Lincoln Financial Sweetens The Deal: $45 Million Boost To Tender Offer, $812 Million In Securities Received

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Deal: $45 Million Boost to Tender Offer, Signaling Confidence in Future Growth

Lincoln Financial Group (NYSE: LNC) has significantly increased its tender offer, adding a substantial $45 million to its existing bid. This move, announced [Date of announcement], brings the total value of the offer to [Total Value after increase], reflecting the company's confidence in its future prospects and strategic direction. The increased offer has already resulted in the company receiving $812 million in securities, exceeding initial expectations.

This development marks a significant shift in Lincoln Financial's approach to its [mention the specific securities or debt involved, e.g., outstanding debt, preferred stock]. The initial offer, announced on [Date of initial announcement], was met with [mention initial market reaction, e.g., a mixed response from investors]. However, this substantial increase demonstrates Lincoln Financial's commitment to streamlining its capital structure and optimizing its financial position.

Why the Increased Tender Offer?

Several factors likely contributed to Lincoln Financial's decision to sweeten the deal. These include:

- Stronger-than-expected investor response: While the initial response may have been lukewarm, the subsequent increase suggests a surge in participation, prompting Lincoln to capitalize on the momentum.

- Improved market conditions: Favorable shifts in the financial markets may have provided Lincoln with a more opportune time to execute its capital restructuring strategy.

- Focus on strategic priorities: By reducing its outstanding debt, Lincoln Financial can better allocate resources towards its core business priorities, such as expanding its product offerings or investing in technology. This aligns with the company's stated long-term goals of [mention company's strategic goals, if publicly available].

Impact on Investors and the Market

The increased tender offer has sent positive signals to the market, potentially boosting investor confidence in Lincoln Financial. This is evident in [mention specific market reactions, e.g., a rise in the company's stock price]. The successful acquisition of $812 million in securities represents a considerable achievement for the company, showcasing its financial strength and strategic effectiveness.

What's Next for Lincoln Financial?

Following the successful tender offer, Lincoln Financial is expected to [mention expected future actions, e.g., focus on integrating acquired assets, further streamlining operations, continuing its expansion in specific market segments]. The company’s strategic moves highlight its commitment to long-term growth and value creation for its shareholders.

Looking Ahead: Analyzing Lincoln Financial's Strategy

This bold move by Lincoln Financial highlights a proactive approach to capital management. The increased tender offer is likely to be viewed favorably by analysts and investors alike, signaling a positive outlook for the company’s future performance. Experts believe that this strategic decision will significantly enhance Lincoln Financial's financial flexibility and position it for future growth opportunities.

Call to Action: Stay tuned for further updates on Lincoln Financial’s strategic initiatives and financial performance by visiting their investor relations website [link to Lincoln Financial's investor relations page].

Keywords: Lincoln Financial, LNC, tender offer, debt restructuring, capital structure, financial markets, investor relations, stock price, securities, market response, strategic priorities, financial strength, growth strategy, investment, capital management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Sweetens The Deal: $45 Million Boost To Tender Offer, $812 Million In Securities Received. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

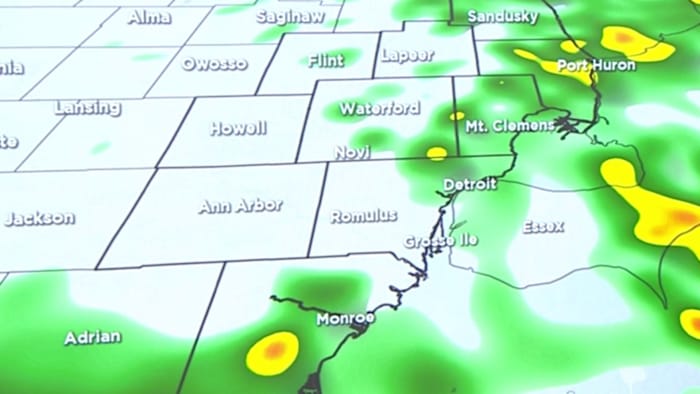

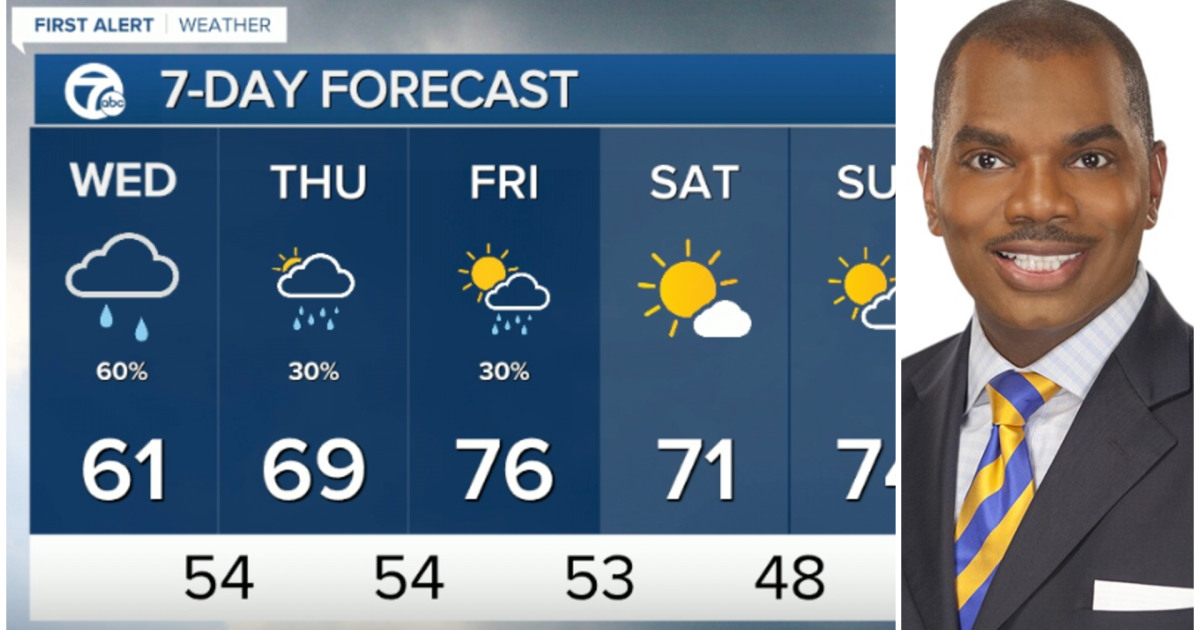

Metro Detroit Weather Alert Prepare For Scattered Showers

May 29, 2025

Metro Detroit Weather Alert Prepare For Scattered Showers

May 29, 2025 -

Geopolitical Fallout Analyzing The Responses Of China North Korea And Russia To Trumps Golden Dome Proposal

May 29, 2025

Geopolitical Fallout Analyzing The Responses Of China North Korea And Russia To Trumps Golden Dome Proposal

May 29, 2025 -

Unprecedented Feat Twin Tennis Players Secure Pa State Titles

May 29, 2025

Unprecedented Feat Twin Tennis Players Secure Pa State Titles

May 29, 2025 -

Metro Detroit Weather Expect More Rain On Wednesday

May 29, 2025

Metro Detroit Weather Expect More Rain On Wednesday

May 29, 2025 -

Henrique Rocha Faz Historia Vitoria Impactante Em Sua Primeira Participacao Em Roland Garros

May 29, 2025

Henrique Rocha Faz Historia Vitoria Impactante Em Sua Primeira Participacao Em Roland Garros

May 29, 2025