Lincoln Financial's Tender Offer Surpasses $800 Million After $45 Million Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial's Tender Offer Tops $800 Million Following $45 Million Increase

Lincoln Financial Group's (NYSE: LNC) tender offer for its outstanding 7.25% Senior Notes due 2028 has officially surpassed $800 million, marking a significant increase after an additional $45 million was accepted. This development signals strong investor interest and confidence in the company's financial strategy. The increased acceptance brings the total value of notes tendered significantly above initial expectations, highlighting a robust response from bondholders.

The tender offer, announced earlier this year, aimed to repurchase a portion of its outstanding debt. This strategic move allows Lincoln Financial to optimize its capital structure, potentially reducing its overall interest expense and enhancing its financial flexibility. The success of the tender offer indicates a successful execution of this financial strategy.

Why the Surge in Participation?

Several factors likely contributed to the surge in participation and the exceeding of the $800 million mark:

-

Attractive Offer Price: The initial tender offer likely presented an attractive price for bondholders considering prevailing interest rates and the overall market environment. The increased acceptance suggests the price remained competitive even with the market fluctuations.

-

Strong Investor Confidence: The increased participation demonstrates strong confidence in Lincoln Financial's future prospects and its ability to manage its debt effectively. This positive sentiment reflects well on the company's overall financial health and stability.

-

Market Conditions: While prevailing interest rate environments can influence bondholder decisions, the significant oversubscription demonstrates that Lincoln Financial's offer outweighed market concerns.

Implications for Lincoln Financial

The successful tender offer, exceeding the $800 million threshold, has several significant implications for Lincoln Financial Group:

-

Reduced Debt Burden: Repurchasing a substantial portion of its outstanding debt reduces the company's overall interest expense, freeing up capital for other strategic initiatives.

-

Enhanced Financial Flexibility: This improved financial flexibility allows Lincoln Financial to pursue growth opportunities, invest in new technologies, and enhance its competitive position within the financial services industry.

-

Improved Credit Ratings: The proactive debt management demonstrated through this tender offer could potentially lead to improved credit ratings, further enhancing the company's financial standing.

What's Next for Lincoln Financial?

While the tender offer has concluded, Lincoln Financial will likely continue to focus on its long-term strategic goals. This might include further initiatives aimed at optimizing its capital structure, expanding its product offerings, or investing in innovative technologies within the insurance and financial services sector. Investors will be keenly watching the company's future moves to assess the lasting impact of this successful debt repurchase program. This event underscores Lincoln Financial's proactive approach to financial management and its commitment to delivering value to its shareholders. Further announcements regarding the company's future financial strategies are anticipated.

Keywords: Lincoln Financial, LNC, tender offer, debt repurchase, bondholders, senior notes, financial strategy, capital structure, interest rates, financial health, investment, NYSE

Related Articles: (Links to relevant news articles about Lincoln Financial or similar corporate actions would be inserted here)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial's Tender Offer Surpasses $800 Million After $45 Million Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

