Market Rally Continues: S&P 500 Leads Gains As Investors Ignore Moody's Negative Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Rally Continues: S&P 500 Leads Gains as Investors Seemingly Ignore Moody's Negative Outlook

The stock market continued its impressive rally on Tuesday, with the S&P 500 leading the gains despite a negative outlook issued by Moody's earlier this week. This unexpected resilience suggests investor confidence remains relatively high, potentially overshadowing concerns about the broader economic climate. But how long can this defiance of negative forecasts last?

The S&P 500 closed up [Insert Percentage]% on Tuesday, reaching [Insert Closing Value]. This follows a strong performance on Monday, and underscores a broader upward trend that has surprised many analysts. The Dow Jones Industrial Average also saw significant gains, while the Nasdaq Composite followed suit, although with slightly more modest increases. This broad-based rally indicates a market that, for now, is shrugging off potential headwinds.

Moody's Downgrade and the Market's Response

Moody's Investors Service downgraded the credit ratings of several small and mid-sized banks on Monday, citing concerns about the deteriorating credit quality of US banks. This action, coupled with their negative outlook on the US banking sector, was expected to trigger some market volatility. However, the market's response has been remarkably muted, at least for now. This begs the question: why are investors seemingly ignoring these warnings?

Several factors may contribute to this apparent disregard for Moody's assessment. One possibility is that investors believe the downgraded banks represent a relatively small portion of the overall financial system. Another explanation could be that investors are focusing on the positive aspects of the economy, such as strong corporate earnings and resilient consumer spending. The continued strength of the labor market, despite recent interest rate hikes by the Federal Reserve, also likely plays a role in bolstering investor sentiment.

What Does This Mean for Investors?

The current market rally presents a complex picture for investors. While the positive momentum is encouraging, it's crucial to remember that the market can be volatile and unpredictable. The seemingly nonchalant response to Moody's downgrade may prove short-lived, with potential for a correction if economic data deteriorates or further negative news emerges.

Investors should consider:

- Diversification: Spreading investments across different asset classes is crucial to mitigate risk.

- Risk Tolerance: Understanding your own risk tolerance is paramount before making any investment decisions.

- Long-Term Strategy: Focusing on a long-term investment strategy can help weather short-term market fluctuations.

- Professional Advice: Consulting with a financial advisor can provide personalized guidance based on your individual circumstances.

Looking Ahead: Potential Catalysts for Future Market Movement

The coming weeks will be crucial in determining the sustainability of the current rally. Key economic indicators, including inflation data and further pronouncements from the Federal Reserve, will play a significant role in shaping market sentiment. Any unexpected shifts in geopolitical events could also trigger significant market movements. It's vital for investors to stay informed and monitor these developments closely.

In conclusion, the current market rally, despite the Moody's negative outlook, presents both opportunities and risks. While the market's resilience is noteworthy, investors should maintain a cautious approach and carefully consider their risk tolerance before making any investment decisions. Staying informed about economic indicators and geopolitical events will be crucial in navigating the complexities of the current market environment. For more in-depth analysis on market trends, check out [Link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Rally Continues: S&P 500 Leads Gains As Investors Ignore Moody's Negative Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Deconstructing Success The Taylor Jenkins Reid Publishing Model

