Lucid Group Stock Market Losses: A 4%+ Decline Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Group Stock Market Losses: A 4%+ Decline Explained

Lucid Group, the electric vehicle (EV) maker, experienced a significant setback on [Date], witnessing its stock price plummet by over 4%. This sharp decline sent ripples through the already volatile EV market, leaving investors wondering about the causes and potential implications. This article delves into the factors contributing to this substantial loss and explores what this means for Lucid's future.

What Triggered the 4%+ Stock Drop?

While pinpointing a single cause for such a dramatic drop is challenging, several contributing factors likely played a role:

-

Overall Market Sentiment: The broader market's performance significantly impacts individual stocks, particularly those in growth sectors like EVs. A general downturn in investor confidence can lead to sell-offs across the board. Recent economic indicators and interest rate hikes have contributed to a cautious market sentiment, affecting Lucid's share price alongside other growth stocks.

-

Production Challenges: Lucid, like many other EV manufacturers, has faced production hurdles. Meeting ambitious production targets remains a significant challenge, impacting the company's ability to deliver vehicles and generate revenue as planned. Any news or speculation regarding further production delays can trigger negative investor reactions.

-

Competition: The EV market is fiercely competitive. Established players like Tesla and a growing number of new entrants constantly vie for market share. News about competitors gaining traction or announcing aggressive new models can impact investor perception of Lucid's competitive position.

-

Investor Sentiment & Analyst Reports: Negative analyst reports or downgrades can significantly influence investor sentiment. Changes in analyst ratings or predictions about future performance can lead to immediate sell-offs, amplifying existing market anxieties.

-

Lack of Significant News: Sometimes, a lack of positive news can be as impactful as negative news. Without significant announcements of new models, partnerships, or substantial sales growth, investor confidence can wane, leading to selling pressure.

Analyzing Lucid's Long-Term Prospects:

Despite this recent setback, Lucid's long-term prospects remain a subject of debate among analysts. The company boasts impressive technology and a luxury brand image, potentially attracting a loyal customer base. However, overcoming production challenges and navigating intense competition will be crucial for sustained growth.

What Investors Should Consider:

Investors considering investing in or holding Lucid stock should carefully weigh the risks and potential rewards. Analyzing the company's financial reports, paying attention to production updates, and monitoring market sentiment are crucial for informed decision-making. Diversification within one's investment portfolio is also a crucial risk mitigation strategy.

Looking Ahead:

The recent 4%+ decline serves as a reminder of the inherent volatility in the EV market. While Lucid possesses considerable potential, its ability to overcome challenges and deliver on its promises will determine its future trajectory. Investors should stay informed and remain vigilant in their assessment of the company's performance. Further analysis of the company's Q[Quarter] earnings report will be essential to gauge its progress and future outlook.

Disclaimer: This article provides general information and should not be considered financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Group Stock Market Losses: A 4%+ Decline Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Qymt Tla W Dlar Amrwz 11 Shhrywr 1404 Ebwr Dlar Az 106 Hzar Twman Tla Nzdyk Bh 9 Mylywn

Sep 03, 2025

Qymt Tla W Dlar Amrwz 11 Shhrywr 1404 Ebwr Dlar Az 106 Hzar Twman Tla Nzdyk Bh 9 Mylywn

Sep 03, 2025 -

6 Million Engagement Ring Georgina Rodriguez And Cristiano Ronaldos Luxurious Display

Sep 03, 2025

6 Million Engagement Ring Georgina Rodriguez And Cristiano Ronaldos Luxurious Display

Sep 03, 2025 -

New I Phone 17 Models A Detailed Look At The Anticipated Features Of The I Phone 17 I Phone 17 Air And I Phone 17 Pro

Sep 03, 2025

New I Phone 17 Models A Detailed Look At The Anticipated Features Of The I Phone 17 I Phone 17 Air And I Phone 17 Pro

