Major Investment: Wellington Management's Stake In Robinhood (HOOD)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Major Investment: Wellington Management Boosts Stake in Robinhood (HOOD) – A Sign of Confidence?

Wall Street is buzzing after revelations that Wellington Management, a prominent global investment firm, has significantly increased its stake in the volatile trading platform, Robinhood (HOOD). This move sends ripples through the financial markets, prompting speculation about the future trajectory of the company and its stock price. The increased investment signifies a vote of confidence in Robinhood's long-term prospects, despite recent market challenges.

Wellington's Strategic Move: A Deeper Dive

Wellington Management, known for its shrewd investment strategies and long-term vision, isn't known for impulsive decisions. Their substantial increase in Robinhood shares suggests a carefully considered assessment of the company's potential. This isn't simply a small adjustment to their portfolio; it's a considerable investment, highlighting a belief in Robinhood's capacity for growth and recovery.

This bold move comes at a time when Robinhood is navigating a complex landscape. The company, which experienced explosive growth during the pandemic-fueled retail trading boom, has since faced headwinds, including reduced trading volumes and increased competition. However, Wellington's investment suggests that they see beyond the current challenges and foresee a brighter future for the platform.

What Does This Mean for HOOD Stock?

The impact of Wellington's increased stake on HOOD's stock price remains to be seen. While the news is undoubtedly positive, influencing investor sentiment, several factors will play a role in the stock's performance. Market conditions, future regulatory changes, and Robinhood's own strategic initiatives will all contribute to the overall trajectory.

- Increased Investor Confidence: The investment by a reputable firm like Wellington can bolster investor confidence, potentially leading to increased demand for HOOD shares.

- Short-Term Volatility: Despite the positive news, the stock market is inherently volatile. Short-term fluctuations are expected, and the impact of this news may not be immediately reflected in a dramatic price surge.

- Long-Term Outlook: Wellington's strategy often focuses on long-term growth. This investment likely reflects a belief in Robinhood's potential for sustained growth over the coming years.

Robinhood's Strategic Initiatives: Paving the Way for Growth?

Robinhood has been actively working to diversify its revenue streams and expand its offerings beyond its core brokerage services. These initiatives could play a crucial role in justifying Wellington's investment and fueling future growth. This includes:

- Expansion into new financial products and services: Robinhood is continually exploring new avenues for revenue generation, moving beyond simple stock trading.

- Improved user experience and platform enhancements: Addressing past criticisms and enhancing user experience is critical for attracting and retaining customers.

- Strengthening regulatory compliance: Navigating the regulatory landscape effectively is crucial for long-term sustainability.

Conclusion: A Cautiously Optimistic Outlook

Wellington Management's significant investment in Robinhood marks a significant development in the company's ongoing narrative. While short-term market fluctuations are inevitable, the investment signals a belief in Robinhood's long-term potential. Whether this translates into immediate and sustained stock price growth remains to be seen, but it certainly provides a boost of confidence for investors and observers alike. Only time will tell if this investment proves to be a shrewd move, but the increased stake by such a respected firm certainly warrants attention. For further updates on the financial markets, be sure to check back regularly.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major Investment: Wellington Management's Stake In Robinhood (HOOD). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

