Lincoln Financial's Tender Offer: A $45 Million Increase And $812 Million In Securities Received

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Pot: $45 Million Tender Offer Increase Signals Strong Investor Confidence

Lincoln Financial Group (LNC) has significantly increased its tender offer, signaling strong investor confidence and a potentially positive outlook for the company. The insurance giant announced a $45 million increase to its previously announced tender offer, bringing the total to a substantial amount. This move follows the successful acquisition of $812 million in securities, exceeding initial expectations. This development has significant implications for both investors and the broader financial market.

A Closer Look at the Increased Tender Offer:

The initial tender offer, while already substantial, has been boosted by $45 million. This increase demonstrates Lincoln Financial's commitment to its strategic objectives and its willingness to invest further in its future growth. The details surrounding the specific securities involved and the reasons behind the increase haven't been fully disclosed, but analysts speculate this could be driven by a number of factors, including a desire to optimize its capital structure or perhaps to take advantage of favorable market conditions. Regardless of the specifics, the move clearly reflects a positive internal assessment of the company's prospects.

$812 Million in Securities Received: Exceeding Expectations:

The success of the tender offer, with $812 million in securities received, significantly surpasses initial projections. This underscores the appeal of Lincoln Financial's investment opportunities and the confidence investors have in the company's long-term strategy. Such a high level of participation in the tender offer suggests a belief that the company is undervalued and poised for growth.

What this Means for Investors:

This development is likely to be viewed favorably by investors. The increased tender offer and the high level of participation demonstrate a strong commitment from Lincoln Financial to its shareholders. This could lead to increased investor confidence and potentially drive up the company's stock price. For those who participated in the tender offer, the successful acquisition of their securities represents a positive return on investment.

Implications for the Broader Market:

The move by Lincoln Financial could also have broader implications for the financial market. It signals a degree of confidence in the insurance sector, which has faced its share of challenges in recent years. This positive news could potentially influence other companies in the sector, potentially leading to similar strategic moves.

Analyzing the Future:

While the specifics of Lincoln Financial's strategic plans remain somewhat opaque, the increased tender offer and the strong response from investors provide a compelling indication of positive future prospects. Analysts will be closely watching Lincoln Financial's future announcements to gain a clearer understanding of its long-term strategy and how this move fits into its overall business objectives. Further information is expected to be released in upcoming financial reports. Investors should continue to monitor these releases for a comprehensive understanding of the company's performance and future trajectory.

Call to Action: Stay informed on Lincoln Financial's progress by following their investor relations website and subscribing to reputable financial news sources for updates on their performance and future announcements. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial's Tender Offer: A $45 Million Increase And $812 Million In Securities Received. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

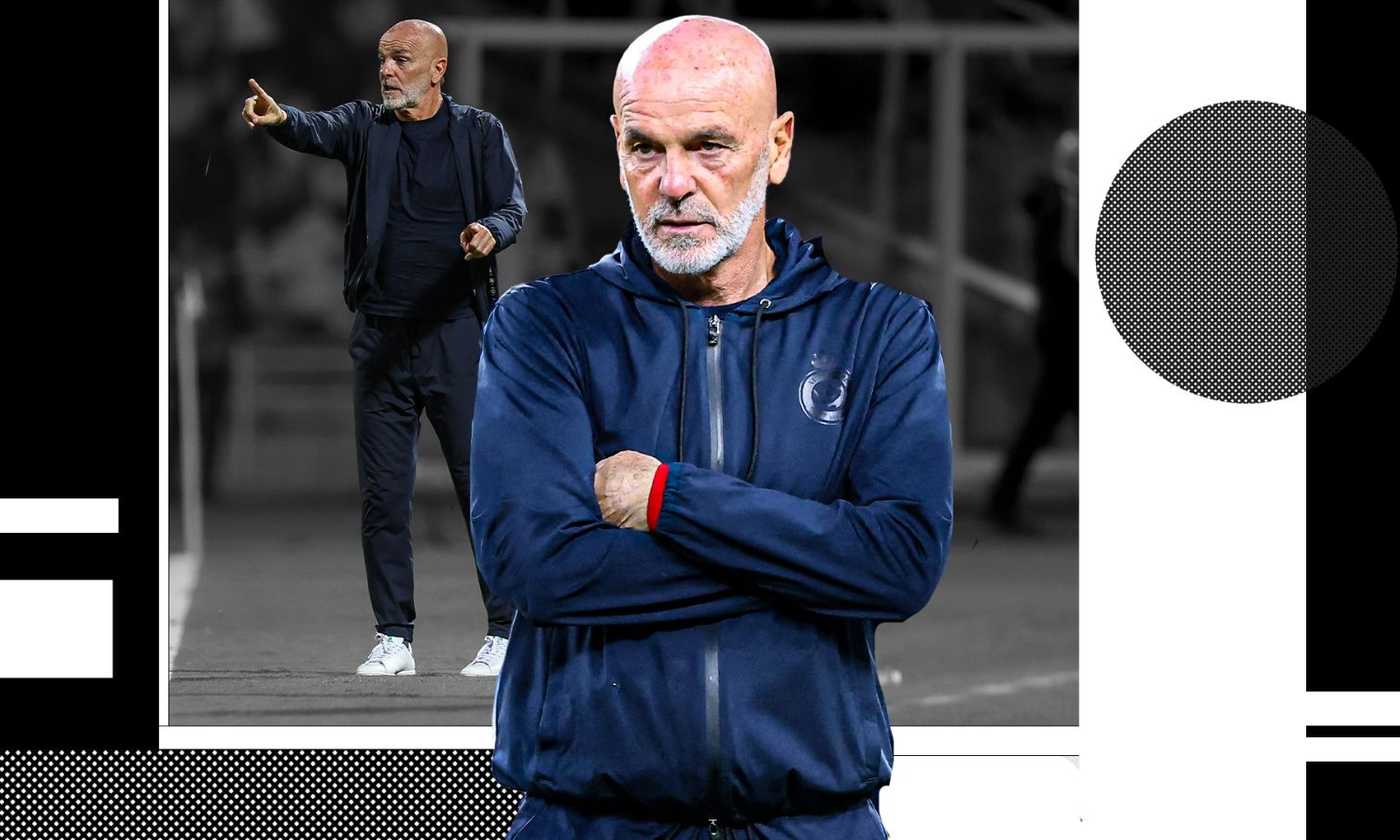

Futuro Atalanta Pioli Tra I Candidati Per La Successione Aggiornamenti

May 29, 2025

Futuro Atalanta Pioli Tra I Candidati Per La Successione Aggiornamenti

May 29, 2025 -

Fritzs Costly Errors Analysis Of His Roland Garros Loss

May 29, 2025

Fritzs Costly Errors Analysis Of His Roland Garros Loss

May 29, 2025 -

Calciomercato Serie A Pioli Di Nuovo In Italia Le Sfide Che Lo Aspettano

May 29, 2025

Calciomercato Serie A Pioli Di Nuovo In Italia Le Sfide Che Lo Aspettano

May 29, 2025 -

Find Houston Power Outages Live Map Reporting And Outage Alerts

May 29, 2025

Find Houston Power Outages Live Map Reporting And Outage Alerts

May 29, 2025 -

Hunger In Gaza Food Distribution Center Overwhelmed By Thousands Seeking Relief

May 29, 2025

Hunger In Gaza Food Distribution Center Overwhelmed By Thousands Seeking Relief

May 29, 2025