Lucid Motors Stock: A 4%+ Drop Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Motors Stock: A 4%+ Drop Explained – What Investors Need to Know

Lucid Group (LCID) stock experienced a significant downturn, plummeting over 4% in a single trading session. This unexpected dip sent ripples through the electric vehicle (EV) sector, leaving investors scrambling for answers. While market volatility is a common occurrence, understanding the underlying factors contributing to this specific drop is crucial for informed decision-making. This article delves into the potential causes of Lucid's stock decline, analyzing recent news and market trends to provide clarity for investors.

H2: The Fall from Grace: Deciphering the 4%+ Drop

Several factors likely contributed to Lucid's recent stock price decline. While pinpointing the exact cause is challenging, a confluence of events likely played a significant role:

-

Overall Market Sentiment: The broader market's performance often influences individual stock prices. A general downturn in the tech sector, particularly within the EV space, can drag down even strong performers like Lucid. Recent interest rate hikes and concerns about inflation have created a climate of uncertainty, impacting investor confidence across the board. [Link to relevant market analysis article]

-

Production Challenges: Lucid, like many other EV startups, has faced production hurdles. Meeting ambitious production targets is a significant challenge, and any perceived shortfall can negatively impact investor sentiment. While Lucid has reported progress, any indication of slower-than-expected production could trigger sell-offs. [Link to Lucid's production reports]

-

Competition Intensifies: The EV market is becoming increasingly competitive. Established automakers are rapidly expanding their EV offerings, and new entrants are constantly emerging. Increased competition can put pressure on pricing and market share, potentially affecting a company's profitability and investor confidence. [Link to article comparing EV competitors]

-

Lack of Recent Positive Catalysts: The absence of significant positive news or announcements from Lucid may have contributed to the sell-off. Investors often react negatively when a company fails to deliver consistent positive updates, leading to a decrease in buying pressure.

H2: Long-Term Outlook for Lucid Motors

Despite the recent setback, Lucid Motors remains a key player in the burgeoning EV market. The company possesses innovative technology and a strong brand identity. However, investors need to carefully consider the risks involved before investing in a company still in its relatively early stages of development.

H3: Key Considerations for Investors:

-

Production Scalability: Lucid's ability to scale its production efficiently will be crucial for its long-term success. Investors should closely monitor production updates and any announcements regarding potential challenges.

-

Financial Performance: Sustained profitability will be essential for Lucid's growth and stability. Investors should review Lucid's financial reports and analyze its progress toward achieving financial goals.

-

Technological Innovation: Maintaining a competitive edge through technological advancements will be key for Lucid to remain relevant in the ever-evolving EV landscape.

H2: What to Do Now?

The recent drop in Lucid's stock price presents both a potential opportunity and a warning. For long-term investors with a high-risk tolerance, this dip could be viewed as a buying opportunity. However, those with a lower risk tolerance might consider waiting for more positive indicators before making any investment decisions. Thorough due diligence and a clear understanding of the inherent risks are crucial before investing in any stock, especially in the volatile EV sector.

Disclaimer: This article provides general information and should not be considered financial advice. Conduct your own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Motors Stock: A 4%+ Drop Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Katrinas Legacy Reflecting On 20 Years Of Disaster Response

Sep 03, 2025

Katrinas Legacy Reflecting On 20 Years Of Disaster Response

Sep 03, 2025 -

Xi And Putin At Sco Summit A New Global Order Takes Shape

Sep 03, 2025

Xi And Putin At Sco Summit A New Global Order Takes Shape

Sep 03, 2025 -

New Helldivers 2 Players Appreciate Veteran Help Leading To Massive Growth

Sep 03, 2025

New Helldivers 2 Players Appreciate Veteran Help Leading To Massive Growth

Sep 03, 2025 -

Drafting Quinshon Judkins Analyzing His Fantasy Football Potential

Sep 03, 2025

Drafting Quinshon Judkins Analyzing His Fantasy Football Potential

Sep 03, 2025 -

Thlyl Bazar Tla W Arz 11 Shhrywr 1404 Pysh Byny Qymt Dlar W Skh Dr Rwz Jary

Sep 03, 2025

Thlyl Bazar Tla W Arz 11 Shhrywr 1404 Pysh Byny Qymt Dlar W Skh Dr Rwz Jary

Sep 03, 2025

Latest Posts

-

Las Vegas Weather Thunderstorm And Shower Chances Continue Temperatures Remain Low

Sep 05, 2025

Las Vegas Weather Thunderstorm And Shower Chances Continue Temperatures Remain Low

