Lincoln Financial's Tender Offer: A $45 Million Increase And $812 Million Response

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial's Tender Offer: A $45 Million Increase Signals Strong Investor Confidence

Lincoln Financial Group (LNC) has announced a significant increase to its tender offer, reflecting robust investor interest and a positive outlook on the company's future. The offer, initially valued at $767 million, has been boosted by $45 million, reaching a total of $812 million. This development underscores the success of the offer and highlights the market's confidence in Lincoln Financial's strategic direction.

This impressive response to the tender offer showcases a strong belief in the company's long-term growth potential and its ability to navigate the ever-evolving financial landscape. The increased offer signifies Lincoln Financial's commitment to maximizing shareholder value and streamlining its operations.

What does this mean for investors?

The increased tender offer is a positive sign for existing shareholders. It indicates that the company is actively managing its capital structure and seeking to optimize its investment portfolio. This proactive approach can lead to improved profitability and potentially higher returns for investors in the future. However, it's crucial to remember that investment decisions should always be made after careful consideration of individual financial goals and risk tolerance. Consulting a financial advisor is highly recommended before making any significant investment changes.

Understanding the Tender Offer Process:

A tender offer is a public invitation by a company to purchase its own outstanding shares from existing shareholders at a specified price. This is often done to reduce the number of outstanding shares, thereby increasing the earnings per share (EPS) for remaining shareholders. The success of a tender offer depends on the participation rate of shareholders. In Lincoln Financial's case, the overwhelming response suggests a high level of confidence in the company's prospects.

Key Highlights:

- Increased Tender Offer: $45 million increase, bringing the total to $812 million.

- Strong Investor Response: Demonstrates confidence in Lincoln Financial's future.

- Strategic Capital Management: This move signifies Lincoln Financial's proactive approach to optimizing its capital structure.

- Potential for Enhanced Shareholder Value: The buyback aims to increase earnings per share (EPS) and enhance returns for remaining shareholders.

Looking Ahead:

The success of Lincoln Financial's tender offer sets a positive tone for the company's future performance. While the immediate impact might be seen in the adjusted share count, the long-term implications could involve increased efficiency, strategic investments, and enhanced shareholder returns. The market will be watching closely to see how Lincoln Financial leverages this capital restructuring to drive further growth and innovation.

Further Research: For more detailed information about Lincoln Financial Group and its recent tender offer, refer to the official company announcements and SEC filings. You can find these resources on the Lincoln Financial Group investor relations website. [Link to Lincoln Financial Investor Relations Website - Replace with actual link]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The information provided should not be considered a recommendation to buy or sell any securities. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial's Tender Offer: A $45 Million Increase And $812 Million Response. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jaheim Arrested R And B Star Accused Of Abusing Six Dogs

May 29, 2025

Jaheim Arrested R And B Star Accused Of Abusing Six Dogs

May 29, 2025 -

Transfer Update Arsenals Bid For Gyokeres And Sporting Cps Reaction

May 29, 2025

Transfer Update Arsenals Bid For Gyokeres And Sporting Cps Reaction

May 29, 2025 -

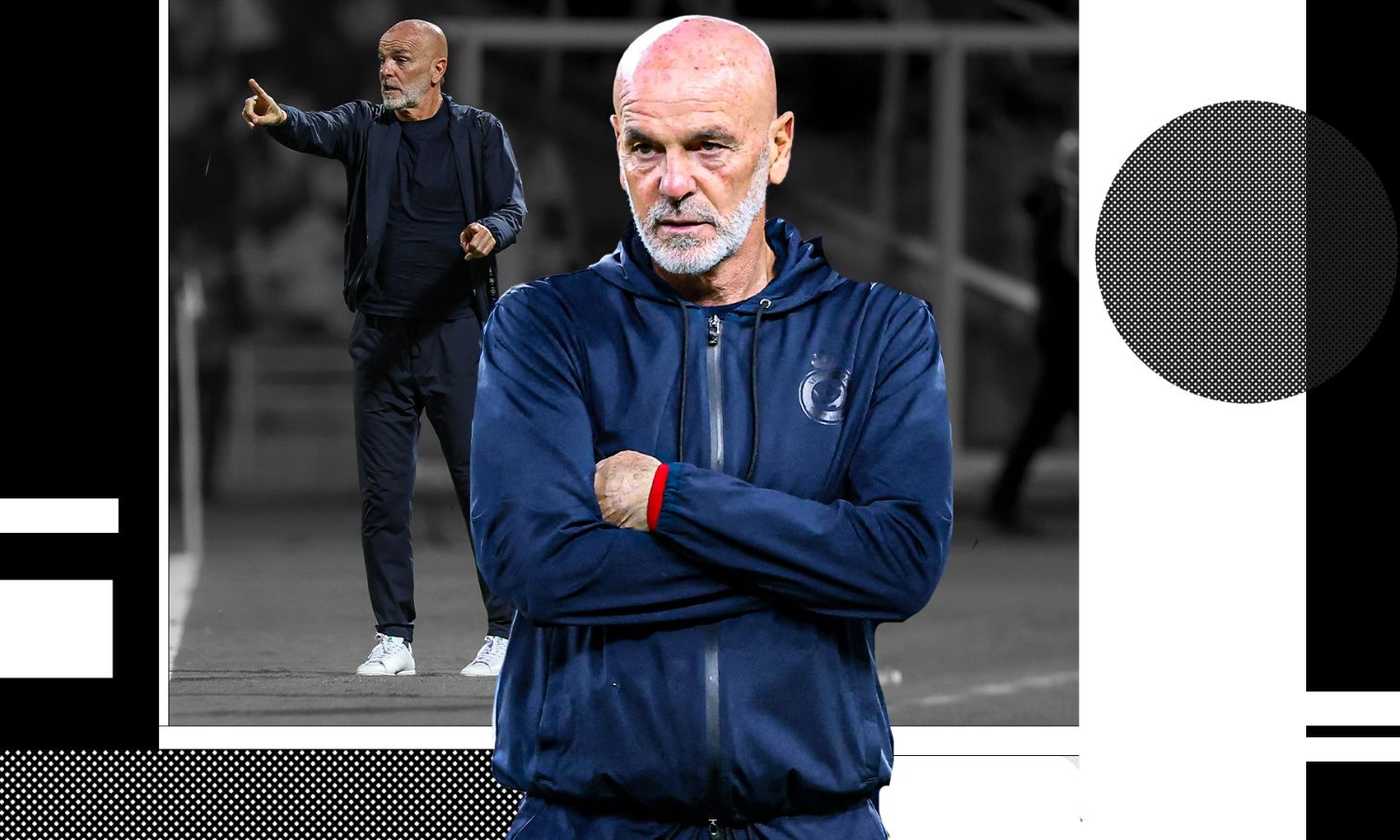

Mercato Atalanta Pioli Nuovo Allenatore Situazione E Prospettive

May 29, 2025

Mercato Atalanta Pioli Nuovo Allenatore Situazione E Prospettive

May 29, 2025 -

Twin Triumph Identical Tennis Players Secure State Titles In Pa

May 29, 2025

Twin Triumph Identical Tennis Players Secure State Titles In Pa

May 29, 2025 -

Dopo L Estero Pioli Sceglie La Serie A Analisi Del Suo Ritorno

May 29, 2025

Dopo L Estero Pioli Sceglie La Serie A Analisi Del Suo Ritorno

May 29, 2025