Sep 03, 2025 -

The Last Stand Memphis Community Challenges Elon Musks X Ai Project

Sep 03, 2025

The Last Stand Memphis Community Challenges Elon Musks X Ai Project

Sep 03, 2025 -

Georgina Rodriguez And Cristiano Ronaldo Engagement Ring Unveiled At Venice Film Festival

Sep 03, 2025

Georgina Rodriguez And Cristiano Ronaldo Engagement Ring Unveiled At Venice Film Festival

Sep 03, 2025

Latest Posts

-

Djokovics Fan Incident Mc Ilroy Applauds His Composed Handling

Sep 05, 2025

Djokovics Fan Incident Mc Ilroy Applauds His Composed Handling

Sep 05, 2025 -

Michael Jackson Biopic Receives Backlash From Daughter Paris

Sep 05, 2025

Michael Jackson Biopic Receives Backlash From Daughter Paris

Sep 05, 2025 -

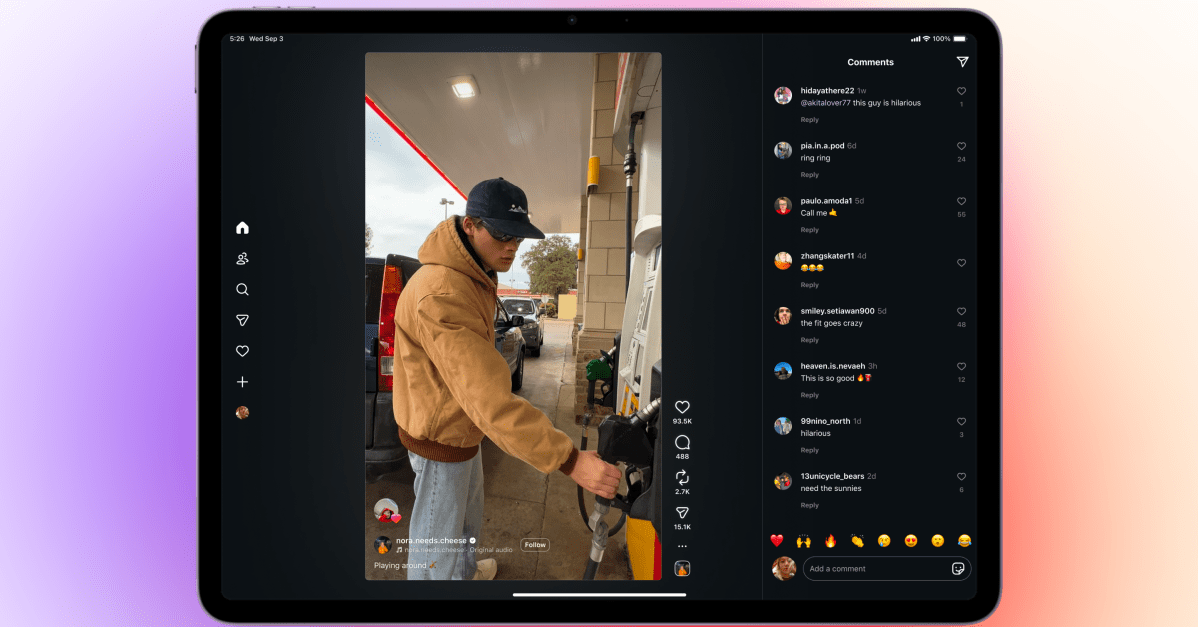

Instagram Finally Arrives On I Pad After 15 Years

Sep 05, 2025

Instagram Finally Arrives On I Pad After 15 Years

Sep 05, 2025 -

Conquering American Opposition Mc Ilroys Djokovic Inspired Ryder Cup Game Plan

Sep 05, 2025

Conquering American Opposition Mc Ilroys Djokovic Inspired Ryder Cup Game Plan

Sep 05, 2025 -

Prince And Paris Jacksons Crucial Role In Upcoming Michael Jackson Biopic According To Colman Domingo

Sep 05, 2025

Prince And Paris Jacksons Crucial Role In Upcoming Michael Jackson Biopic According To Colman Domingo

Sep 05, 2025