Sep 05, 2025 -

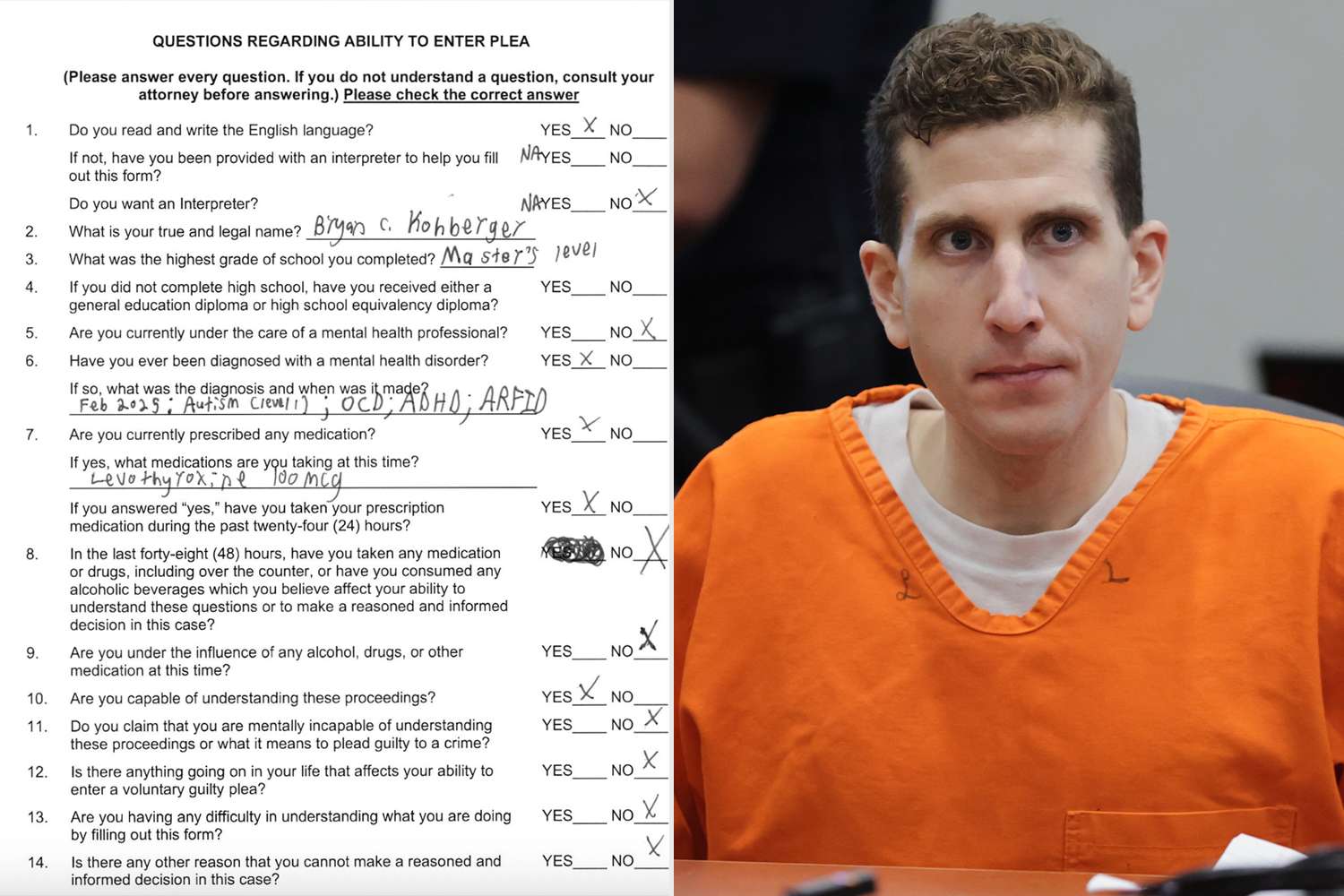

Four Mental Health Disorders Revealed In Bryan Kohbergers Plea

Sep 05, 2025

Four Mental Health Disorders Revealed In Bryan Kohbergers Plea

Sep 05, 2025 -

Uk Surgeons Conviction Fraud And Leg Amputation For Sexual Reasons

Sep 05, 2025

Uk Surgeons Conviction Fraud And Leg Amputation For Sexual Reasons

Sep 05, 2025 -

Nhs Surgeons Leg Amputations And Fraud A Shocking Jailing

Sep 05, 2025

Nhs Surgeons Leg Amputations And Fraud A Shocking Jailing

Sep 05, 2025 -

Idaho Murders Suspect Bryan Kohberger Diagnosed With Multiple Disorders

Sep 05, 2025

Idaho Murders Suspect Bryan Kohberger Diagnosed With Multiple Disorders

Sep 05, 2025