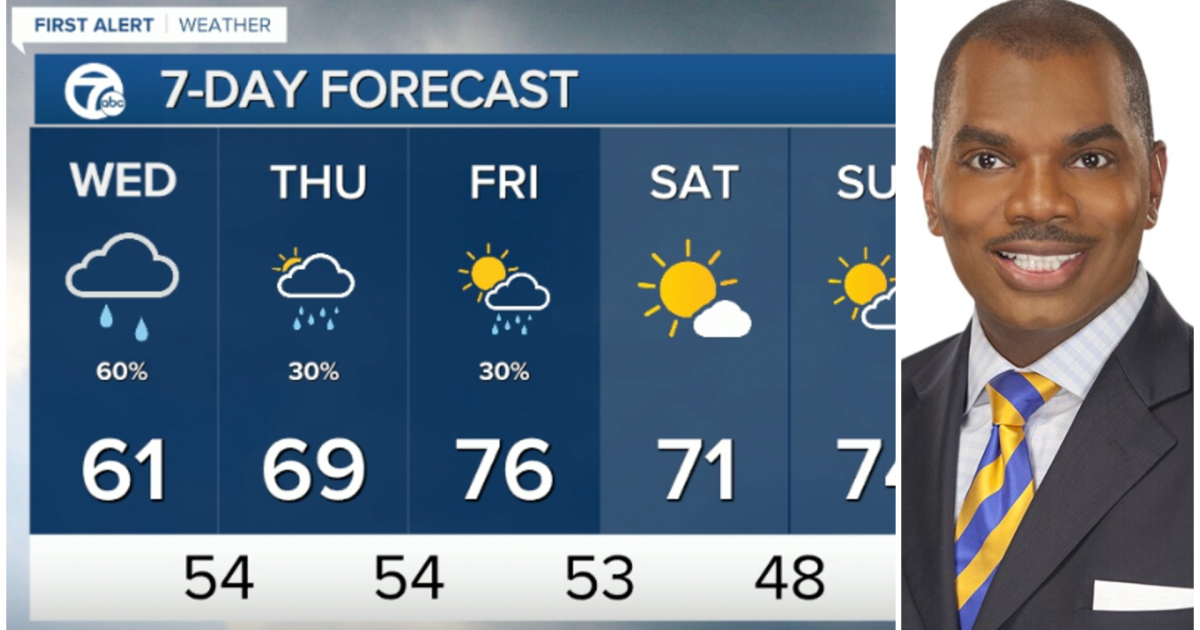

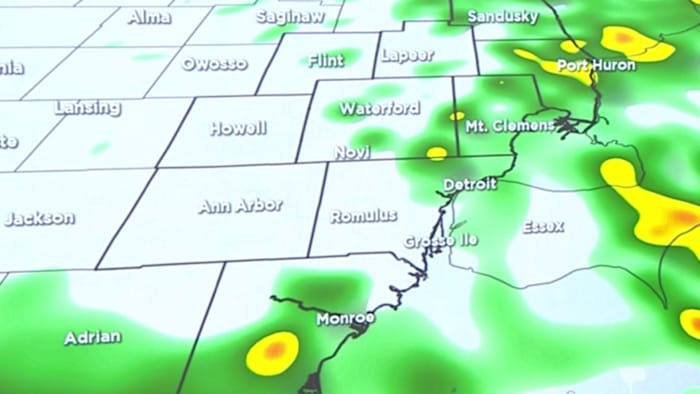

Wednesday Rain Metro Detroit Weather Forecast And Alerts

May 29, 2025

Wednesday Rain Metro Detroit Weather Forecast And Alerts

May 29, 2025 -

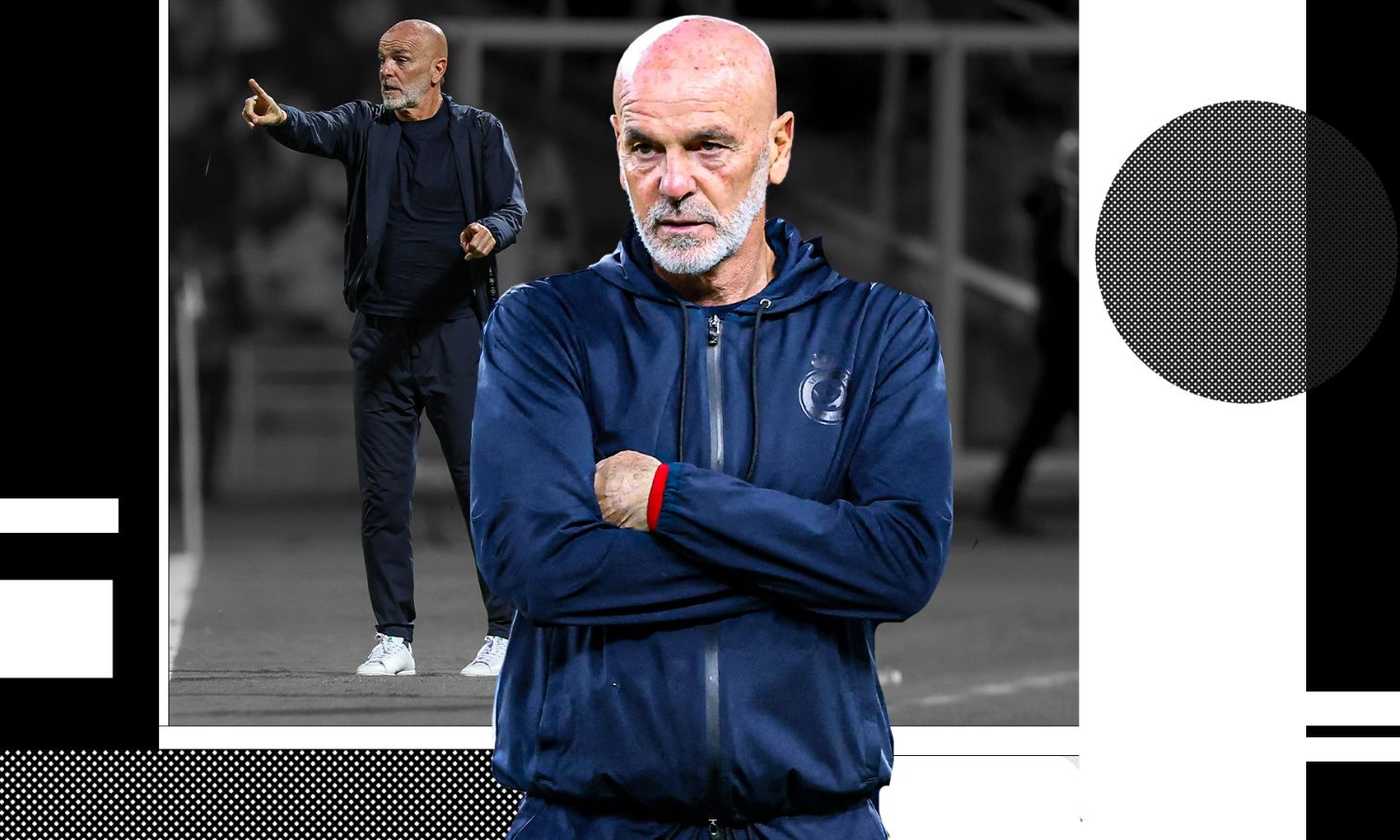

Mercato Atalanta Pioli Nuovo Allenatore Situazione E Prospettive

May 29, 2025

Mercato Atalanta Pioli Nuovo Allenatore Situazione E Prospettive

May 29, 2025 -

This Weeks Metro Detroit Weather Preparing For Scattered Showers

May 29, 2025

This Weeks Metro Detroit Weather Preparing For Scattered Showers

May 29, 2025 -

Geopolitical Fallout Analyzing The Responses Of China North Korea And Russia To Trumps Golden Dome Proposal

May 29, 2025

Geopolitical Fallout Analyzing The Responses Of China North Korea And Russia To Trumps Golden Dome Proposal

May 29, 2025 -

Roland Garros Henrique Rocha E Nuno Borges Conquistam Feito Inedito

May 29, 2025

Roland Garros Henrique Rocha E Nuno Borges Conquistam Feito Inedito

May 29, 2025