Lincoln Financial Sweetens The Deal: Tender Offer Jumps By $45 Million

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Deal: Tender Offer Jumps by $45 Million

Lincoln Financial Group (LNC) has significantly increased its tender offer for its outstanding 7.875% Senior Notes due 2028, boosting the total consideration by a substantial $45 million. This move reflects the company's commitment to optimizing its capital structure and demonstrates a proactive approach to managing its debt profile. The increased offer underscores Lincoln Financial's financial strength and its willingness to engage favorably with its noteholders.

The initial tender offer, announced [insert original announcement date], was already considered attractive by many market analysts. However, this unexpected increase represents a considerable sweetener, likely aimed at maximizing participation and streamlining the debt repurchase process. The revised offer price now stands at [insert revised offer price per $1,000 principal amount] per $1,000 principal amount of the notes, representing a [insert percentage increase] increase from the original offer.

What Does This Mean for Investors?

This development presents a potentially lucrative opportunity for holders of the 7.875% Senior Notes due 2028. The enhanced offer price provides a significant premium over the current market value, making it an attractive proposition for those seeking to divest their holdings. The increased offer also signals confidence from Lincoln Financial in its future prospects and financial stability.

- Higher Return: The increased tender offer translates to a higher return for participating noteholders.

- Reduced Risk: Accepting the offer allows investors to remove the risk associated with holding the notes until maturity.

- Improved Liquidity: The tender offer provides a straightforward mechanism for investors to quickly liquidate their holdings.

This strategic move by Lincoln Financial is likely to be well-received by the market, potentially boosting investor confidence in the company. The increased offer could also influence the trading price of the notes in the secondary market. Investors who haven't yet considered participating in the tender offer may now find it more compelling given the improved terms.

Implications for Lincoln Financial's Financial Strategy

The increased tender offer reflects Lincoln Financial's ongoing efforts to manage its debt and optimize its capital structure for long-term growth. By repurchasing these notes, the company reduces its future interest expense and enhances its financial flexibility. This proactive approach to debt management is a positive signal for investors looking for stability and long-term value. It also suggests a focus on streamlining operations and maximizing shareholder returns.

This move aligns with the broader trend of corporations actively managing their debt portfolios in the current economic climate. By proactively addressing its debt obligations, Lincoln Financial demonstrates responsible financial management and strengthens its overall financial position. The company is clearly prioritizing efficient capital allocation, positioning itself for future growth and opportunity.

Next Steps for Investors

Investors holding the 7.875% Senior Notes due 2028 should carefully review the amended terms of the tender offer and consult with their financial advisors to determine the best course of action. The deadline for participation in the tender offer is [insert deadline date], so timely action is crucial. More detailed information can be found on Lincoln Financial's investor relations website [insert link to investor relations website].

This significant increase in the tender offer underscores Lincoln Financial's financial strength and commitment to its investors. This move is a positive development for both the company and its noteholders. We will continue to monitor this situation and provide updates as they become available. Remember to always conduct thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Sweetens The Deal: Tender Offer Jumps By $45 Million. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unexpected Roland Garros Exit For Taylor Fritz Altmaier Claims Upset Win

May 28, 2025

Unexpected Roland Garros Exit For Taylor Fritz Altmaier Claims Upset Win

May 28, 2025 -

Outperforming Palantir This Artificial Intelligence Stocks Recent Gains Explained

May 28, 2025

Outperforming Palantir This Artificial Intelligence Stocks Recent Gains Explained

May 28, 2025 -

Los Angeles Sparks Cameron Brink Offers Hope Video Suggests Impending Return

May 28, 2025

Los Angeles Sparks Cameron Brink Offers Hope Video Suggests Impending Return

May 28, 2025 -

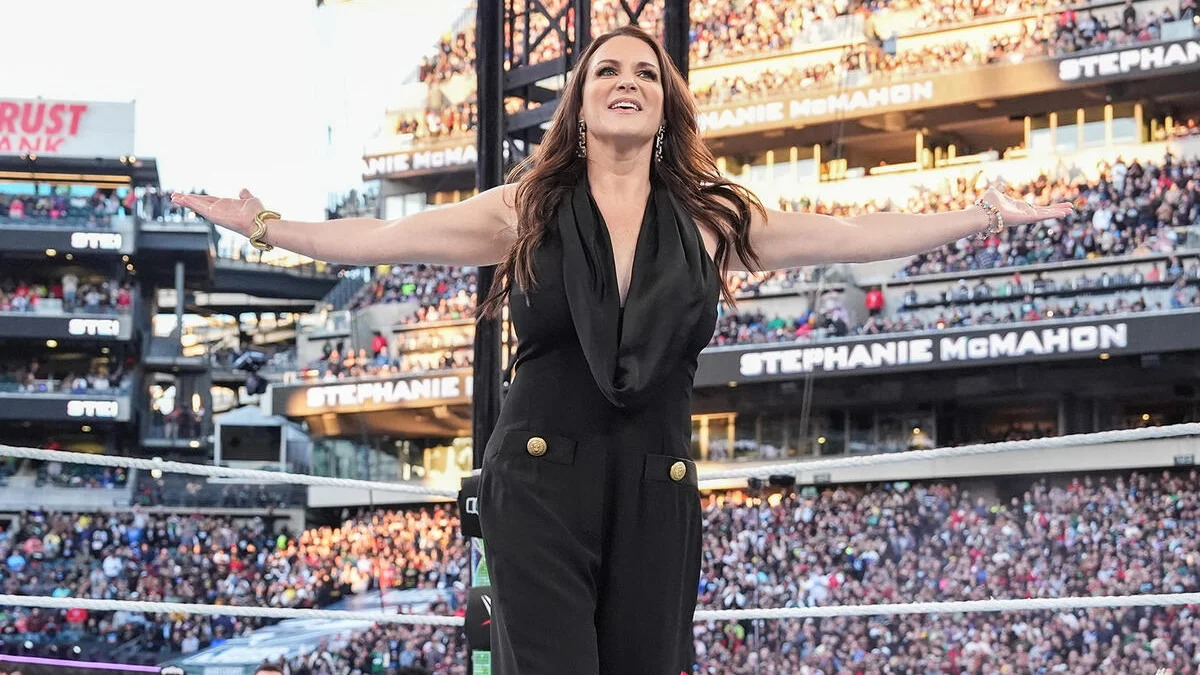

Stephanie Mc Mahon Opens Up About A Tattoo She Never Got

May 28, 2025

Stephanie Mc Mahon Opens Up About A Tattoo She Never Got

May 28, 2025 -

Juan Manuel Cerundolo Vs Hamad Medjedovic French Open 2025 Match Preview And Picks

May 28, 2025

Juan Manuel Cerundolo Vs Hamad Medjedovic French Open 2025 Match Preview And Picks

May 28, 2025