Market In Turmoil: Understanding The Impact Of The ETH Crash

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market in Turmoil: Understanding the Impact of the ETH Crash

The cryptocurrency market experienced a significant jolt recently with the sharp decline in Ethereum (ETH) prices. This crash sent shockwaves through the entire crypto ecosystem, leaving investors wondering what triggered the downturn and what the future holds. Understanding the impact of this ETH crash is crucial for navigating the volatile landscape of digital assets.

What Caused the ETH Crash?

Pinpointing the exact cause of any market downturn is rarely straightforward, and the recent ETH crash is no exception. However, several contributing factors are likely at play:

-

Macroeconomic Factors: Global economic uncertainty, including high inflation and rising interest rates, significantly impacts investor sentiment. Risk-off sentiment often leads to investors selling off volatile assets like cryptocurrencies to protect their capital. This is a key factor driving downward pressure across the entire market, not just ETH.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions. Fear of stricter regulations or unexpected policy changes can trigger sell-offs as investors become hesitant. Recent regulatory crackdowns in certain regions have undoubtedly contributed to market volatility.

-

Market Sentiment and FUD: Fear, Uncertainty, and Doubt (FUD) play a massive role in cryptocurrency markets. Negative news, rumors, or even social media trends can quickly escalate into widespread selling, exacerbating price drops. The interconnected nature of crypto means a negative event in one area can quickly ripple through the entire ecosystem.

-

Technical Factors: While less dominant than macroeconomic and sentiment-driven factors, technical indicators and chart patterns can influence short-term price movements. Breakdowns of key support levels can trigger cascading sell-offs as traders take profits or cut losses.

The Ripple Effect: Impact Beyond ETH

The ETH crash didn't exist in a vacuum. Its impact rippled throughout the broader cryptocurrency market:

-

Altcoin Decline: Many altcoins (cryptocurrencies other than Bitcoin and Ethereum) experienced significant price drops alongside ETH. This is largely due to the correlation between various crypto assets and the general sentiment in the market. When ETH falls, investors often sell their altcoin holdings as well.

-

DeFi Impact: The decentralized finance (DeFi) sector, heavily reliant on Ethereum's blockchain, suffered considerable consequences. The value of locked assets in DeFi protocols decreased, and the overall activity within the DeFi ecosystem slowed.

-

NFT Market Slowdown: The non-fungible token (NFT) market, also closely tied to Ethereum, experienced a slump. Lower ETH prices impacted NFT valuations and trading volume.

Navigating the Volatility: Tips for Investors

The ETH crash highlights the inherent risks in the cryptocurrency market. Here are some crucial considerations for investors:

-

Diversification: Diversifying your crypto portfolio across different assets can mitigate risk. Don't put all your eggs in one basket.

-

Risk Management: Implement robust risk management strategies, such as setting stop-loss orders to limit potential losses.

-

Long-Term Perspective: Cryptocurrency markets are notoriously volatile. A long-term investment horizon is crucial for weathering market downturns.

-

Stay Informed: Keep up-to-date with market news, regulatory developments, and technological advancements. Understanding the factors influencing the market is essential for making informed decisions.

Looking Ahead:

The future of Ethereum and the broader cryptocurrency market remains uncertain. While the recent crash has caused significant losses for some, it also presents opportunities for long-term investors. Careful analysis, informed decision-making, and a risk-averse approach will be crucial for navigating the ongoing volatility. Remember to always conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions.

Keywords: ETH crash, Ethereum price, cryptocurrency market, crypto crash, DeFi, NFT, market volatility, regulatory uncertainty, macroeconomic factors, investment advice, crypto trading, altcoins, Bitcoin.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market In Turmoil: Understanding The Impact Of The ETH Crash. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Crypto Market Update Btc Xrp Sol Doge See Modest Post Fed Rally

Sep 23, 2025

Crypto Market Update Btc Xrp Sol Doge See Modest Post Fed Rally

Sep 23, 2025 -

Secs Stance On Crypto Etfs Black Rocks Ethereum Proposal And Future Implications

Sep 23, 2025

Secs Stance On Crypto Etfs Black Rocks Ethereum Proposal And Future Implications

Sep 23, 2025 -

Marescas Candid Admission Defensive Depth A Major Concern For Upcoming Matches

Sep 23, 2025

Marescas Candid Admission Defensive Depth A Major Concern For Upcoming Matches

Sep 23, 2025 -

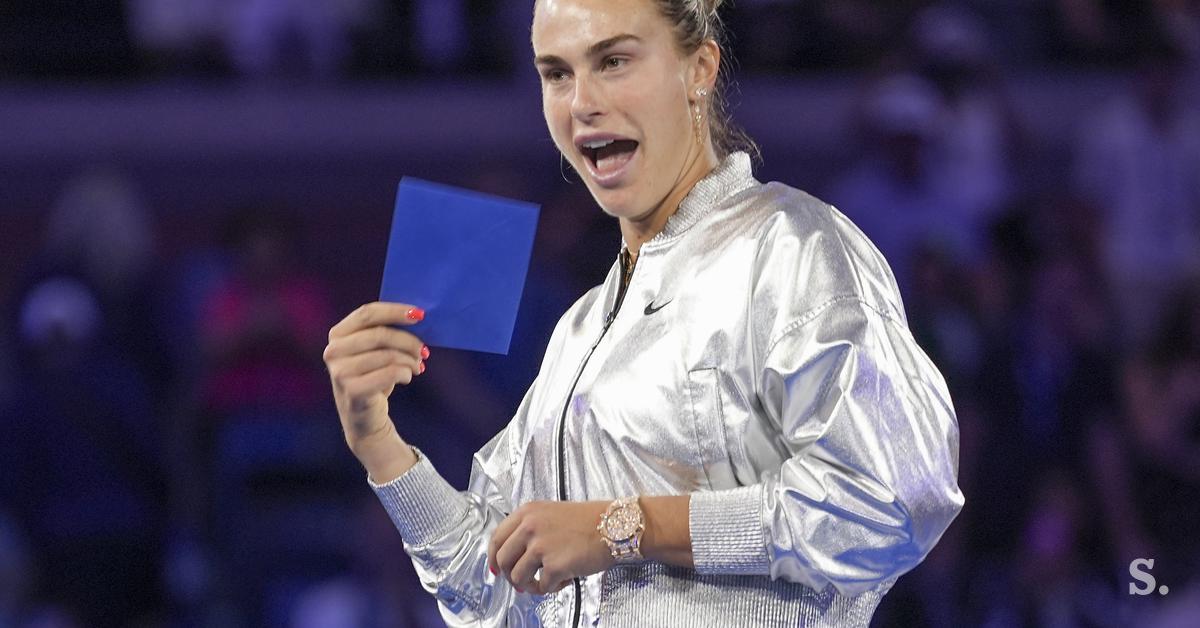

Teniski Vrh Sabalenka Premaga Swiatek Erjavec Doseze Vrhunec V Sloveniji

Sep 23, 2025

Teniski Vrh Sabalenka Premaga Swiatek Erjavec Doseze Vrhunec V Sloveniji

Sep 23, 2025 -

Historic Low Bitcoin Volatility Signals Potential Price Surge

Sep 23, 2025

Historic Low Bitcoin Volatility Signals Potential Price Surge

Sep 23, 2025