Lower Mortgage Refinance Rates Now Available: Check Today's Rates (May 19, 2025)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lower Mortgage Refinance Rates Now Available: Check Today's Rates (May 19, 2025)

Are you paying too much for your mortgage? With interest rates fluctuating, now could be the perfect time to explore refinancing and potentially save thousands of dollars over the life of your loan. Lower mortgage refinance rates are currently available, as of May 19, 2025, offering homeowners a chance to secure a better deal. Check today's rates and see how much you could save!

Why Refinance Your Mortgage Now?

Several factors are contributing to the current availability of lower refinance rates. Recent economic indicators, coupled with shifts in the mortgage market, have created a more favorable environment for borrowers. This means you might be able to:

- Lower your monthly payment: A lower interest rate can significantly reduce your monthly mortgage payment, freeing up cash flow for other financial goals.

- Shorten your loan term: Refinancing to a shorter-term loan can help you pay off your mortgage faster and save on overall interest paid.

- Switch to a better loan type: Perhaps you're currently stuck with an adjustable-rate mortgage (ARM) and want the stability of a fixed-rate mortgage. Refinancing allows for this transition.

- Access your home equity: A cash-out refinance allows you to tap into your home's equity for home improvements, debt consolidation, or other financial needs. However, carefully consider the implications of increasing your overall loan amount.

What to Consider Before Refinancing

While lower rates are enticing, it's crucial to weigh the pros and cons before making a decision. Key factors to consider include:

- Closing costs: Refinancing involves closing costs, which can range depending on your lender and location. Ensure you understand these fees upfront and factor them into your decision.

- Interest rate fluctuations: While rates are currently lower, they are subject to change. Lock in a rate quickly to secure the best offer.

- Your credit score: A higher credit score typically qualifies you for lower interest rates. Check your credit report before applying.

- Your current mortgage terms: Compare your current interest rate and loan terms to the offered refinance rate to determine potential savings.

Finding the Best Mortgage Refinance Rate

Shopping around for the best rate is essential. Don't just rely on your current lender; compare offers from multiple lenders, including:

- Large national banks: These banks often offer competitive rates and a wide range of loan products.

- Local credit unions: Credit unions frequently provide more personalized service and potentially lower rates.

- Online lenders: Online lenders offer convenience and can sometimes provide more competitive rates.

Remember to carefully review the terms and conditions of each offer before making a decision. Consider using a mortgage calculator to estimate your potential monthly savings and total interest paid over the life of the loan. [Link to a reputable mortgage calculator here]

Act Now – Don't Miss Out!

Lower mortgage refinance rates are available now, but they won't last forever. Take advantage of this opportunity to potentially save money and improve your financial situation. Check today's rates from various lenders and see how much you could save by refinancing your mortgage. Contact a qualified mortgage professional today for personalized advice and to discuss your refinancing options. Don't delay – start exploring your refinance options today!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a financial advisor before making any major financial decisions. Interest rates are subject to change.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lower Mortgage Refinance Rates Now Available: Check Today's Rates (May 19, 2025). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fatality Reported At Brooklyn Half Marathon Runner Dies Mid Race

May 19, 2025

Fatality Reported At Brooklyn Half Marathon Runner Dies Mid Race

May 19, 2025 -

Baltimore Orioles Announce Tyler O Neills 10 Day Il Stint

May 19, 2025

Baltimore Orioles Announce Tyler O Neills 10 Day Il Stint

May 19, 2025 -

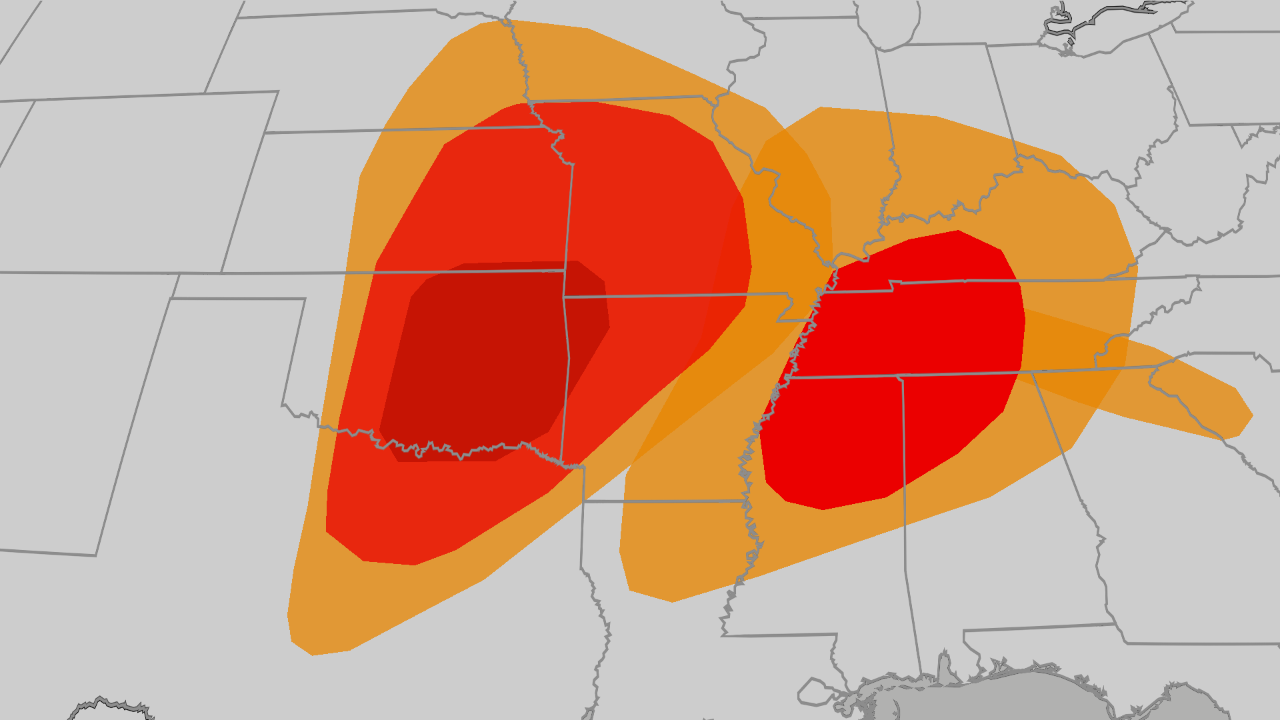

Tornado Threat Intensifies Severe Weather Outbreak Across The Us

May 19, 2025

Tornado Threat Intensifies Severe Weather Outbreak Across The Us

May 19, 2025 -

Man Dies While Participating In Brooklyn Half Marathon

May 19, 2025

Man Dies While Participating In Brooklyn Half Marathon

May 19, 2025 -

Orioles News O Neill Benched Kjerstads Rehabilitation And Rutschmans Struggles

May 19, 2025

Orioles News O Neill Benched Kjerstads Rehabilitation And Rutschmans Struggles

May 19, 2025