Lower US Treasury Yields Reflect Fed's Projected 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lower US Treasury Yields Reflect Fed's Projected 2025 Rate Cut: A Sign of Easing Inflation?

US Treasury yields have dipped recently, signaling a shift in market sentiment regarding the Federal Reserve's (Fed) monetary policy. This decline comes on the heels of the Fed's projected rate cut in 2025, a forecast that has sparked considerable debate among economists and investors. The question on everyone's mind: is this a sign that inflation is finally easing, or is it something else entirely?

This article delves into the implications of lower Treasury yields, exploring the factors driving this trend and analyzing its potential consequences for the US economy and global markets.

Understanding the Connection Between Treasury Yields and Fed Policy

US Treasury yields are fundamentally linked to the Fed's actions. When the Fed raises interest rates to combat inflation, as it has been doing aggressively over the past year, investors demand higher yields on Treasury bonds to compensate for the increased risk-free rate. Conversely, when the Fed signals a potential rate cut, as it did in its recent projections, investors anticipate lower future returns and consequently, Treasury yields fall. This inverse relationship is a cornerstone of understanding bond market dynamics.

The Fed's projection of a rate cut in 2025 is a significant development. It suggests that the central bank anticipates inflation will be sufficiently under control by then to allow for a loosening of monetary policy. This projection, however, is not without its critics. Some argue that the projected timeline is overly optimistic, citing persistent inflationary pressures and potential geopolitical risks.

What's Driving the Decline in Treasury Yields?

Several factors contribute to the recent decline in US Treasury yields beyond the Fed's projections:

- Easing Inflationary Pressures: While inflation remains above the Fed's target, recent data suggests a potential slowdown in price increases. This, coupled with the Fed's projections, leads investors to believe that the worst of inflation might be behind us.

- Recessionary Fears: Concerns about a potential recession in the US and globally are also playing a role. A recession typically leads to lower interest rates as the Fed attempts to stimulate economic activity. This anticipation contributes to lower Treasury yields.

- Geopolitical Uncertainty: Global events, including the war in Ukraine and ongoing tensions in other regions, continue to impact investor sentiment. Uncertainty often pushes investors towards safer assets like Treasury bonds, potentially driving down yields.

Implications for Investors and the Economy

The decline in Treasury yields has significant implications for various sectors:

- Bond Market: Lower yields mean higher bond prices, offering opportunities for fixed-income investors. However, it also signifies lower returns for those seeking income from bonds.

- Stock Market: Lower yields can boost the stock market as investors seek higher returns in equities. However, the relationship is complex and depends on other factors like corporate earnings and economic growth.

- Mortgage Rates: While not directly correlated, lower Treasury yields can influence mortgage rates, potentially making borrowing cheaper for homebuyers.

Looking Ahead: Uncertainty Remains

While the decline in US Treasury yields reflects the Fed's projected 2025 rate cut and suggests a potential easing of inflationary pressures, significant uncertainties remain. The path of inflation, the resilience of the US economy, and global geopolitical developments will all play crucial roles in shaping future interest rate movements.

Investors and economists alike will be closely watching economic indicators and Fed communications in the coming months for further clues about the direction of interest rates and the overall health of the US economy. Staying informed and diversifying investments are crucial strategies in navigating this dynamic market environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lower US Treasury Yields Reflect Fed's Projected 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Update S And P 500s Six Day Rally Dow And Nasdaq Gains Moodys Impact

May 21, 2025

Stock Market Update S And P 500s Six Day Rally Dow And Nasdaq Gains Moodys Impact

May 21, 2025 -

Powerful Tornadoes Cause Widespread Damage In Multiple States

May 21, 2025

Powerful Tornadoes Cause Widespread Damage In Multiple States

May 21, 2025 -

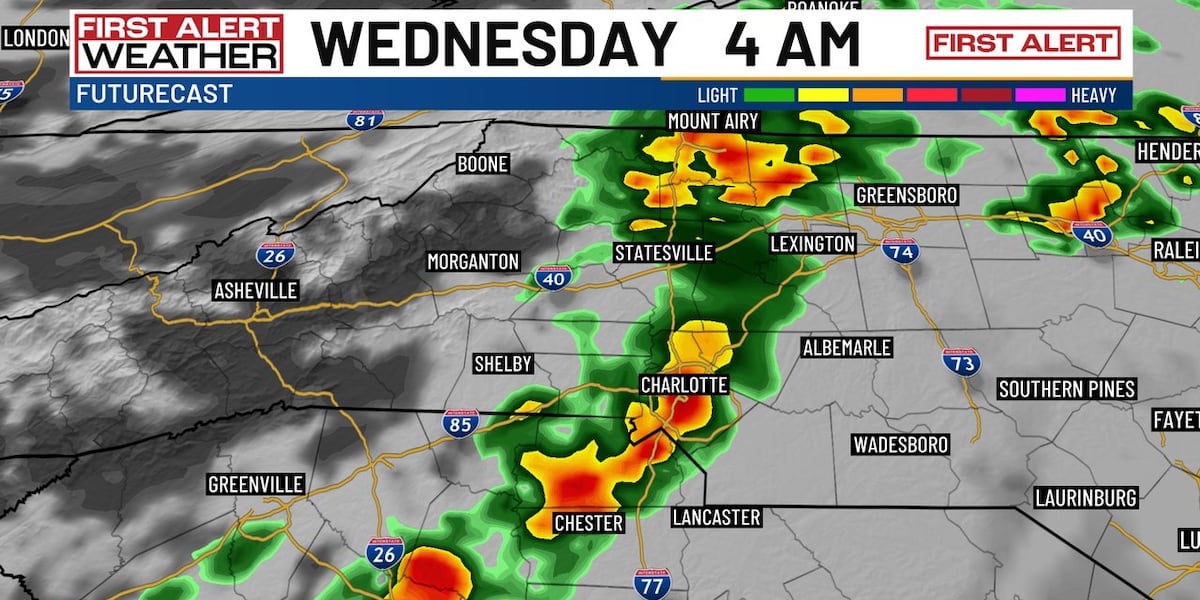

Charlotte Forecasts Overnight Storms Ahead Of A Noticeable Temperature Decrease

May 21, 2025

Charlotte Forecasts Overnight Storms Ahead Of A Noticeable Temperature Decrease

May 21, 2025 -

Ellen De Generes Social Media Reappearance A Touching Return After Tragedy

May 21, 2025

Ellen De Generes Social Media Reappearance A Touching Return After Tragedy

May 21, 2025 -

Severe Weather Emergency Tornadoes Slam Midwest And Southern Us

May 21, 2025

Severe Weather Emergency Tornadoes Slam Midwest And Southern Us

May 21, 2025