Market Reversal: S&P 500 Gains Erase 2023 Losses On Nvidia Strength

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reversal: S&P 500 Gains Erase 2023 Losses on Nvidia Strength

The stock market experienced a dramatic turnaround this week, with the S&P 500 erasing all its losses for 2023. This remarkable recovery is largely attributed to the stellar performance of Nvidia, whose strong earnings report sent shockwaves through the tech sector and beyond. The unexpected surge raises questions about the future direction of the market and the enduring power of tech giants.

Nvidia's Earnings Surprise Ignites Market Rally

Nvidia, the leading designer of graphics processing units (GPUs), reported blowout second-quarter earnings that significantly exceeded analysts' expectations. The company's success, driven by booming demand for its AI chips, fueled a broad market rally. Investors, initially cautious due to persistent inflation concerns and rising interest rates, were reinvigorated by Nvidia's exceptional performance, seeing it as a sign of continued strength in the artificial intelligence sector. This positive sentiment spread quickly, lifting other tech stocks and contributing to the overall market surge.

Beyond Nvidia: A Broader Market Shift?

While Nvidia's results were undeniably the catalyst, the market reversal suggests a broader shift in investor sentiment. Several factors may have contributed to this positive turn:

- Easing Inflation Concerns: While inflation remains a concern, recent economic data points to a potential slowdown, reducing fears of aggressive interest rate hikes by the Federal Reserve.

- Strong Corporate Earnings: Nvidia's performance is not an isolated incident. Several other companies have also reported strong earnings, bolstering investor confidence.

- Increased Investor Risk Appetite: After a period of uncertainty, investors may be increasing their risk appetite, leading to a greater willingness to invest in equities.

Analyzing the S&P 500 Rebound: A Temporary Surge or Sustainable Growth?

The rapid recovery raises crucial questions about the sustainability of this market rebound. While the Nvidia-fueled rally is impressive, it's crucial to consider potential headwinds:

- Geopolitical Instability: Ongoing geopolitical tensions, particularly the war in Ukraine, pose a significant risk to global markets.

- Interest Rate Uncertainty: The Federal Reserve's future monetary policy remains uncertain, potentially impacting market volatility.

- Inflationary Pressures: While inflation may be slowing, persistent inflationary pressures could still dampen economic growth and market performance.

What Does This Mean for Investors?

The recent market reversal highlights the importance of diversification and a long-term investment strategy. While the short-term gains are encouraging, investors should remain cautious and avoid making rash decisions based solely on recent market performance. Conducting thorough research and seeking professional financial advice are crucial steps for navigating the complexities of the stock market. This market shift serves as a reminder that market fluctuations are common, and a diversified portfolio can help mitigate risk.

Looking Ahead: Navigating Market Volatility

The market's dramatic turnaround underscores the unpredictable nature of the stock market. While Nvidia's success is a significant positive, investors must remain aware of potential risks and maintain a balanced perspective. Staying informed about economic indicators, geopolitical events, and corporate earnings is essential for making informed investment decisions. Regularly reviewing your investment strategy and adapting it to changing market conditions is crucial for long-term success. Learn more about and to better prepare for future market volatility.

Keywords: S&P 500, Nvidia, market reversal, stock market, earnings report, AI, artificial intelligence, tech stocks, market rally, investor sentiment, inflation, interest rates, economic growth, market volatility, investment strategy, risk management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reversal: S&P 500 Gains Erase 2023 Losses On Nvidia Strength. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ancelotti Era Begins Brazilian National Teams New Manager

