Market Reaction: S&P 500 And Nasdaq Slide As Fed Policy And Iran Situation Weigh On Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reaction: S&P 500 and Nasdaq Slide as Fed Policy and Iran Tensions Weigh on Investors

Wall Street experienced a significant downturn today, with both the S&P 500 and Nasdaq Composite indices closing lower. The decline reflects growing investor concerns about the Federal Reserve's ongoing monetary policy and escalating tensions in the Middle East, specifically the situation in Iran. This double whammy of economic uncertainty and geopolitical risk sent shockwaves through the market, leaving many investors wondering what comes next.

The Federal Reserve's Hawkish Stance Continues to Pressure Markets

The Federal Reserve's commitment to combating inflation, even at the cost of potentially slowing economic growth, remains a major source of market anxiety. Recent statements from Fed officials suggest interest rates may remain higher for longer than initially anticipated. This prospect fuels concerns about a potential recession, impacting corporate earnings and investor confidence. The [link to relevant Fed statement/article], released earlier this week, further solidified this hawkish stance, leading to a sell-off in riskier assets. Investors are nervously eyeing upcoming economic data releases for clues on the future direction of interest rates.

Iran Tensions Add to Market Volatility

Adding to the pressure is the increasingly volatile situation in Iran. Recent events, including [brief, factual description of relevant news, with links to reputable news sources], have raised concerns about potential regional instability and its impact on global oil prices. Energy markets are particularly sensitive to geopolitical events in the Middle East, and any disruption to oil supply could have significant inflationary consequences, further complicating the Fed's task. This uncertainty is driving investors towards safer assets, contributing to the decline in the S&P 500 and Nasdaq.

Key Market Indicators:

- S&P 500: Closed down [Percentage]% at [Closing Value].

- Nasdaq Composite: Closed down [Percentage]% at [Closing Value].

- Crude Oil Prices: Experienced a [Percentage]% [increase/decrease] on [Date], reflecting the heightened geopolitical risks.

What This Means for Investors:

The current market downturn underscores the interconnectedness of global economics and geopolitics. Investors are advised to carefully consider their risk tolerance and diversify their portfolios. A cautious approach, potentially focusing on less volatile assets, might be prudent given the current uncertainty. Seeking advice from a qualified financial advisor is always recommended during times of market volatility.

Looking Ahead:

The coming weeks will be crucial in determining the market's trajectory. Investors will be keenly watching for further developments in both the macroeconomic landscape and the geopolitical arena. Upcoming economic data releases, particularly inflation figures and employment reports, will provide valuable insights into the Fed's future policy decisions. Similarly, any de-escalation or escalation of tensions in Iran will have a significant impact on investor sentiment.

Call to Action: Stay informed about market developments by regularly checking reputable financial news sources. Consider consulting a financial advisor to discuss your investment strategy in light of the current market conditions. Understanding the interplay between macroeconomic factors and geopolitical events is vital for navigating the complexities of today's investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reaction: S&P 500 And Nasdaq Slide As Fed Policy And Iran Situation Weigh On Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Club World Cup Bayern Munich And Boca Juniors Predicted Lineups And Team News

Jun 21, 2025

Club World Cup Bayern Munich And Boca Juniors Predicted Lineups And Team News

Jun 21, 2025 -

The High Stakes Of Summer Trumps War On Climate Science

Jun 21, 2025

The High Stakes Of Summer Trumps War On Climate Science

Jun 21, 2025 -

Devers Trade Shockwaves Mlb Managers And Coaches Respond

Jun 21, 2025

Devers Trade Shockwaves Mlb Managers And Coaches Respond

Jun 21, 2025 -

Gabbard And The Trump Administration A Growing Rift New Cnn Insights

Jun 21, 2025

Gabbard And The Trump Administration A Growing Rift New Cnn Insights

Jun 21, 2025 -

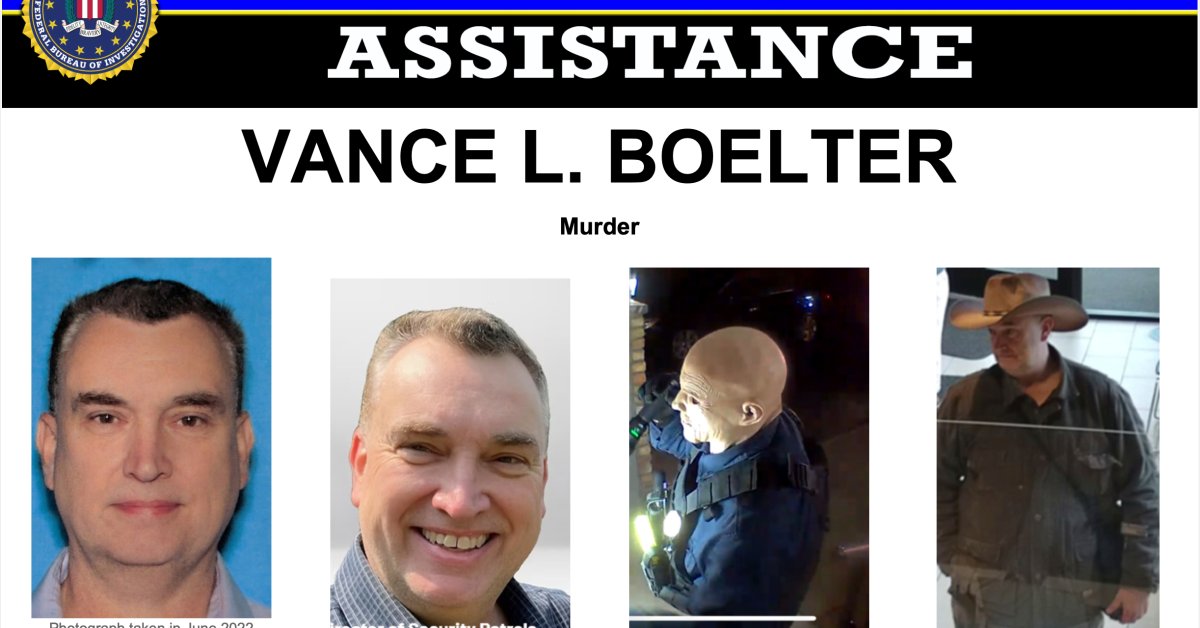

Vance Boelter Arrested Details Emerge In Minnesota Lawmaker Shooting Case

Jun 21, 2025

Vance Boelter Arrested Details Emerge In Minnesota Lawmaker Shooting Case

Jun 21, 2025