Lincoln National Raises Cash Tender Offer: $420 Million Upsize Announced

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln National Ups the Ante: $420 Million Cash Tender Offer Expansion Shakes Up the Market

Lincoln National Corporation (LNC) sent ripples through the financial markets today with the announcement of a significant expansion to its previously announced cash tender offer. The company has increased the offer size by a substantial $420 million, boosting investor confidence and sparking considerable interest in the insurance giant's strategic moves. This development marks a key moment for LNC and underscores its commitment to optimizing its capital structure and bolstering its financial flexibility.

This unexpected upsize reflects a strong response to the initial tender offer, exceeding initial expectations and highlighting the attractiveness of Lincoln National's offer to bondholders. The increased capital infusion will allow LNC to pursue strategic initiatives, potentially including acquisitions, investments in new technologies, or bolstering its existing product offerings. The specifics of how this additional capital will be deployed remain to be seen, but analysts are already speculating on several possibilities.

Understanding the Expanded Tender Offer:

The original tender offer, announced [insert date of original announcement], aimed to repurchase a specific tranche of its outstanding debt. This expansion suggests that Lincoln National is keen to seize this opportunity to further optimize its balance sheet. The enlarged offer presents a compelling proposition for bondholders, providing them with an attractive exit strategy in the current market environment.

Key Implications for Investors:

- Stronger Balance Sheet: The increased tender offer signals a commitment to financial strength and stability, enhancing LNC's credit rating prospects. This is a positive sign for long-term investors.

- Strategic Opportunities: The additional capital provides Lincoln National with greater financial flexibility to pursue growth opportunities, potentially leading to increased profitability in the future.

- Market Confidence: The successful upsize reflects confidence in Lincoln National's future prospects and strengthens its position within the competitive insurance market.

What's Next for Lincoln National?

The market will be closely watching Lincoln National's next move. This significant capital injection opens up several exciting avenues for strategic growth and innovation. Investors will be eager to learn more about how the company plans to utilize this new capital to further enhance shareholder value. Further announcements regarding the deployment of these funds are anticipated in the coming weeks or months.

Analyzing the Financial Landscape: This move by Lincoln National highlights the ongoing trend of companies strategically managing their balance sheets in response to the dynamic macroeconomic environment. The increased competition within the insurance sector underscores the importance of proactive financial management.

Stay Informed: Keep an eye on Lincoln National's investor relations page and official press releases for the latest updates on this development. Financial news sources will also provide ongoing coverage of this significant event and its impact on the broader financial markets.

Keywords: Lincoln National, LNC, cash tender offer, debt repurchase, financial markets, insurance industry, investment, stock market, bondholders, capital structure, strategic initiatives, financial flexibility, balance sheet, shareholder value, macroeconomic environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln National Raises Cash Tender Offer: $420 Million Upsize Announced. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Twin Tennis Players Make History Dual State Championship Wins In Pennsylvania

May 29, 2025

Twin Tennis Players Make History Dual State Championship Wins In Pennsylvania

May 29, 2025 -

Receitas E Tradicoes Organizando Uma Festa Portuguesa Inesquecivel

May 29, 2025

Receitas E Tradicoes Organizando Uma Festa Portuguesa Inesquecivel

May 29, 2025 -

Buzz Feed Bzfd Receives 40 Million Loan To Improve Financial Position

May 29, 2025

Buzz Feed Bzfd Receives 40 Million Loan To Improve Financial Position

May 29, 2025 -

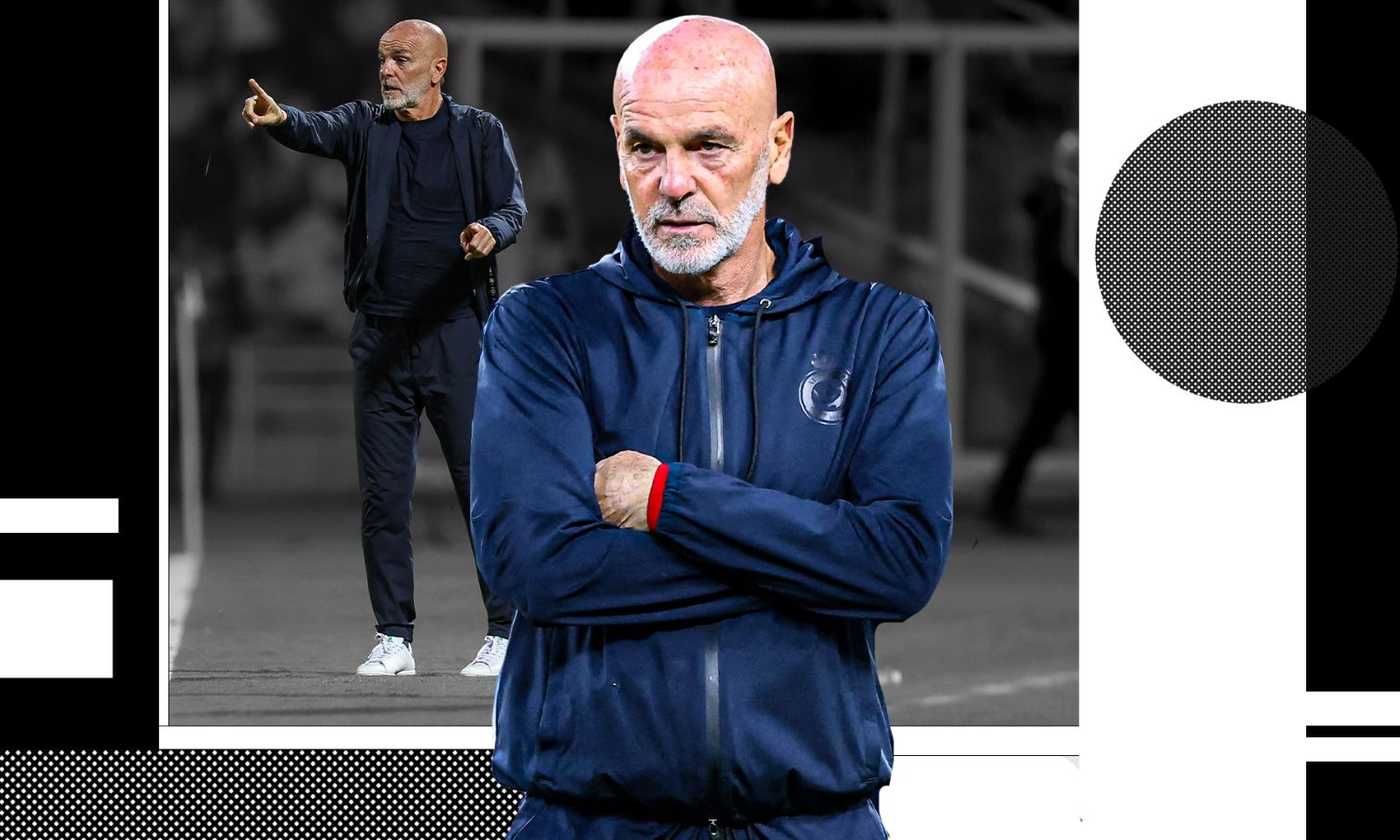

Il Dopo Gasperini All Atalanta Pioli E Un Opzione Concreta

May 29, 2025

Il Dopo Gasperini All Atalanta Pioli E Un Opzione Concreta

May 29, 2025 -

Roland Garros 2024 Fritzs Disappointing Performance Highlights Key Point Struggles

May 29, 2025

Roland Garros 2024 Fritzs Disappointing Performance Highlights Key Point Struggles

May 29, 2025