Lucid Group (LCID) Stock Target Price Set At $25.94 By Brokerages

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Group (LCID) Stock: Brokerages Set Bullish Target Price at $25.94 – Is This Electric Vehicle Maker Ready to Soar?

Lucid Group (LCID), the luxury electric vehicle (EV) manufacturer, is making headlines as several brokerages have set a consensus target price of $25.94 for its stock. This optimistic forecast suggests a significant upside potential for investors, sparking renewed interest in the company's future prospects. But is this bullish prediction justified? Let's delve into the factors driving this price target and analyze the potential risks and rewards.

The Bullish Case for Lucid:

Several key factors contribute to the optimistic outlook for LCID stock. These include:

-

Strong Product Portfolio: Lucid's flagship vehicle, the Air, has garnered significant praise for its impressive range, luxurious interior, and cutting-edge technology. This positions Lucid to compete effectively in the high-end EV market, a segment expected to experience robust growth in the coming years.

-

Growing Production Capacity: Lucid is actively expanding its production capacity to meet the increasing demand for its vehicles. This expansion is crucial for the company's long-term growth and profitability. Increased production translates directly to higher revenue streams and improved investor confidence.

-

Government Incentives and Subsidies: The burgeoning EV market is heavily influenced by government incentives and subsidies aimed at promoting the adoption of electric vehicles. Lucid is well-positioned to benefit from these supportive policies, boosting sales and profitability.

-

Technological Innovation: Lucid's commitment to technological innovation, particularly in battery technology and autonomous driving capabilities, is a key differentiator in a competitive market. Continuous innovation ensures the company remains at the forefront of EV technology.

Challenges Facing Lucid:

Despite the positive outlook, Lucid faces several challenges:

-

Competition: The EV market is becoming increasingly competitive, with established players like Tesla and a growing number of new entrants vying for market share. Lucid needs to maintain its competitive edge through continuous innovation and strategic marketing.

-

Supply Chain Disruptions: Similar to other automotive manufacturers, Lucid has experienced supply chain disruptions that have impacted its production and delivery timelines. Mitigating these disruptions is crucial for achieving its production targets.

-

Profitability: While Lucid is making strides in production, achieving consistent profitability remains a key challenge. Scaling operations effectively and managing costs efficiently are vital for long-term sustainability.

Analyst Opinions and the $25.94 Target Price:

The $25.94 average target price represents a consensus view from multiple brokerage firms. While individual analyst price targets may vary, the overall sentiment reflects a belief in Lucid's growth potential. However, it's crucial to remember that these are just predictions and actual stock performance can differ significantly. Always conduct your own thorough research before making any investment decisions.

Should You Invest in LCID Stock?

The $25.94 target price presents a compelling argument for investors, but it’s essential to carefully weigh the potential risks and rewards. The EV market is dynamic and unpredictable, and Lucid's success hinges on its ability to overcome the challenges mentioned above. Before investing, consider:

-

Your Risk Tolerance: Investing in growth stocks like LCID carries inherent risk. Are you comfortable with the potential for significant price fluctuations?

-

Long-Term Investment Horizon: Lucid's growth story is likely to unfold over several years. Do you have a long-term investment horizon suitable for this type of investment?

-

Diversification: Diversifying your investment portfolio is a crucial risk management strategy. Don't put all your eggs in one basket.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Keywords: Lucid Group, LCID, LCID stock, electric vehicle, EV, stock target price, investment, stock market, EV market, luxury electric vehicle, Tesla, stock prediction, brokerage forecast.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Group (LCID) Stock Target Price Set At $25.94 By Brokerages. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba 2 K26 Review Early Impressions And First Look

Sep 03, 2025

Nba 2 K26 Review Early Impressions And First Look

Sep 03, 2025 -

Official Donnarumma Signs For Manchester City Replacing Ederson

Sep 03, 2025

Official Donnarumma Signs For Manchester City Replacing Ederson

Sep 03, 2025 -

Ederson Out Donnarumma In Manchester Citys Goalkeeping Shake Up

Sep 03, 2025

Ederson Out Donnarumma In Manchester Citys Goalkeeping Shake Up

Sep 03, 2025 -

The American Dream On Sale Labor Day Deals And Economic Reality

Sep 03, 2025

The American Dream On Sale Labor Day Deals And Economic Reality

Sep 03, 2025 -

Suspected Russian Gps Jamming Incident Involving Ursula Von Der Leyens Plane

Sep 03, 2025

Suspected Russian Gps Jamming Incident Involving Ursula Von Der Leyens Plane

Sep 03, 2025

Latest Posts

-

Monster Season 3 Teaser Charlie Hunnams Chilling Ed Gein Portrayal

Sep 05, 2025

Monster Season 3 Teaser Charlie Hunnams Chilling Ed Gein Portrayal

Sep 05, 2025 -

Bryan Kohberger And Arfid Exploring The Connection

Sep 05, 2025

Bryan Kohberger And Arfid Exploring The Connection

Sep 05, 2025 -

Great Lakes Water Contamination Expands Affecting 1 Million Residents

Sep 05, 2025

Great Lakes Water Contamination Expands Affecting 1 Million Residents

Sep 05, 2025 -

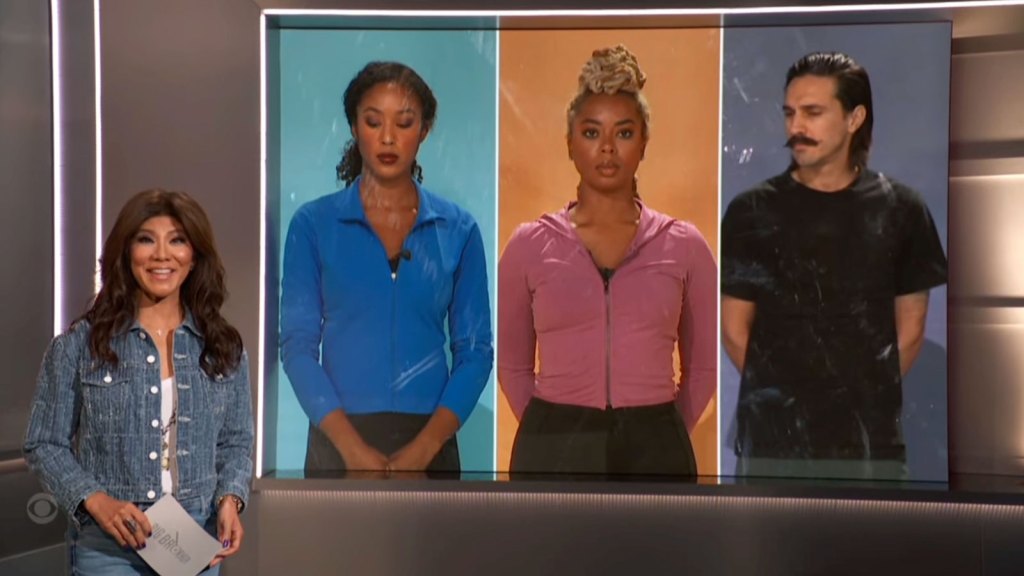

Big Brother Season 27 Week 8 Who Went Home Before Jury

Sep 05, 2025

Big Brother Season 27 Week 8 Who Went Home Before Jury

Sep 05, 2025 -

From Fan To Troll The Untold Story Of A Belichick Prank

Sep 05, 2025

From Fan To Troll The Untold Story Of A Belichick Prank

Sep 05, 2025