Lucid Stock Falls Over 4%: Reasons Behind The Sharp Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Stock Falls Over 4%: Reasons Behind the Sharp Decline

Lucid Group (LCID) stock experienced a significant downturn, plunging over 4% on [Date of Stock Drop]. This sharp decline sent ripples through the electric vehicle (EV) sector, prompting investors to question the future trajectory of the promising yet volatile automaker. Several factors contributed to this sudden drop, ranging from broader market anxieties to specific concerns surrounding Lucid's performance.

Market Sentiment and Broader Economic Concerns:

The overall market sentiment played a crucial role in Lucid's stock performance. A prevailing sense of uncertainty surrounding inflation, interest rate hikes, and a potential recession significantly impacted investor confidence across various sectors, including the EV market. This negative sentiment often disproportionately affects growth stocks like Lucid, which are perceived as riskier investments during economic downturns. [Link to a relevant market analysis article].

Production Challenges and Delivery Delays:

Lucid, like many EV manufacturers, continues to navigate supply chain disruptions and logistical hurdles. While the company has made strides in increasing production, any perceived shortfall in meeting projected delivery targets can trigger immediate investor reaction. Reports of potential delays, even minor ones, can significantly impact investor confidence and contribute to stock price volatility. [Link to a Lucid press release or news article about production].

Competition Intensifies in the EV Market:

The electric vehicle market is becoming increasingly crowded, with established automakers and new entrants vying for market share. The fierce competition exerts pressure on pricing, margins, and overall profitability. Lucid's ability to differentiate itself and maintain a competitive edge in this rapidly evolving landscape remains a key concern for investors. This competitive pressure contributes to the inherent volatility of its stock. [Link to an article comparing major EV players].

Analyst Ratings and Price Target Adjustments:

Changes in analyst ratings and price target adjustments can significantly influence stock prices. A downgrade from a prominent financial analyst or a reduction in the price target can trigger sell-offs, particularly for stocks already facing headwinds. [Link to relevant analyst reports if available].

Lack of Profitability and Reliance on Funding:

Lucid, like many early-stage EV companies, is not yet profitable. Its reliance on funding and ongoing capital raises to support its growth and expansion plans can create vulnerability to market fluctuations. Investor confidence is directly linked to the company's ability to achieve profitability and demonstrate a sustainable business model. [Link to Lucid's financial reports].

What's Next for Lucid Stock?

The future trajectory of Lucid stock remains uncertain. While the company boasts impressive technology and a compelling product lineup, overcoming the challenges outlined above will be crucial for regaining investor confidence and stabilizing its stock price. Closely monitoring production figures, delivery schedules, and broader economic indicators will be key for investors gauging the future performance of LCID. [Link to Lucid's investor relations page].

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves inherent risks, and it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Stock Falls Over 4%: Reasons Behind The Sharp Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Qymt Amrwz Tla Dlar W Skh 11 Shhrywr 1404 Aya Rwnd Sewdy Adamh Dard

Sep 03, 2025

Qymt Amrwz Tla Dlar W Skh 11 Shhrywr 1404 Aya Rwnd Sewdy Adamh Dard

Sep 03, 2025 -

Check Your Tickets Hoosier Lottery Mega Millions And Cash 5 Winning Numbers August 29 2025

Sep 03, 2025

Check Your Tickets Hoosier Lottery Mega Millions And Cash 5 Winning Numbers August 29 2025

Sep 03, 2025 -

Why Did Lucid Stock Price Drop 4 Today Analysis And Insights

Sep 03, 2025

Why Did Lucid Stock Price Drop 4 Today Analysis And Insights

Sep 03, 2025 -

Georgina Rodriguezs Massive Engagement Ring Takes Center Stage In Venice

Sep 03, 2025

Georgina Rodriguezs Massive Engagement Ring Takes Center Stage In Venice

Sep 03, 2025 -

7 New Apple Products Predicted For September Launch

Sep 03, 2025

7 New Apple Products Predicted For September Launch

Sep 03, 2025

Latest Posts

-

Depp V Heard Dissecting A Publicly Contested Union

Sep 05, 2025

Depp V Heard Dissecting A Publicly Contested Union

Sep 05, 2025 -

I Pad Users Rejoice Instagrams Official App Is Finally Here

Sep 05, 2025

I Pad Users Rejoice Instagrams Official App Is Finally Here

Sep 05, 2025 -

Wednesday September 3rd Ny Lotto Results Win 4 And Take 5

Sep 05, 2025

Wednesday September 3rd Ny Lotto Results Win 4 And Take 5

Sep 05, 2025 -

Find The Winning Ny Lotto Numbers Win 4 And Take 5 Results Sept 3rd

Sep 05, 2025

Find The Winning Ny Lotto Numbers Win 4 And Take 5 Results Sept 3rd

Sep 05, 2025 -

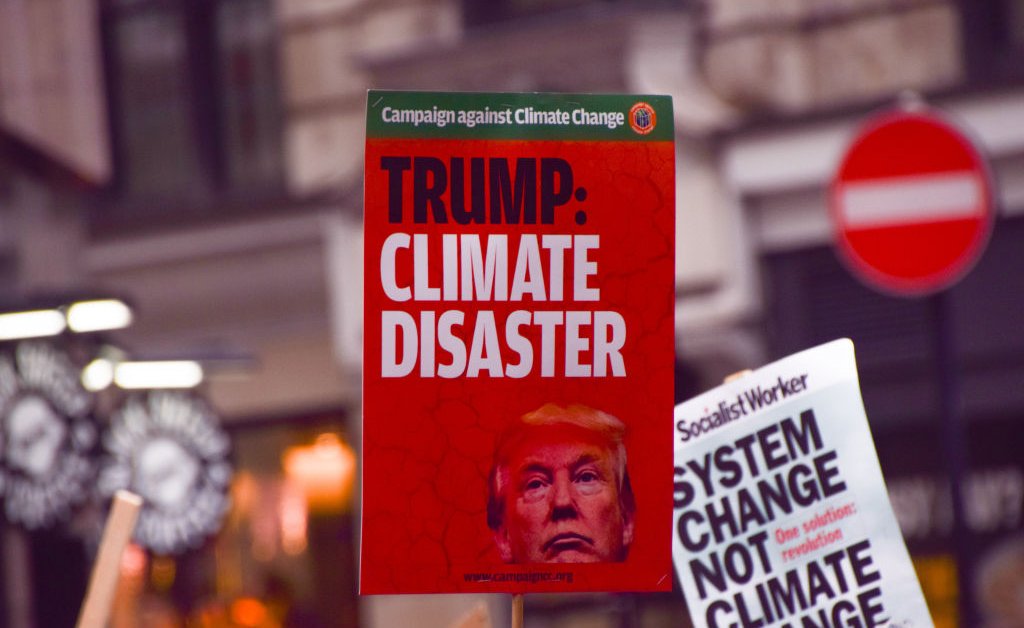

Leading Scientists Denounce Trump Administrations Climate Report As Inadequate And Misleading

Sep 05, 2025

Leading Scientists Denounce Trump Administrations Climate Report As Inadequate And Misleading

Sep 05, 2025