sentence

May 14, 2025

Child Molestation Case Texas Mother Receives Prison Sentence

May 14, 2025 -

Mother Receives Prison Time For Sex Crimes Against Child Friend

May 14, 2025

Mother Receives Prison Time For Sex Crimes Against Child Friend

May 14, 2025 -

The Extent Of Bidens Cognitive Decline Staff Reports Raise Serious Questions

May 14, 2025

The Extent Of Bidens Cognitive Decline Staff Reports Raise Serious Questions

May 14, 2025 -

Nvidia Drives Tech Surge Lifting S And P 500 Above 2023 Losses Live Market Updates

May 14, 2025

Nvidia Drives Tech Surge Lifting S And P 500 Above 2023 Losses Live Market Updates

May 14, 2025 -

Philadelphia Flyers Hire Rick Tocchet As Head Coach

May 14, 2025

Philadelphia Flyers Hire Rick Tocchet As Head Coach

May 14, 2025