May 20, 2025

Deconstructing Success The Taylor Jenkins Reid Publishing Model

May 20, 2025 -

Helldivers 2 Masters Of Ceremony Warbond Drop May 15th Launch

May 20, 2025

Helldivers 2 Masters Of Ceremony Warbond Drop May 15th Launch

May 20, 2025 -

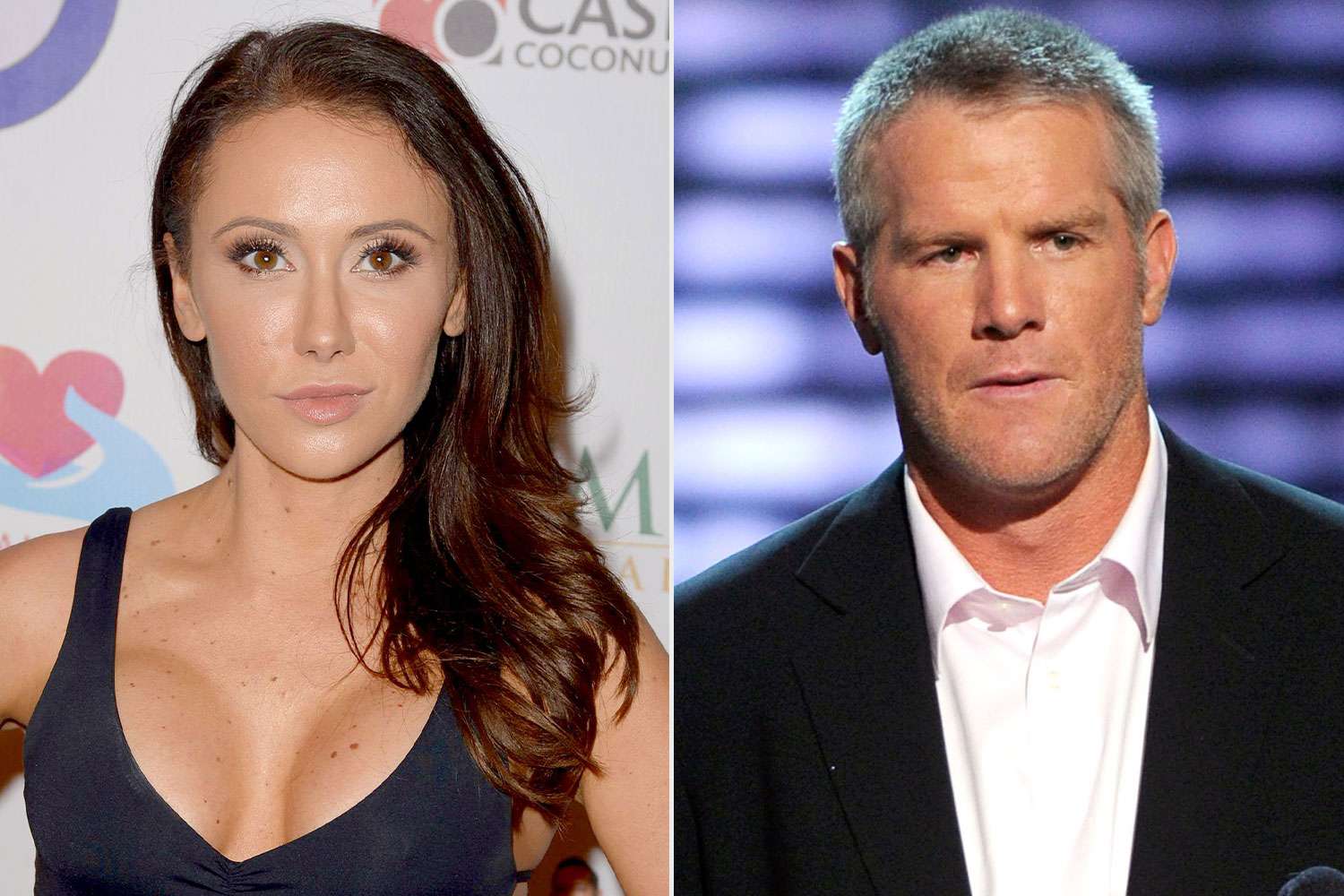

Years Later Jenn Sterger Addresses The Emotional Toll Of The Brett Favre Scandal

May 20, 2025

Years Later Jenn Sterger Addresses The Emotional Toll Of The Brett Favre Scandal

May 20, 2025 -

Helldivers 2 May 15th Update New Masters Of Ceremony Warbond Rewards

May 20, 2025

Helldivers 2 May 15th Update New Masters Of Ceremony Warbond Rewards

May 20, 2025 -

Untold Controversy A J Perez Recounts Threats From Favres Team

May 20, 2025

Untold Controversy A J Perez Recounts Threats From Favres Team

May 20, 2025