Lincoln Financial's Tender Offer Surge: $45 Million Addition Yields $812 Million In Investor Response

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial's Tender Offer Surge: $45 Million Boost Fuels $812 Million Investor Response

Lincoln Financial Group (LNC) is experiencing a significant surge in its tender offer, exceeding initial expectations by a considerable margin. The company announced a substantial increase in the offer, adding $45 million to the total, ultimately resulting in a remarkable $812 million response from investors. This unexpected influx of capital highlights investor confidence in Lincoln Financial's strategy and future prospects. The successful tender offer allows Lincoln Financial to further strengthen its financial position and pursue strategic growth initiatives.

Understanding the Tender Offer

A tender offer is a public invitation by a company to its shareholders to sell their shares at a specified price within a defined period. This is often used by companies for various reasons, including debt reduction, share buybacks, or streamlining their capital structure. In Lincoln Financial's case, this substantial response suggests a positive market sentiment towards the company's financial health and future potential.

Key Highlights of the Surge:

- Initial Offer Exceeded: The additional $45 million injected into the tender offer significantly surpassed initial projections, showcasing strong investor participation.

- Total Investor Response: The final tally of $812 million represents a substantial commitment from investors, reflecting confidence in Lincoln Financial's trajectory.

- Strategic Implications: This influx of capital provides Lincoln Financial with greater financial flexibility to pursue strategic growth opportunities and enhance shareholder value.

- Market Reaction: The successful tender offer is likely to positively impact Lincoln Financial's stock price and overall market perception. (Note: Always consult with a financial advisor before making any investment decisions.)

What Does This Mean for Lincoln Financial?

This successful tender offer represents a significant vote of confidence from investors. It provides Lincoln Financial with the resources to:

- Reduce Debt: The company can use the funds to reduce its outstanding debt, improving its financial stability and credit rating.

- Invest in Growth: The capital infusion allows for investments in new technologies, expansion into new markets, or acquisitions of complementary businesses.

- Strengthen Capital Position: A stronger capital position enhances Lincoln Financial's ability to weather economic downturns and maintain its competitive edge.

Looking Ahead:

The remarkable response to Lincoln Financial's tender offer signals a positive outlook for the company. This successful capital raise positions Lincoln Financial for continued growth and success in the competitive insurance and financial services sector. Industry analysts will be closely watching the company's strategic moves following this significant capital injection. The long-term impact on shareholders remains to be seen, but the immediate outcome is undeniably positive.

Learn More:

For more detailed information on Lincoln Financial Group and its financial performance, you can visit their investor relations website: [Insert Lincoln Financial Investor Relations Website Link Here]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial's Tender Offer Surge: $45 Million Addition Yields $812 Million In Investor Response. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

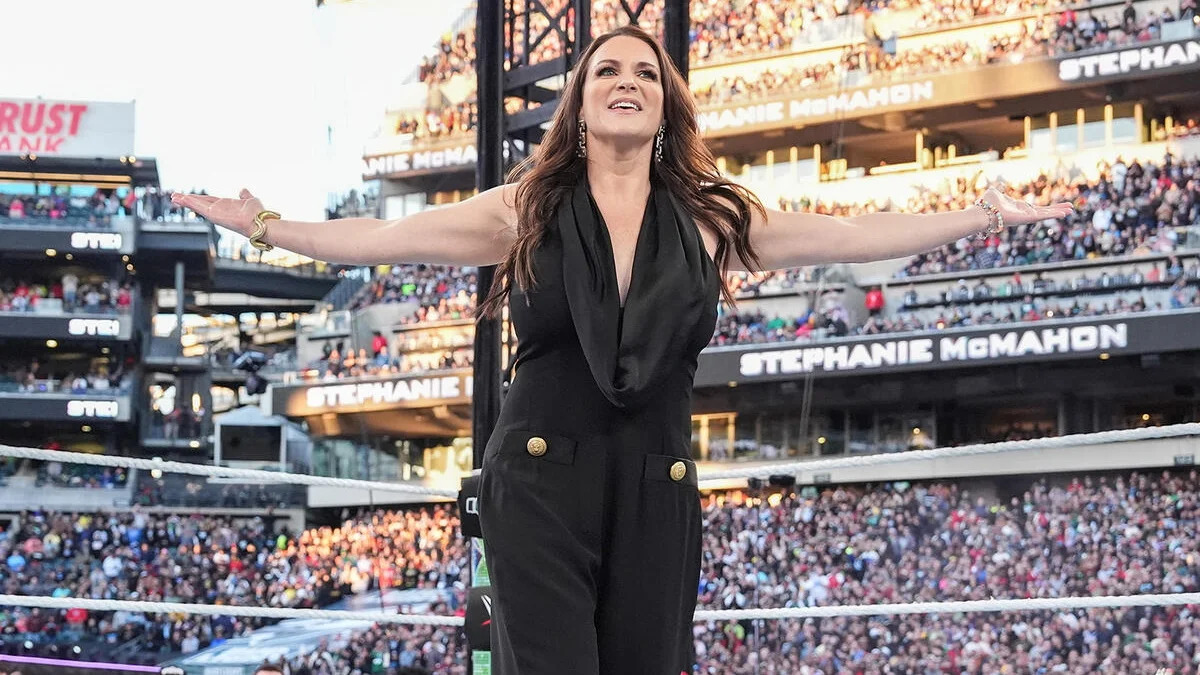

The Tattoo Stephanie Mc Mahon Almost Got A Wwe Untold Story

May 28, 2025

The Tattoo Stephanie Mc Mahon Almost Got A Wwe Untold Story

May 28, 2025 -

China North Korea And Russia React Analyzing Trumps Golden Dome Initiative

May 28, 2025

China North Korea And Russia React Analyzing Trumps Golden Dome Initiative

May 28, 2025 -

Uninked Stephanie Mc Mahons Rejected Wrestling Tattoo Design

May 28, 2025

Uninked Stephanie Mc Mahons Rejected Wrestling Tattoo Design

May 28, 2025 -

Wwes Stephanie Mc Mahon Shares Why Shes Glad She Skipped A Tattoo

May 28, 2025

Wwes Stephanie Mc Mahon Shares Why Shes Glad She Skipped A Tattoo

May 28, 2025 -

Phil Robertsons Death Celebrating The Life Of A Duck Dynasty Legend

May 28, 2025

Phil Robertsons Death Celebrating The Life Of A Duck Dynasty Legend

May 28, 2025