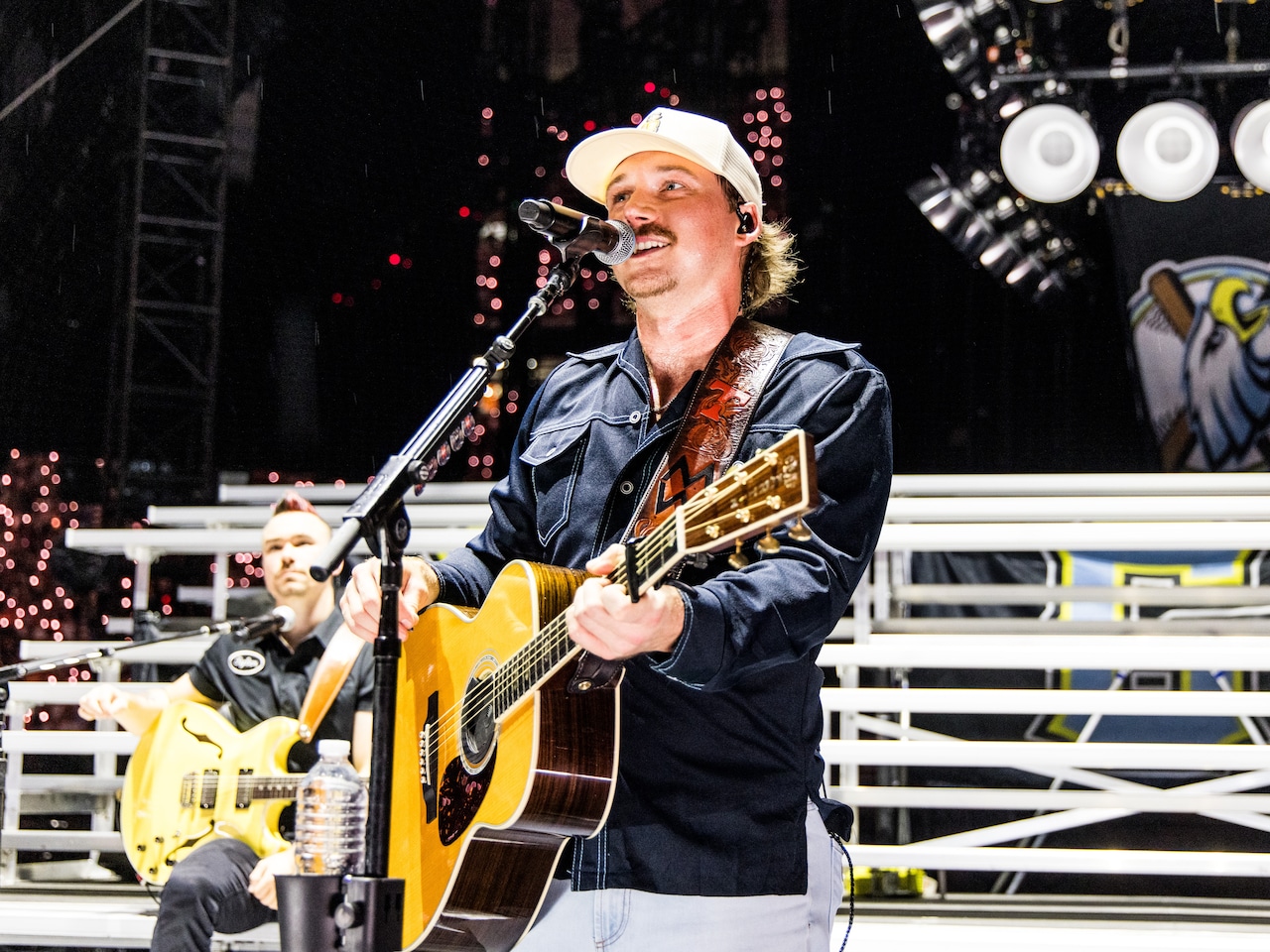

Cheap Morgan Wallen I M The Problem Tour Tickets Houston June 20th And 21st

Jun 14, 2025

Cheap Morgan Wallen I M The Problem Tour Tickets Houston June 20th And 21st

Jun 14, 2025 -

Wellington Management Group Boosts Robinhood Hood Holding By 15 775 Shares

Jun 14, 2025

Wellington Management Group Boosts Robinhood Hood Holding By 15 775 Shares

Jun 14, 2025 -

L A Curfew Protests Continue Into Second Night Amid Rising Tensions

Jun 14, 2025

L A Curfew Protests Continue Into Second Night Amid Rising Tensions

Jun 14, 2025 -

Keys And Anisimova Dominate At Queens As Navarro Escapes Defeat

Jun 14, 2025

Keys And Anisimova Dominate At Queens As Navarro Escapes Defeat

Jun 14, 2025 -

Whos The Target Analyzing Delaney Rowes Recent Remarks

Jun 14, 2025

Whos The Target Analyzing Delaney Rowes Recent Remarks

Jun 14, 2025