Lincoln National's Upsized Cash Tender Offer Reaches $420M

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln National Ups the Ante: $420M Cash Tender Offer Success

Lincoln National Corporation (LNC) has successfully concluded its upsized cash tender offer, raking in a substantial $420 million. This surpasses the initial target, demonstrating strong investor confidence in the company's strategy. The offer, announced earlier this year, focused on repurchasing its outstanding notes, a move analysts interpret as a strategic maneuver to optimize the company's capital structure and potentially boost shareholder value.

This significant financial transaction highlights Lincoln National's proactive approach to managing its debt and capital allocation. The success of the tender offer underscores the attractiveness of the offer terms to bondholders and reflects positively on Lincoln National's creditworthiness.

Details of the Upsized Tender Offer

The tender offer, which closed on [Insert Closing Date], involved the repurchase of [Insert Specific Details about the notes repurchased, e.g., "a significant portion of its outstanding 4.75% senior notes due 2028"]. The upsizing from the initial planned amount showcases the strong demand from investors eager to participate. This strategic move allows Lincoln National to refine its balance sheet and potentially unlock further opportunities for growth and development.

Key takeaways from this successful tender offer include:

- Increased Capital Flexibility: By reducing its outstanding debt, Lincoln National gains greater flexibility in allocating capital to other strategic initiatives. This could involve investments in new technologies, expansion into new markets, or further shareholder return programs.

- Improved Financial Strength: The reduction in debt enhances Lincoln National's overall financial strength and stability, improving its credit rating and reducing its interest expense. This strengthens the company's resilience in the face of economic uncertainty.

- Positive Market Sentiment: The successful completion of the upsized tender offer is viewed favorably by the market, potentially boosting investor confidence and positively impacting Lincoln National's stock price.

Impact on Lincoln National's Future Strategy

This move suggests Lincoln National is prioritizing debt management and capital optimization as key components of its long-term strategy. The company's financial performance and future strategic decisions will be closely watched by analysts and investors alike. This success could pave the way for further capital allocation initiatives designed to maximize shareholder returns. The repurchase program's success also positions Lincoln National for continued growth and expansion in the competitive insurance sector.

What this means for Investors

The successful tender offer signals a positive outlook for Lincoln National's financial health. For investors, this could translate into increased confidence in the company's long-term prospects. However, it’s crucial to remember that investing always involves risk, and individual investment decisions should be made after careful consideration and consultation with a financial advisor.

Looking ahead, analysts will be keen to see how Lincoln National utilizes its enhanced financial flexibility. Will they invest further in their core businesses? Explore acquisitions? Or return even more capital to shareholders? Only time will tell, but the $420 million tender offer marks a significant milestone in the company's journey.

Further Reading:

- [Link to Lincoln National's Investor Relations page]

- [Link to a relevant news article about the insurance industry]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and seek professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln National's Upsized Cash Tender Offer Reaches $420M. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

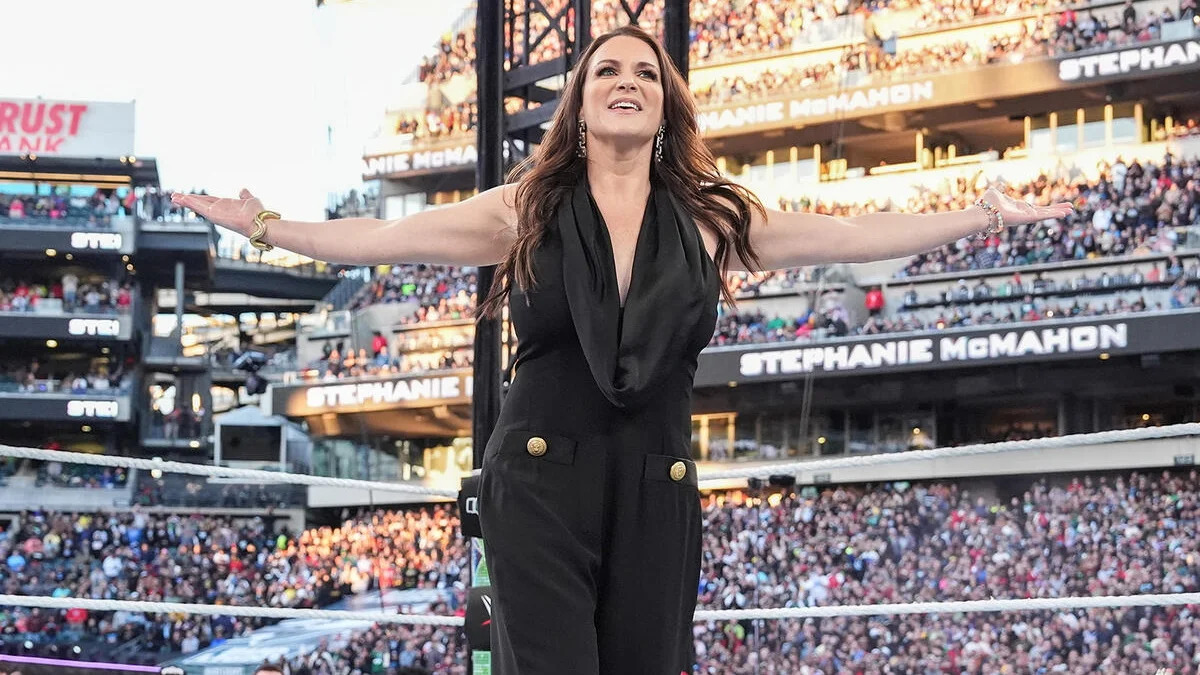

Stephanie Mc Mahon Opens Up About A Tattoo Decision Shes Glad She Avoided

May 28, 2025

Stephanie Mc Mahon Opens Up About A Tattoo Decision Shes Glad She Avoided

May 28, 2025 -

Stephanie Mc Mahon Reveals Unsurprising Tattoo Regret A Wwe Insider Story

May 28, 2025

Stephanie Mc Mahon Reveals Unsurprising Tattoo Regret A Wwe Insider Story

May 28, 2025 -

Roland Garros Update Medjedovic Secures Second Round Spot

May 28, 2025

Roland Garros Update Medjedovic Secures Second Round Spot

May 28, 2025 -

Smr Nne And Oklo Nyse Oklo Breakout Triggered Analyzing The Nuclear Catalyst

May 28, 2025

Smr Nne And Oklo Nyse Oklo Breakout Triggered Analyzing The Nuclear Catalyst

May 28, 2025 -

Severe Storm Leaves Over 165 000 Without Power

May 28, 2025

Severe Storm Leaves Over 165 000 Without Power

May 28, 2025