Luckin Coffee (OTCMKTS:LKNCY) Stock Up: Is It Still A Buy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Luckin Coffee (OTCMKTS:LKNCY) Stock Up: Is it Still a Buy?

Luckin Coffee (OTCMKTS:LKNCY) has seen its stock price surge recently, leaving many investors wondering if this Chinese coffee giant is still a worthwhile investment. The company, once embroiled in a major accounting scandal, has been working hard to rebuild its reputation and regain investor trust. But is this resurgence sustainable, or is it just a fleeting moment of market optimism? Let's delve into the details.

The Rise from the Ashes:

Luckin Coffee's journey has been nothing short of dramatic. After a shocking accounting scandal in 2020 revealed fabricated sales figures, the company's stock plummeted. Delisting from the Nasdaq followed, leaving many investors with significant losses. However, the company has since undergone a significant restructuring, focusing on operational improvements and transparency. This turnaround has been a key factor in its recent stock price increase.

Key Factors Driving the Stock Uptick:

Several factors contribute to the renewed interest in LKNCY:

- Operational Restructuring: Luckin Coffee has implemented significant changes to its operational structure, focusing on efficiency and profitability. This includes streamlining its supply chain and optimizing its store network.

- Strong Revenue Growth: Despite the past controversies, Luckin Coffee has demonstrated impressive revenue growth in recent quarters, showcasing its resilience and ability to attract customers. This growth is fueled by its strong brand recognition and a growing market for coffee in China.

- Increased Transparency: The company has made efforts to improve its financial reporting and transparency, aiming to regain the trust of investors and regulators. This commitment to transparency is crucial for its long-term success.

- Market Sentiment: Positive market sentiment towards the Chinese economy, particularly in the consumer sector, has also contributed to the recent stock price increase.

Is it Still a Buy? Analyzing the Risks:

While the recent performance of LKNCY is encouraging, investors should carefully consider the inherent risks before investing:

- Past Accounting Scandal: The lingering shadow of the past accounting scandal remains a significant risk. Although the company has taken steps to address these issues, investor confidence may take time to fully recover.

- Geopolitical Risks: Investing in Chinese companies carries inherent geopolitical risks, including potential regulatory changes and trade tensions between the US and China.

- Competition: Luckin Coffee operates in a highly competitive market, facing strong competition from established players both domestically and internationally.

What Experts Say:

Analyst opinions on LKNCY remain divided. Some analysts highlight the company's strong operational recovery and growth potential, recommending a buy or hold strategy. Others remain cautious, citing the risks associated with the company's past and the competitive landscape. It's crucial to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Conclusion:

The recent surge in Luckin Coffee's stock price is undeniably impressive. However, investors need to carefully weigh the potential rewards against the significant risks involved. The company's turnaround has been remarkable, but the past accounting scandal and ongoing geopolitical uncertainties remain substantial concerns. Ultimately, whether LKNCY is a "buy" depends on your individual risk tolerance and investment strategy. Thorough research and a well-informed decision-making process are crucial. Remember to always consult with a qualified financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Luckin Coffee (OTCMKTS:LKNCY) Stock Up: Is It Still A Buy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

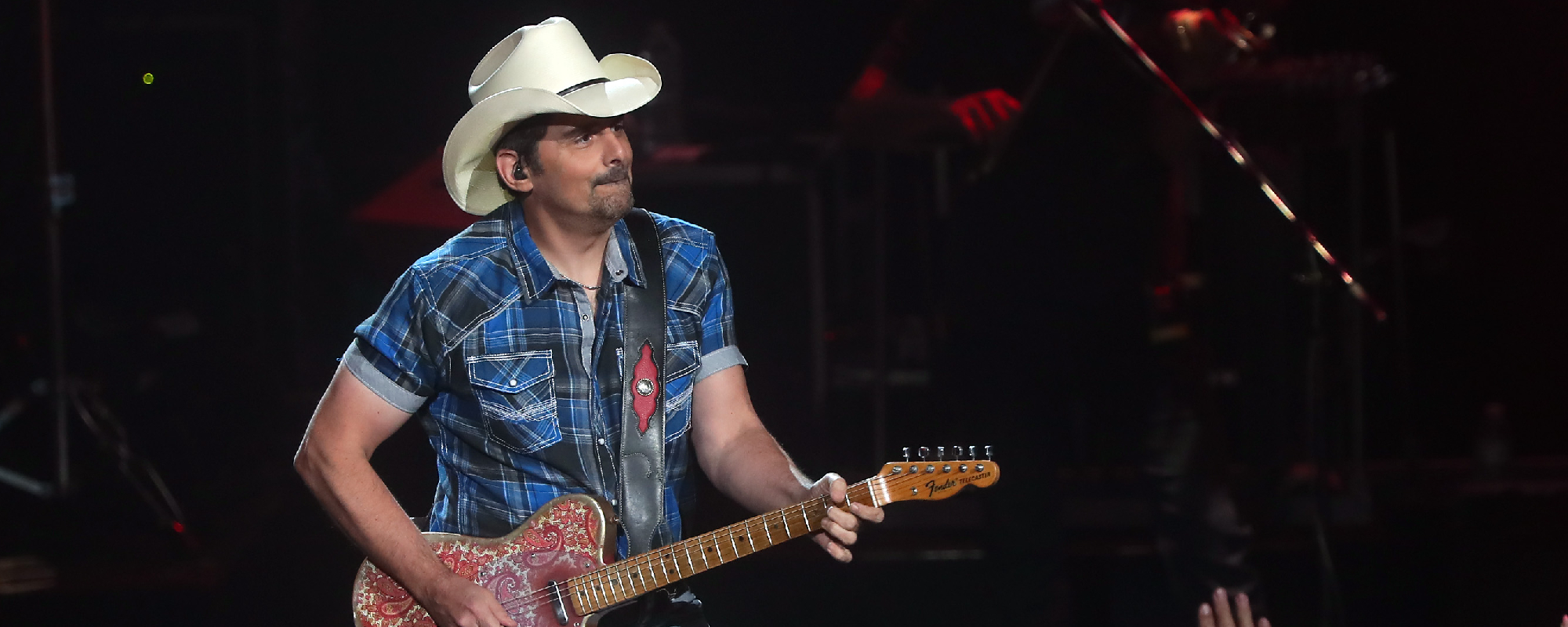

Police Surround Brad Paisley On Stage During Connecticut Show

Aug 01, 2025

Police Surround Brad Paisley On Stage During Connecticut Show

Aug 01, 2025 -

Analyzing The 2025 Sec Football Schedules Cbs Sports Strength Of Schedule

Aug 01, 2025

Analyzing The 2025 Sec Football Schedules Cbs Sports Strength Of Schedule

Aug 01, 2025 -

Ohio Powerball Lottery July 30th Winning Numbers And Prize Winners

Aug 01, 2025

Ohio Powerball Lottery July 30th Winning Numbers And Prize Winners

Aug 01, 2025 -

July 28 2025 Powerball Results Jackpot Winner Announced

Aug 01, 2025

July 28 2025 Powerball Results Jackpot Winner Announced

Aug 01, 2025 -

Stephen Colbert Pushes Boundaries Provoking Cbs Censorship

Aug 01, 2025

Stephen Colbert Pushes Boundaries Provoking Cbs Censorship

Aug 01, 2025