Lucid Motors (LCID) Stock: Brokerage Price Targets And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Motors (LCID) Stock: Brokerage Price Targets and Future Outlook

Lucid Motors (LCID) has captured significant attention in the electric vehicle (EV) market, but its stock price has experienced considerable volatility. Understanding the current brokerage price targets and the future outlook for LCID stock is crucial for potential investors. This article delves into the key factors influencing analyst predictions and offers a balanced perspective on the company's trajectory.

Current Brokerage Price Targets: A Mixed Bag

Analyst sentiment towards Lucid Motors is currently mixed, reflected in the range of price targets set by various brokerages. While some analysts remain bullish, citing the company's technological advancements and luxury market positioning, others express concerns regarding production challenges and competition within the increasingly crowded EV landscape.

-

Bullish Predictions: Several firms maintain optimistic price targets, projecting substantial growth potential for LCID based on anticipated production increases and expansion into new markets. These predictions often hinge on successful execution of Lucid's ambitious production plans and the continued strong demand for its luxury EVs.

-

Cautious Outlooks: Conversely, other analysts have issued more cautious price targets, reflecting concerns about the company's profitability and its ability to compete effectively with established EV giants like Tesla and emerging rivals. Production delays and higher-than-expected manufacturing costs are frequently cited as contributing factors to these more conservative projections.

Factors Influencing the Future Outlook of LCID Stock:

Several key factors will significantly shape the future performance of LCID stock:

-

Production Ramp-Up: Successfully scaling up production to meet growing demand is paramount. Any significant delays or production bottlenecks could negatively impact investor confidence and the stock price.

-

Demand for Luxury EVs: The overall demand for luxury electric vehicles plays a crucial role. Economic downturns or shifts in consumer preferences could affect Lucid's sales figures and ultimately, its stock price.

-

Competition: The EV market is becoming increasingly competitive. Lucid's ability to differentiate itself through innovation, superior technology, and a strong brand identity will be critical for maintaining its market share.

-

Financial Performance: Lucid's path to profitability is a key factor investors are watching closely. Demonstrating consistent revenue growth and improved margins will be essential for bolstering investor confidence.

-

Technological Advancements: Continued innovation and investment in research and development are crucial for maintaining a competitive edge. Introducing new models and technologies that cater to evolving consumer needs will be a key driver of future growth.

H2: Navigating the Volatility: Tips for Investors

Investing in LCID stock involves inherent risks due to its volatility. Before making any investment decisions, it's crucial to conduct thorough due diligence and consider your own risk tolerance.

-

Diversification: Diversifying your investment portfolio is essential to mitigate risks. Don't put all your eggs in one basket.

-

Long-Term Perspective: Investing in the EV sector requires a long-term perspective. Short-term fluctuations are expected, and focusing on the company's long-term potential is vital.

-

Stay Informed: Keep abreast of the latest news and developments regarding Lucid Motors, including financial reports, production updates, and industry trends. Reliable financial news sources are your best bet.

Conclusion:

The future outlook for Lucid Motors (LCID) stock is complex and depends on several interconnected factors. While some analysts remain optimistic about its long-term potential, others express concerns about its ability to navigate the challenges of a rapidly evolving EV market. Thorough research and a well-defined investment strategy are essential for investors considering adding LCID to their portfolios. Remember to consult with a qualified financial advisor before making any investment decisions. This information is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Motors (LCID) Stock: Brokerage Price Targets And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Beef Eddie Johnsons Cba In The 80s Jab At Patrick Beverley Sparks Debate

Sep 02, 2025

Nba Beef Eddie Johnsons Cba In The 80s Jab At Patrick Beverley Sparks Debate

Sep 02, 2025 -

Rockstars Massive Gta Vi Budget The 300 Million Water Detail

Sep 02, 2025

Rockstars Massive Gta Vi Budget The 300 Million Water Detail

Sep 02, 2025 -

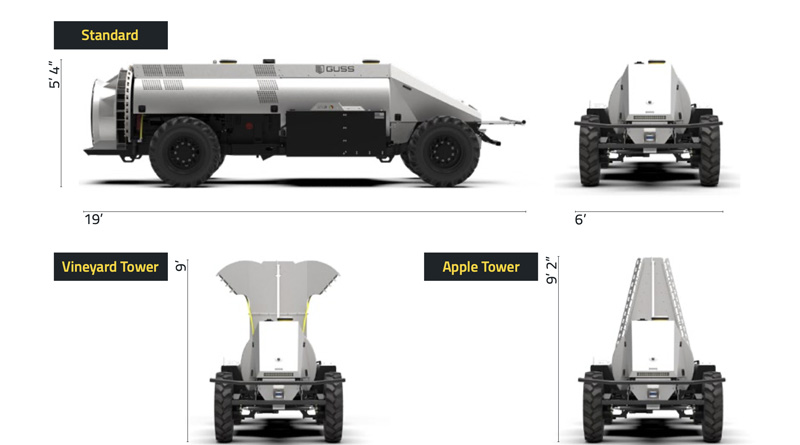

The Future Of Orchard And Vineyard Spraying Introducing The Mini Guss Autonomous System

Sep 02, 2025

The Future Of Orchard And Vineyard Spraying Introducing The Mini Guss Autonomous System

Sep 02, 2025 -

Box Office Bomb Becomes Streaming Champion Mel Gibsons Surprising Turnaround

Sep 02, 2025

Box Office Bomb Becomes Streaming Champion Mel Gibsons Surprising Turnaround

Sep 02, 2025 -

Digital Humans The Ai Solution For Singapore Companies Facing Manpower And Customer Reach Challenges

Sep 02, 2025

Digital Humans The Ai Solution For Singapore Companies Facing Manpower And Customer Reach Challenges

Sep 02, 2025

Latest Posts

-

New Photo Shows Georgina Rodriguezs Impressive Engagement Ring From Cristiano Ronaldo

Sep 02, 2025

New Photo Shows Georgina Rodriguezs Impressive Engagement Ring From Cristiano Ronaldo

Sep 02, 2025 -

Find Out Now Hoosier Lottery Cash 5 Winning Numbers August 30 2025

Sep 02, 2025

Find Out Now Hoosier Lottery Cash 5 Winning Numbers August 30 2025

Sep 02, 2025 -

Huge Savings Lg C5 Evo 4 K Oled Tv Labor Day Deal On E Bay

Sep 02, 2025

Huge Savings Lg C5 Evo 4 K Oled Tv Labor Day Deal On E Bay

Sep 02, 2025 -

Lucid Group Lcid Stock Suffers 4 Loss Market Analysis And Outlook

Sep 02, 2025

Lucid Group Lcid Stock Suffers 4 Loss Market Analysis And Outlook

Sep 02, 2025 -

Minneapolis Shooting Investigation Current Status And Open Questions

Sep 02, 2025

Minneapolis Shooting Investigation Current Status And Open Questions

Sep 02, 2025