Lincoln Financial Sweetens Tender Offer By $45 Million, Investors Respond With $812 Million

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens Tender Offer, Investors Respond with Overwhelming Support

Lincoln Financial Group (LNC) has successfully sweetened its tender offer for its outstanding 7.000% Senior Notes due 2028, resulting in a significant surge of investor participation. The company initially offered to repurchase $767 million of the notes but increased its offer by $45 million, bringing the total to $812 million—a figure that was dramatically exceeded by investor response. This move underscores Lincoln Financial's commitment to optimizing its capital structure and managing its debt profile effectively.

A Strategic Move to Strengthen Financial Health

This significant tender offer represents a proactive strategy by Lincoln Financial to enhance its financial flexibility and strengthen its overall balance sheet. By repurchasing a substantial portion of its outstanding debt, the company reduces its future interest expense, improving profitability and freeing up capital for other strategic initiatives. This financial maneuvering is particularly relevant in the current economic climate, characterized by fluctuating interest rates and potential market volatility. The success of the offer demonstrates investor confidence in Lincoln Financial’s long-term prospects.

Investor Confidence and Market Response

The overwhelming response to the increased tender offer – exceeding the initial target by a considerable margin – speaks volumes about the confidence investors have in Lincoln Financial’s management and its future performance. The market generally reacted positively to the news, suggesting a favorable perception of the company's financial strategy. This strong investor support allows Lincoln Financial to proactively manage its debt obligations and potentially invest in growth opportunities.

Detailed Breakdown of the Offer:

- Initial Offer: $767 million

- Increased Offer: $812 million (+$45 million)

- Response: Overwhelming investor participation, exceeding the increased offer amount.

- Impact: Reduced future interest expense, improved financial flexibility, and enhanced investor confidence.

Implications for the Future:

This strategic debt reduction maneuver positions Lincoln Financial for future growth and stability. The company can now allocate resources to areas such as innovation, expansion into new markets, or enhancing its existing product offerings. This proactive approach to debt management contrasts with a more passive strategy, demonstrating a commitment to fiscal responsibility and a proactive stance in navigating the ever-changing financial landscape. It is likely that this move will be viewed favorably by credit rating agencies, further strengthening Lincoln Financial's creditworthiness.

The Broader Context:

The success of Lincoln Financial's tender offer is also a reflection of broader trends in the financial services industry. Companies are increasingly focusing on optimizing their capital structures to navigate economic uncertainty and enhance shareholder value. This proactive approach is likely to become increasingly common as businesses strive to maintain financial resilience in a dynamic market environment.

Conclusion:

Lincoln Financial's successful tender offer demonstrates a clear commitment to strategic financial management. The overwhelming investor response highlights confidence in the company’s future and its ability to navigate the challenges of the current economic climate. This move solidifies Lincoln Financial’s position and sets a strong foundation for future growth and success. For investors, this is a positive sign indicating financial stability and a proactive approach to managing debt. It remains to be seen what strategic investments Lincoln Financial will make with the capital freed up by this successful tender offer. We will continue to monitor the situation and provide updates as they become available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Sweetens Tender Offer By $45 Million, Investors Respond With $812 Million. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chaos And Conflict Us Aid Fails To Reach Hungry Gaza Residents

May 29, 2025

Chaos And Conflict Us Aid Fails To Reach Hungry Gaza Residents

May 29, 2025 -

Tension Con Tom Cruise Influencer Espanola Cuenta Su Experiencia

May 29, 2025

Tension Con Tom Cruise Influencer Espanola Cuenta Su Experiencia

May 29, 2025 -

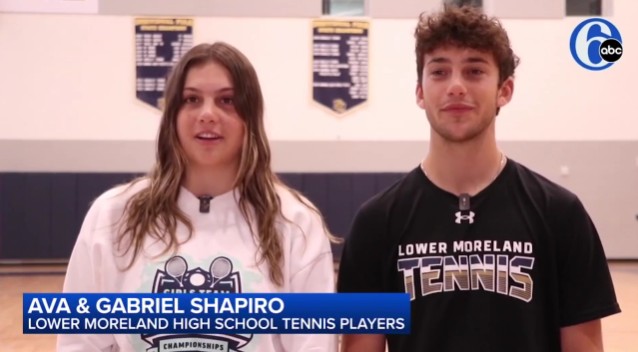

6 Abc Features Lower Moreland Senior Twins State Tennis Victory

May 29, 2025

6 Abc Features Lower Moreland Senior Twins State Tennis Victory

May 29, 2025 -

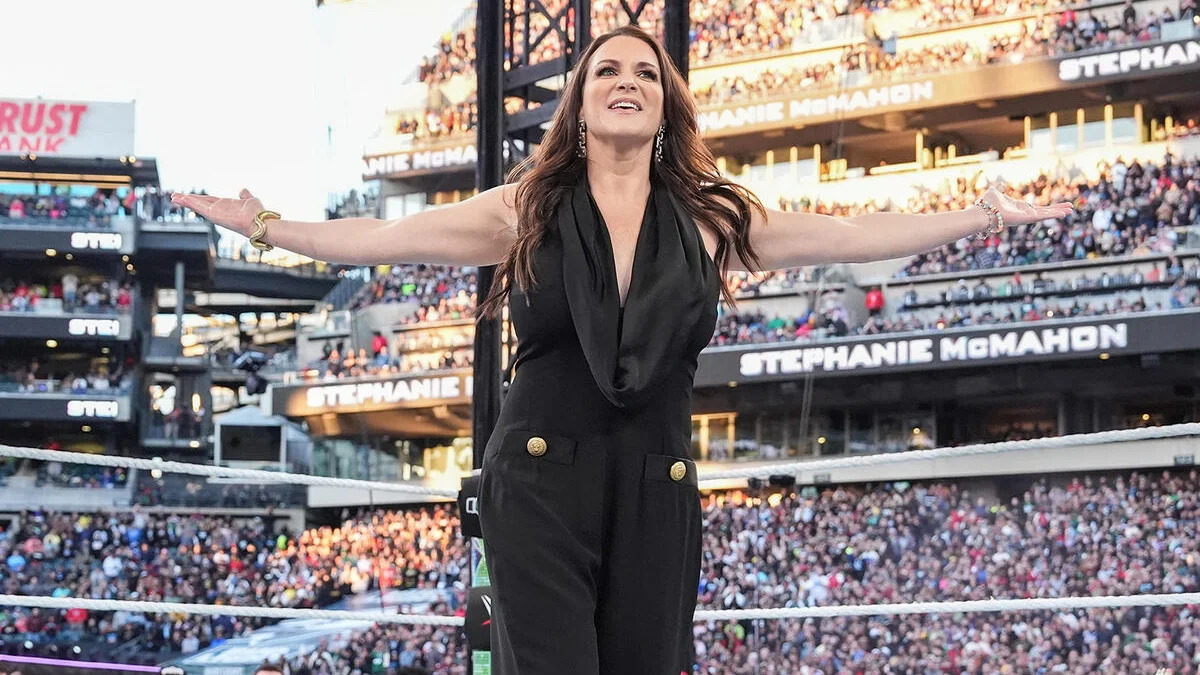

Stephanie Mc Mahons Thank God Moment The Tattoo She Avoided

May 29, 2025

Stephanie Mc Mahons Thank God Moment The Tattoo She Avoided

May 29, 2025 -

French Open 2025 Fritz And Navarros First Round Exits Shock Roland Garros

May 29, 2025

French Open 2025 Fritz And Navarros First Round Exits Shock Roland Garros

May 29, 2025