Market Downturn Today: S&P 500 And Nasdaq Suffer Losses Due To Fed And Iran Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Downturn Today: S&P 500 and Nasdaq Suffer Losses Amidst Fed Concerns and Iran Tensions

Investors brace for impact as both the S&P 500 and Nasdaq experience significant drops, fueled by anxieties surrounding the Federal Reserve's monetary policy and escalating geopolitical risks in Iran.

Today's market downturn saw a significant sell-off, with major indices like the S&P 500 and Nasdaq posting substantial losses. The double whammy of persistent concerns about the Federal Reserve's interest rate hikes and rising tensions in Iran contributed to a climate of uncertainty and risk aversion among investors. This volatile market behavior underscores the interconnectedness of global economic factors and geopolitical events.

The Fed's Tightening Grip: A Continued Drag on Market Sentiment

The Federal Reserve's ongoing efforts to combat inflation through interest rate increases continue to weigh heavily on market sentiment. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profitability. Investors are closely scrutinizing the Fed's communication for any hints about the future trajectory of interest rates, making the market particularly susceptible to even subtle shifts in policy expectations. This uncertainty is a key driver behind the current market volatility. [Link to recent Fed statement/article]

The fear is that aggressive rate hikes could inadvertently trigger a recession, leading to a more significant market correction. Analysts are divided on the ultimate impact of the Fed's actions, with some predicting a "soft landing" while others foresee a more severe economic slowdown. This divergence of opinions contributes to the ongoing market uncertainty.

Iran Tensions Add Fuel to the Fire

Adding to the market's anxieties are the escalating tensions in Iran. Recent developments [cite specific news source] have heightened concerns about potential regional instability and its impact on global oil prices and supply chains. Any disruption to oil supplies could trigger further inflationary pressures, forcing the Fed to maintain or even increase its aggressive monetary policy stance. This creates a vicious cycle that further dampens investor confidence.

The geopolitical uncertainty surrounding Iran introduces a significant element of unpredictability into the market. Investors often react negatively to such uncertainty, preferring to adopt a wait-and-see approach, which translates into selling off assets and seeking safer havens.

S&P 500 and Nasdaq Bear the Brunt

The S&P 500, a broad measure of the US stock market, experienced a [percentage]% drop today, while the Nasdaq, heavily weighted towards technology stocks, saw an even steeper decline of [percentage]%. This suggests that investors are particularly concerned about the impact of higher interest rates on growth-oriented sectors. Technology companies, often reliant on debt financing for expansion, are particularly vulnerable to rising borrowing costs.

What Lies Ahead?

The outlook for the near future remains uncertain. The market's response to future Fed announcements and further developments in Iran will be crucial in determining the trajectory of the S&P 500 and Nasdaq. Investors are advised to maintain a diversified portfolio, carefully monitor economic indicators, and consult with financial advisors before making any significant investment decisions. Staying informed about both economic and geopolitical developments is crucial for navigating these turbulent times.

Call to Action: Stay tuned for updates on our website for further analysis and market insights as the situation unfolds. [Link to relevant section/page on your website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Downturn Today: S&P 500 And Nasdaq Suffer Losses Due To Fed And Iran Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Murder Indictment Barry Morphew Charged In Wifes Disappearance

Jun 21, 2025

Murder Indictment Barry Morphew Charged In Wifes Disappearance

Jun 21, 2025 -

Late Game Heroics Pressly Secures Win For Astros Against Pirates

Jun 21, 2025

Late Game Heroics Pressly Secures Win For Astros Against Pirates

Jun 21, 2025 -

La Rapper Swifty Blue Mexican Mafias Alleged Murder Plot Unveiled

Jun 21, 2025

La Rapper Swifty Blue Mexican Mafias Alleged Murder Plot Unveiled

Jun 21, 2025 -

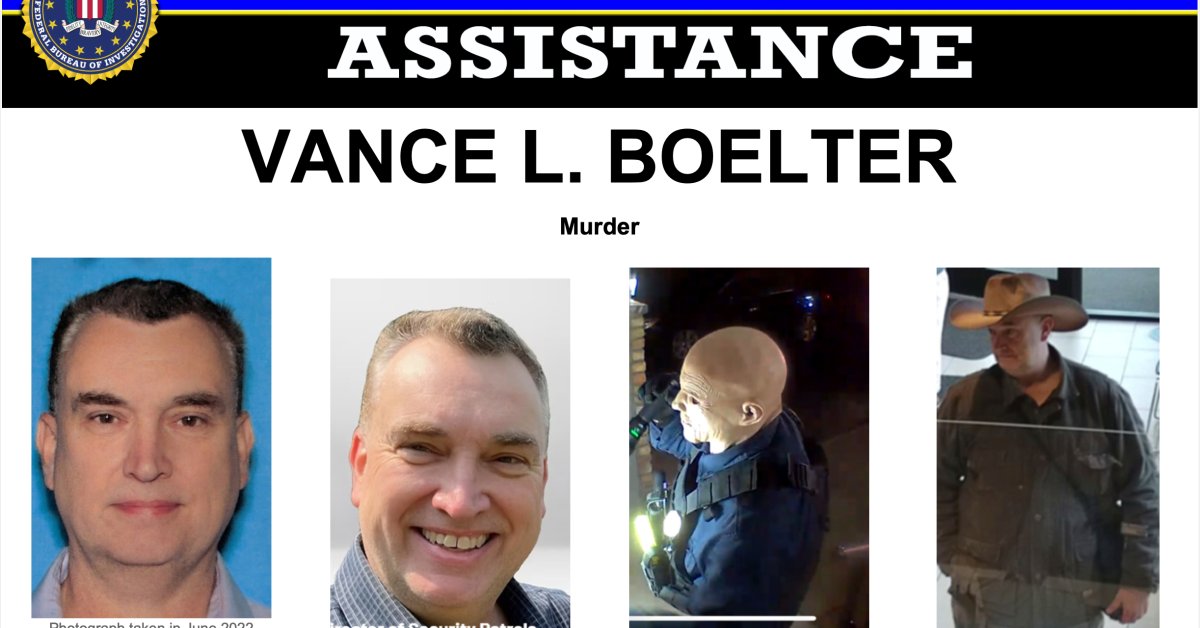

Details Emerge After Arrest Of Vance L Boelter Suspected Minnesota Shooter

Jun 21, 2025

Details Emerge After Arrest Of Vance L Boelter Suspected Minnesota Shooter

Jun 21, 2025 -

Trump Directs Ice To Expand Deportations Impact On Democratic Cities

Jun 21, 2025

Trump Directs Ice To Expand Deportations Impact On Democratic Cities

Jun 21, 2025