Lincoln Financial Sweetens The Deal: $45 Million Boost To Tender Offer

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Deal: $45 Million Boost to Tender Offer

Lincoln National Corporation (LNC) has significantly increased its tender offer for its outstanding 7.25% senior notes due 2028, boosting the total consideration by a substantial $45 million. This move signals a proactive approach by the financial giant to optimize its capital structure and potentially reduce its debt burden. The increased offer underscores the company's commitment to enhancing shareholder value and streamlining its financial obligations.

This development has sent ripples through the financial markets, sparking considerable interest among investors and analysts alike. The sweetened deal presents a compelling opportunity for noteholders, offering an attractive return on their investment. However, understanding the implications of this offer requires careful consideration.

Understanding the Amended Tender Offer

The original tender offer, announced [Insert Original Announcement Date], was already considered attractive by many. However, Lincoln Financial’s decision to raise the offer price by $45 million, bringing the total consideration to [Insert New Total Consideration], demonstrates a strong commitment to attracting a high participation rate. This strategic move likely aims to accelerate the reduction of its outstanding debt, improving its overall financial flexibility.

Why the Increase? Several Factors at Play

Several factors may have contributed to Lincoln Financial's decision to sweeten the deal. These include:

- Favorable Market Conditions: The current economic climate may have presented a window of opportunity for Lincoln Financial to repurchase its debt at a relatively favorable price.

- Strategic Debt Management: Reducing debt levels is a common strategy employed by companies to improve their credit rating and enhance their financial stability.

- Shareholder Value: Repurchasing debt can free up capital for other strategic initiatives, potentially benefiting shareholders in the long run.

- Increased Investor Demand: The initial tender offer might have received less participation than anticipated, prompting Lincoln Financial to increase its offer to incentivize more noteholders.

What this Means for Investors

The increased tender offer presents a significant opportunity for holders of the 7.25% senior notes due 2028. The improved terms offer a higher return compared to holding the notes to maturity. However, investors should carefully review the amended offer documents and consider their individual financial circumstances before making a decision. Consulting a financial advisor is always recommended.

Looking Ahead: Implications for Lincoln Financial's Future

This strategic move reflects Lincoln Financial's proactive approach to managing its financial obligations. By reducing its debt burden, the company strengthens its financial position, improves its creditworthiness, and enhances its capacity for future growth and investment. This proactive debt management could potentially lead to increased investor confidence and a positive impact on Lincoln National Corporation's (LNC) stock price.

Call to Action: Stay informed about Lincoln Financial's financial developments by regularly checking their investor relations website and following reputable financial news sources. Remember to consult a financial advisor before making any investment decisions. This article is for informational purposes only and does not constitute financial advice.

Keywords: Lincoln Financial, Lincoln National Corporation (LNC), tender offer, debt repurchase, senior notes, financial news, investment, debt management, capital structure, shareholder value, financial markets, amended offer.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Sweetens The Deal: $45 Million Boost To Tender Offer. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

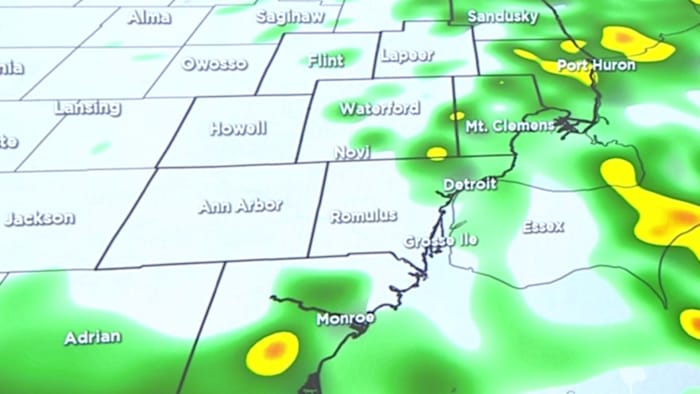

Prepare For Rain Scattered Showers Expected In Metro Detroit This Week

May 29, 2025

Prepare For Rain Scattered Showers Expected In Metro Detroit This Week

May 29, 2025 -

From Tv Reporter To Hollywood Icon Examining Lauren Sanchezs Style Evolution

May 29, 2025

From Tv Reporter To Hollywood Icon Examining Lauren Sanchezs Style Evolution

May 29, 2025 -

Canadas 51st Statehood Trump Proposes Golden Dome Protection Deal

May 29, 2025

Canadas 51st Statehood Trump Proposes Golden Dome Protection Deal

May 29, 2025 -

Lincoln Financial Sweetens Tender Offer By 45 Million Amid Strong Investor Response

May 29, 2025

Lincoln Financial Sweetens Tender Offer By 45 Million Amid Strong Investor Response

May 29, 2025 -

La Influencer Angela Marmol Presume Su Video Mas Exitoso En Tik Tok

May 29, 2025

La Influencer Angela Marmol Presume Su Video Mas Exitoso En Tik Tok

May 29, 2025