Market Analysis: Wellington Management's Investment In 15,775 Robinhood (HOOD) Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Analysis: Wellington Management's Stake in Robinhood Sparks Investor Interest

Wellington Management, a prominent global investment firm, recently revealed a significant investment in Robinhood Markets, Inc. (HOOD), adding 15,775 shares to its portfolio. This move has sent ripples through the market, prompting analysts to dissect the implications of this strategic investment and its potential impact on Robinhood's future trajectory. The question on many investors' minds is: what does this mean for HOOD stock?

Wellington Management's Strategic Move:

Wellington Management's reputation for shrewd investment strategies makes this move particularly noteworthy. The firm, known for its long-term, value-oriented approach, doesn't typically make headlines for quick trades. Their investment in Robinhood, therefore, suggests a degree of confidence in the company's long-term prospects, despite the challenges it has faced recently. This significant investment could signal a turning point for the retail brokerage giant.

Robinhood's Recent Performance and Challenges:

Robinhood's stock price has experienced significant volatility since its initial public offering (IPO). The company has grappled with regulatory scrutiny, intense competition in the brokerage sector, and the broader market downturn. However, Robinhood continues to innovate, expanding its offerings beyond its core brokerage services to include crypto trading, options trading, and wealth management tools. This diversification strategy could be a key factor in Wellington Management's decision.

Analyzing the Investment:

While the 15,775 shares represent a relatively small position for a firm of Wellington Management's size, the symbolic importance is substantial. It indicates that even seasoned investors see potential for growth and recovery in Robinhood. The investment could also be interpreted as a vote of confidence in Robinhood's management team and its ability to navigate the current market challenges.

What's Next for Robinhood?

The long-term outlook for Robinhood remains uncertain, but several factors could influence its future performance:

- Regulatory Landscape: Navigating the evolving regulatory landscape will be crucial for Robinhood's continued success.

- Competition: The intense competition within the brokerage industry will necessitate continuous innovation and strategic adaptation.

- Market Conditions: The overall market environment will significantly impact Robinhood's performance, as it does with most growth stocks.

- Innovation and Expansion: Robinhood's ability to successfully expand its product offerings and penetrate new markets will be critical for long-term growth.

Investor Sentiment and Market Implications:

Wellington Management's investment is likely to boost investor confidence in Robinhood, at least in the short term. The news could encourage other institutional investors to reconsider their positions or even initiate new investments. However, it's important to remember that this is just one data point, and long-term success will depend on Robinhood's execution of its business strategy.

Conclusion:

Wellington Management's strategic investment in Robinhood's 15,775 shares serves as a compelling case study in market analysis. While the long-term future remains uncertain, the move highlights the potential for growth and recovery in the company. This investment signals a noteworthy shift in investor sentiment and warrants further observation of Robinhood's performance in the coming months and years. Investors should conduct thorough due diligence before making any investment decisions based on this news. For more detailed financial news and market analysis, be sure to check back regularly.

Keywords: Robinhood, HOOD stock, Wellington Management, investment, market analysis, stock market, brokerage, retail investing, investment strategy, financial news, stock price, market volatility, regulatory landscape, competition, growth stocks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Analysis: Wellington Management's Investment In 15,775 Robinhood (HOOD) Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Soto Extends Hot Streak Another Blast Against New York Mets

Jun 13, 2025

Soto Extends Hot Streak Another Blast Against New York Mets

Jun 13, 2025 -

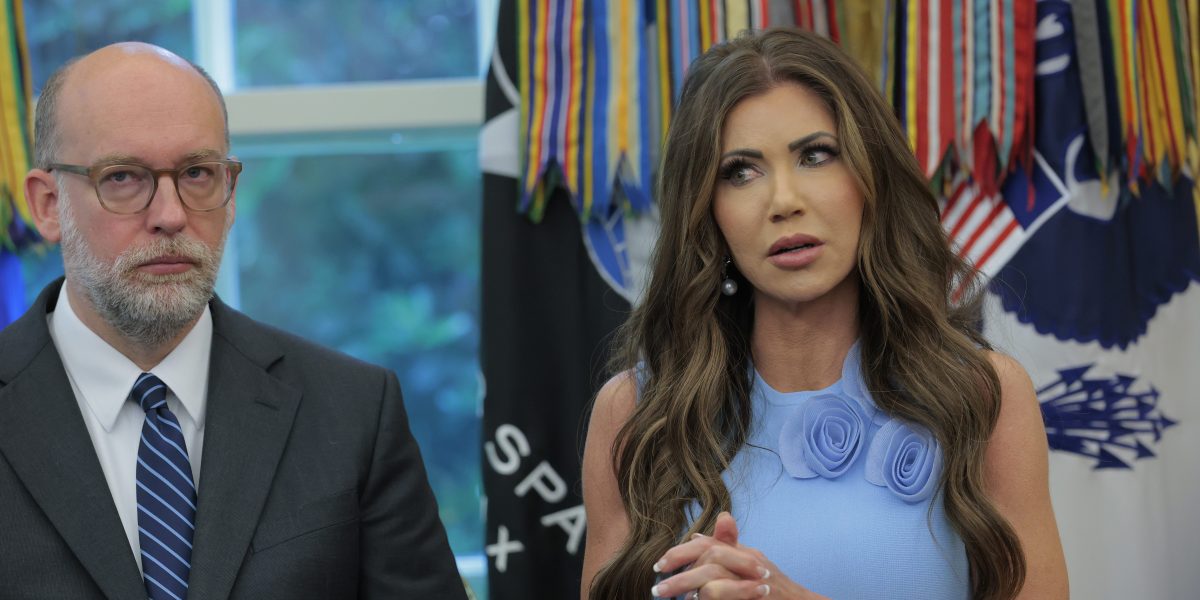

Kristi Noems Claim Of Deploying Soldiers Against Protesters A Controversy Explained

Jun 13, 2025

Kristi Noems Claim Of Deploying Soldiers Against Protesters A Controversy Explained

Jun 13, 2025 -

Taylor Jenkins Reid The Author The Brand The Publishing Phenomenon

Jun 13, 2025

Taylor Jenkins Reid The Author The Brand The Publishing Phenomenon

Jun 13, 2025 -

Robinhood Asset Surge 255 Billion And 108 Trading Volume Increase

Jun 13, 2025

Robinhood Asset Surge 255 Billion And 108 Trading Volume Increase

Jun 13, 2025 -

Noem Hegseth Discussion Sparks Debate Military Role In Domestic Civilian Matters

Jun 13, 2025

Noem Hegseth Discussion Sparks Debate Military Role In Domestic Civilian Matters

Jun 13, 2025