May 13, 2025

Ancelotti Era Begins Brazilian National Teams New Manager

May 13, 2025 -

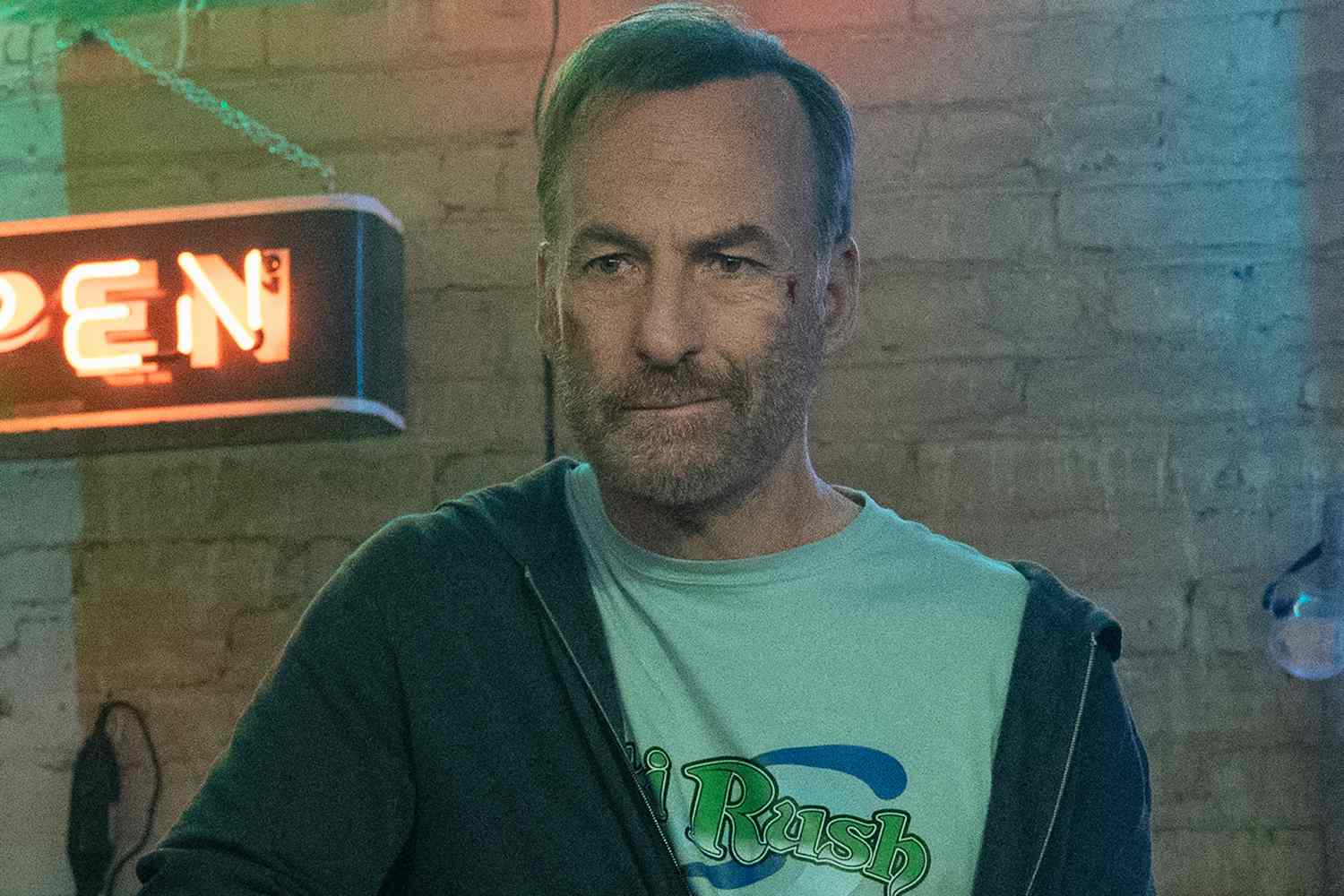

Action Packed Nobody 2 Trailer Bob Odenkirks Family Trip Takes A Dark Turn

May 13, 2025

Action Packed Nobody 2 Trailer Bob Odenkirks Family Trip Takes A Dark Turn

May 13, 2025 -

Sinner Batte De Jong Aggiornamenti Live Dal Match

May 13, 2025

Sinner Batte De Jong Aggiornamenti Live Dal Match

May 13, 2025 -

Atp Rome Masters 2024 Day 6 Predictions Can Sinner Triumph

May 13, 2025

Atp Rome Masters 2024 Day 6 Predictions Can Sinner Triumph

May 13, 2025 -

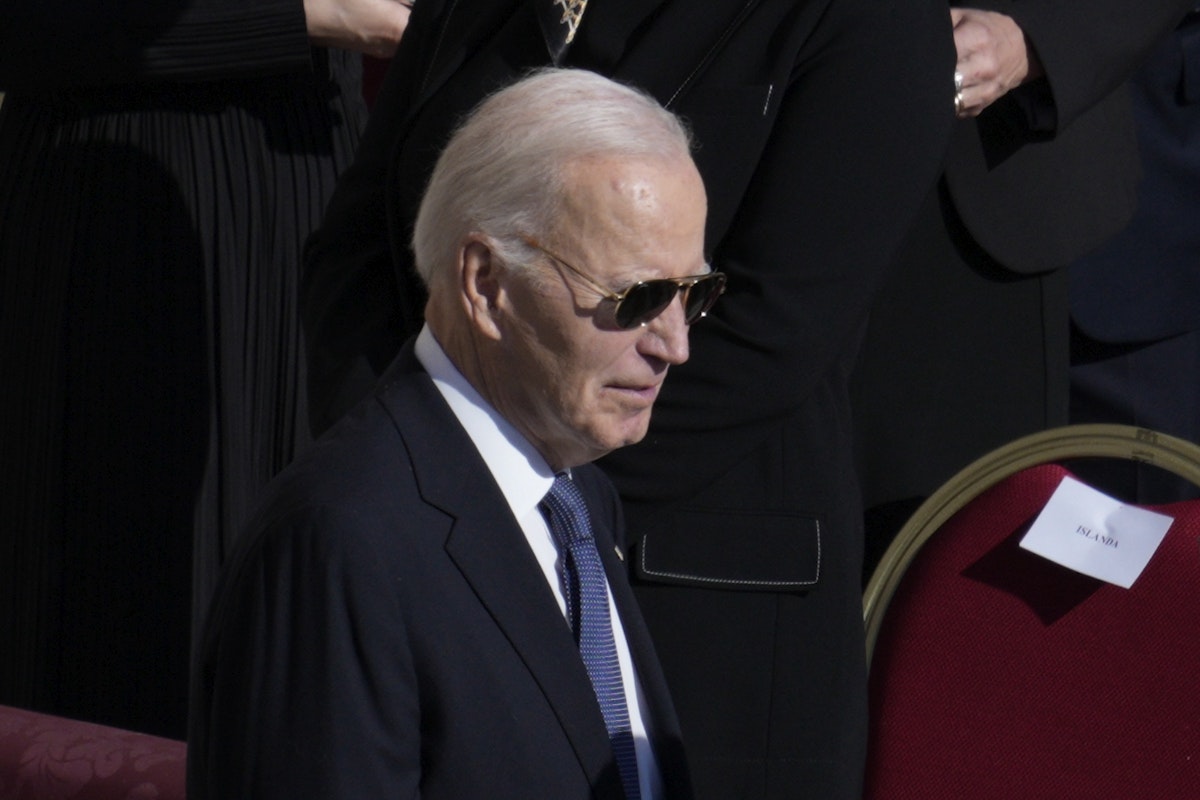

The Unseen Struggle Bidens Staff And The Presidents Declining Health

May 13, 2025

The Unseen Struggle Bidens Staff And The Presidents Declining Health

May 13, 2025