Luckin Coffee Stock Up 5.2%: Should You Buy LKNCY Now?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Luckin Coffee Stock Up 5.2%: Should You Buy LKNCY Now?

Luckin Coffee (LKNCY) saw its stock price jump 5.2% recently, sparking renewed interest from investors. This significant surge follows a period of volatility and uncertainty, leaving many wondering: is now the time to buy? This article delves into the factors contributing to this price increase and analyzes whether investing in LKNCY is a wise move.

The Recent Surge: A Closer Look

The 5.2% increase wasn't a random fluctuation. Several factors likely contributed to this positive momentum. While specific catalysts are often difficult to pinpoint definitively in the fast-paced world of stock markets, analysts point to a few key areas:

- Stronger-than-expected Q2 earnings: While full financial details might need further investigation, early reports suggest that Luckin Coffee's recent quarterly performance might have exceeded market expectations. This positive news often fuels investor confidence.

- Growth in the Chinese coffee market: China's burgeoning coffee market presents significant growth opportunities. Luckin Coffee's strategic positioning within this market, coupled with its innovative business model, continues to attract attention from both consumers and investors. This expanding market represents a powerful tailwind for the company.

- Increased investor confidence: After weathering significant challenges in the past, the recent positive news might signify a turning point for investor sentiment towards Luckin Coffee. This renewed confidence is translating into increased buying activity.

- Strategic initiatives: Luckin Coffee has been actively pursuing various strategic initiatives aimed at enhancing its market position and operational efficiency. These initiatives, while not always immediately reflected in stock prices, contribute to long-term growth potential.

Should You Buy LKNCY? A Cautious Approach

While the recent price increase is encouraging, investors should proceed with caution. The stock remains volatile, and its past performance highlights inherent risks. Before making any investment decision, consider these points:

- Past controversies: Luckin Coffee has faced significant challenges, including a major accounting scandal. While the company has taken steps to address these issues, the past remains a factor to consider. Thoroughly research the company's history and current financial standing.

- Market competition: The Chinese coffee market is becoming increasingly competitive. Luckin Coffee faces stiff competition from established players and new entrants, creating uncertainty about its future market share.

- Regulatory environment: The regulatory landscape in China can be unpredictable, posing potential risks for businesses operating within the country.

Where to Find More Information:

Before investing in any stock, conducting thorough due diligence is crucial. We recommend:

- Reviewing Luckin Coffee's official financial reports: These reports provide detailed information about the company's financial performance and position. [Link to Luckin Coffee Investor Relations]

- Consulting with a financial advisor: A financial advisor can provide personalized guidance based on your individual investment goals and risk tolerance.

- Staying updated on market news: Keeping abreast of relevant news and analysis will help you make informed investment decisions.

Conclusion:

The recent 5.2% surge in Luckin Coffee's stock price presents an intriguing opportunity, but it's not without significant risks. The potential for growth in the Chinese coffee market is undeniable, but the company's past controversies and competitive landscape demand a cautious approach. Thorough research and informed decision-making are essential before considering an investment in LKNCY. Remember, this article provides information for educational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Luckin Coffee Stock Up 5.2%: Should You Buy LKNCY Now?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

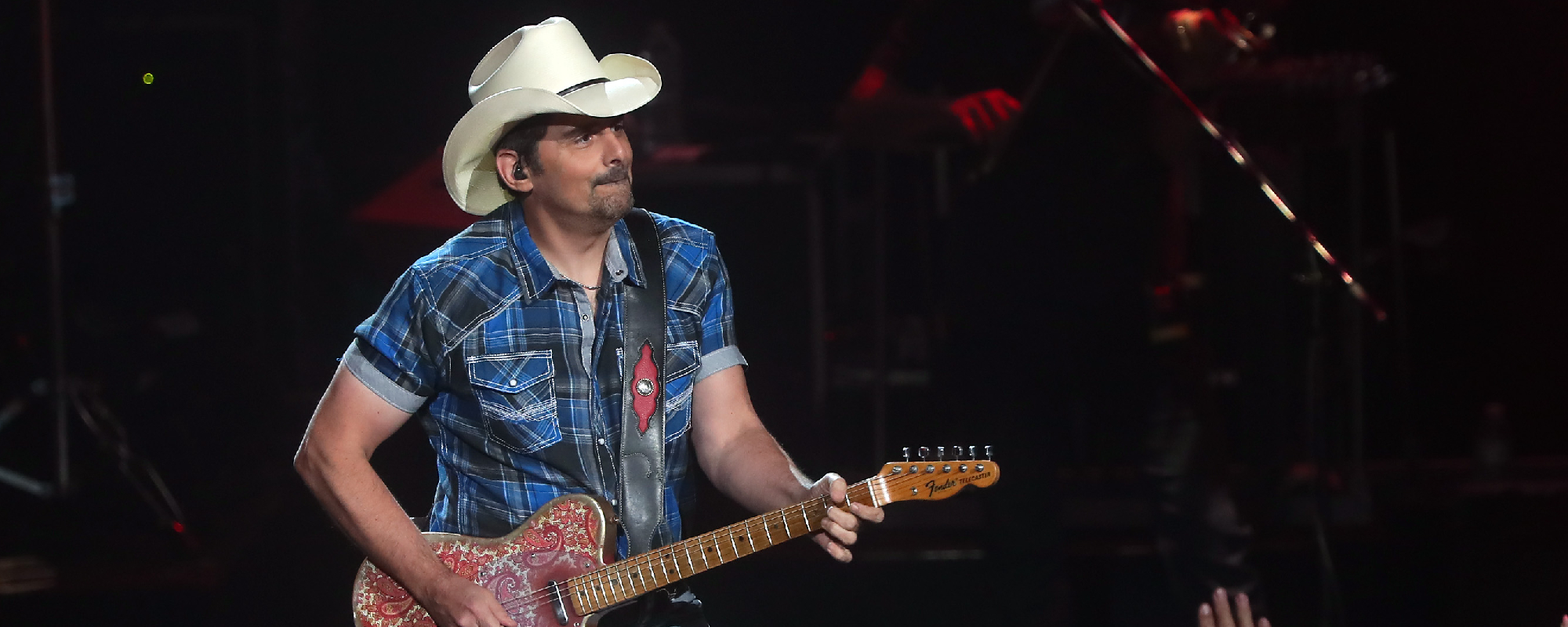

Brad Paisleys Wilmington Show Features Surprise Guest Appearance By Local Police

Aug 01, 2025

Brad Paisleys Wilmington Show Features Surprise Guest Appearance By Local Police

Aug 01, 2025 -

Analyzing J J Mc Carthys Performance Key Takeaways From Vikings Training

Aug 01, 2025

Analyzing J J Mc Carthys Performance Key Takeaways From Vikings Training

Aug 01, 2025 -

Trump Details Falling Out With Epstein Allegations Of Mar A Lago Misconduct

Aug 01, 2025

Trump Details Falling Out With Epstein Allegations Of Mar A Lago Misconduct

Aug 01, 2025 -

Brad Paisley Performs Mr Policeman Amidst Unexpected Police Presence

Aug 01, 2025

Brad Paisley Performs Mr Policeman Amidst Unexpected Police Presence

Aug 01, 2025 -

Luckin Coffees Q2 2025 Financial Report Strong Revenue And Store Growth

Aug 01, 2025

Luckin Coffees Q2 2025 Financial Report Strong Revenue And Store Growth

Aug 01, 2025