Lincoln Financial Sweetens The Pot: Tender Offer Jumps By $45 Million

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Pot: Tender Offer Jumps by $45 Million

Lincoln Financial Group (LNC) has significantly increased its tender offer for its outstanding 7.25% Senior Notes due 2028, adding a substantial $45 million to the initial offer. This move signals a proactive strategy by the insurance giant to optimize its capital structure and potentially reduce its debt burden. The revised offer underscores Lincoln Financial's commitment to shareholder value and financial flexibility.

The increased tender offer comes as a surprise to many analysts, who were already impressed by the initial offer. This bold move highlights Lincoln Financial's confidence in its future prospects and its ability to manage its financial obligations effectively. The company's proactive approach to debt management is likely to be viewed favorably by investors.

Understanding the Increased Tender Offer:

The initial tender offer, announced [Insert Date of Initial Announcement], aimed to repurchase a significant portion of its outstanding 7.25% Senior Notes. However, the newly revised offer, now totaling [Insert Total Amount of Revised Offer], represents a substantial increase, signaling a more aggressive approach to debt reduction. This strategic move allows Lincoln Financial to potentially reduce its interest expense and enhance its overall financial position.

This strategic maneuver isn't just about reducing debt; it's a calculated move to improve Lincoln Financial's financial flexibility. By reducing its outstanding debt, the company positions itself for future growth opportunities and strategic investments. This enhanced financial agility is crucial in today's dynamic financial market.

What This Means for Investors:

This increased tender offer presents a positive development for current noteholders, offering them an improved opportunity to sell their bonds at a more favorable price. The enhanced offer likely reflects Lincoln Financial's strong belief in its future financial performance.

For potential investors, this action showcases Lincoln Financial's commitment to managing its liabilities effectively. This commitment, coupled with a healthy balance sheet, could boost investor confidence and potentially lead to a positive impact on the company's stock price.

Analyzing the Strategic Implications:

Several key strategic implications arise from Lincoln Financial's enhanced tender offer:

- Improved Credit Rating: Reducing debt levels can improve the company's credit rating, leading to lower borrowing costs in the future.

- Enhanced Financial Flexibility: A stronger balance sheet allows Lincoln Financial to pursue strategic acquisitions or investments.

- Increased Shareholder Value: Ultimately, effective debt management contributes positively to shareholder returns.

Looking Ahead:

This significant increase in Lincoln Financial's tender offer signifies a proactive and well-calculated strategy to bolster its financial position. The move reflects confidence in the company's future and a commitment to maximizing value for its stakeholders. It will be interesting to observe the market reaction and the ultimate impact of this strategic decision on Lincoln Financial's overall financial performance.

Keywords: Lincoln Financial, LNC, Tender Offer, Debt Reduction, Senior Notes, Financial Markets, Investment, Stock Price, Corporate Finance, Financial News, Insurance Company, Debt Management, Capital Structure, Shareholder Value.

Call to Action (subtle): Stay tuned for further updates on Lincoln Financial's financial performance and strategic initiatives. Follow [Your News Source] for the latest news and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Sweetens The Pot: Tender Offer Jumps By $45 Million. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Could Cameron Brink Be Returning Soon To The Los Angeles Sparks

May 28, 2025

Could Cameron Brink Be Returning Soon To The Los Angeles Sparks

May 28, 2025 -

Lincoln Financial Sweetens The Pot 45 M Tender Offer Boost Amid Strong Investor Response

May 28, 2025

Lincoln Financial Sweetens The Pot 45 M Tender Offer Boost Amid Strong Investor Response

May 28, 2025 -

Disappointing News Cameron Brinks Knee Injury Delays Return For Sparks

May 28, 2025

Disappointing News Cameron Brinks Knee Injury Delays Return For Sparks

May 28, 2025 -

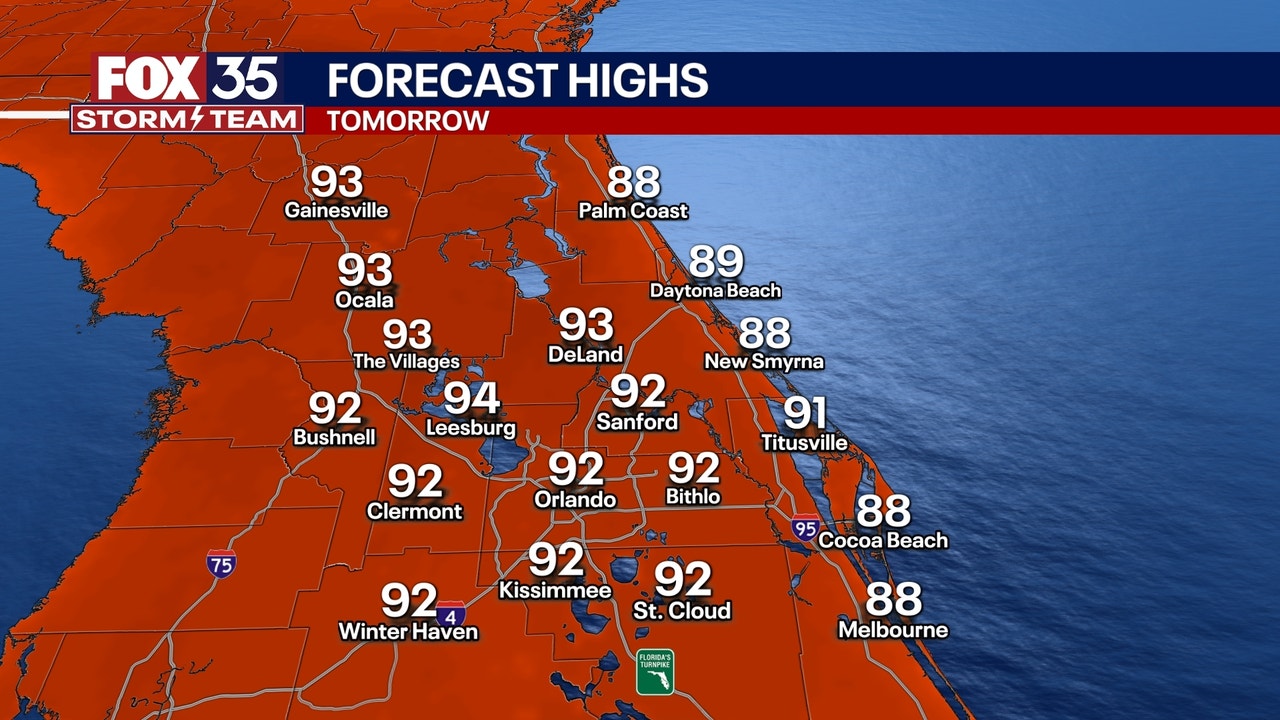

Severe Weather Outlook For Orlando Heat Humidity And Increased Storm Potential

May 28, 2025

Severe Weather Outlook For Orlando Heat Humidity And Increased Storm Potential

May 28, 2025 -

Upset At Roland Garros American Seeds Fritz And Navarro Fall In First Round

May 28, 2025

Upset At Roland Garros American Seeds Fritz And Navarro Fall In First Round

May 28, 2025