Lincoln Financial Sweetens Tender Offer: $812 Million In Securities Submitted

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens Tender Offer: $812 Million in Securities Submitted

Lincoln Financial Group (LNC) has sweetened its tender offer for its outstanding 7.875% Senior Notes due 2026, increasing the consideration offered to entice more bondholders to participate. This move, announced [Date of Announcement], signals a proactive approach by the insurance giant to manage its debt profile and potentially reduce its overall financial obligations. The increased offer resulted in the submission of $812 million in securities, a significant portion of the outstanding notes.

This development follows [mention previous attempts or relevant news if any, link to relevant news articles]. The initial tender offer, announced on [Date of Initial Offer], fell short of Lincoln Financial's target, prompting this revised and more attractive offer. The company is clearly aiming to capitalize on current market conditions and investor sentiment to successfully restructure its debt.

Details of the Sweetened Tender Offer

The original offer valued the notes at [Original Offer Price]. The sweetened offer now includes [New Offer Price], representing a [Percentage Increase]% increase in value. This significant improvement aims to incentivize bondholders who previously hesitated to tender their securities. The deadline for the revised tender offer is [Date of Deadline].

The strategic move by Lincoln Financial underscores several key considerations:

- Improved Debt Management: Reducing the outstanding amount of 7.875% Senior Notes due 2026 significantly improves Lincoln Financial's debt management strategy. This lowers their interest expense and enhances overall financial flexibility.

- Market Conditions: The increased offer likely reflects current market conditions and the prevailing interest rate environment. By offering a more compelling price, Lincoln Financial aims to secure a larger participation rate.

- Investor Confidence: While the initial offer may have indicated some hesitation from bondholders, the sweetened offer demonstrates Lincoln Financial's commitment to addressing its debt obligations and maintaining investor confidence.

Analyzing the Impact

The success of the sweetened tender offer and the substantial $812 million in securities submitted represents a positive development for Lincoln Financial. It demonstrates the company's ability to actively manage its financial position and adapt to changing market dynamics. This improved debt structure can contribute to enhanced financial stability and potentially free up capital for future investments and growth initiatives.

However, it is important to note that [Mention any potential drawbacks or uncertainties. E.g., the success of the tender offer is contingent on market conditions and investor participation. The company may still face challenges in managing its broader debt portfolio].

What's Next for Lincoln Financial?

The successful tender offer represents a significant step towards strengthening Lincoln Financial's financial position. The company will likely continue to monitor its debt profile and adjust its strategies as needed to optimize its capital structure. Further announcements regarding future debt management initiatives are anticipated.

Keywords: Lincoln Financial, LNC, tender offer, debt management, senior notes, bonds, financial restructuring, investment, market conditions, interest rates, financial news, corporate finance.

Call to Action (subtle): Stay tuned for further updates on Lincoln Financial's financial performance and future strategies. Follow us for the latest news in the financial sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Sweetens Tender Offer: $812 Million In Securities Submitted. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Economic Potential Of Climate Action Insights From Brazils Finance Chief

May 28, 2025

Economic Potential Of Climate Action Insights From Brazils Finance Chief

May 28, 2025 -

Powerball Jackpot Soars To 167 Million May 24 Drawing Results

May 28, 2025

Powerball Jackpot Soars To 167 Million May 24 Drawing Results

May 28, 2025 -

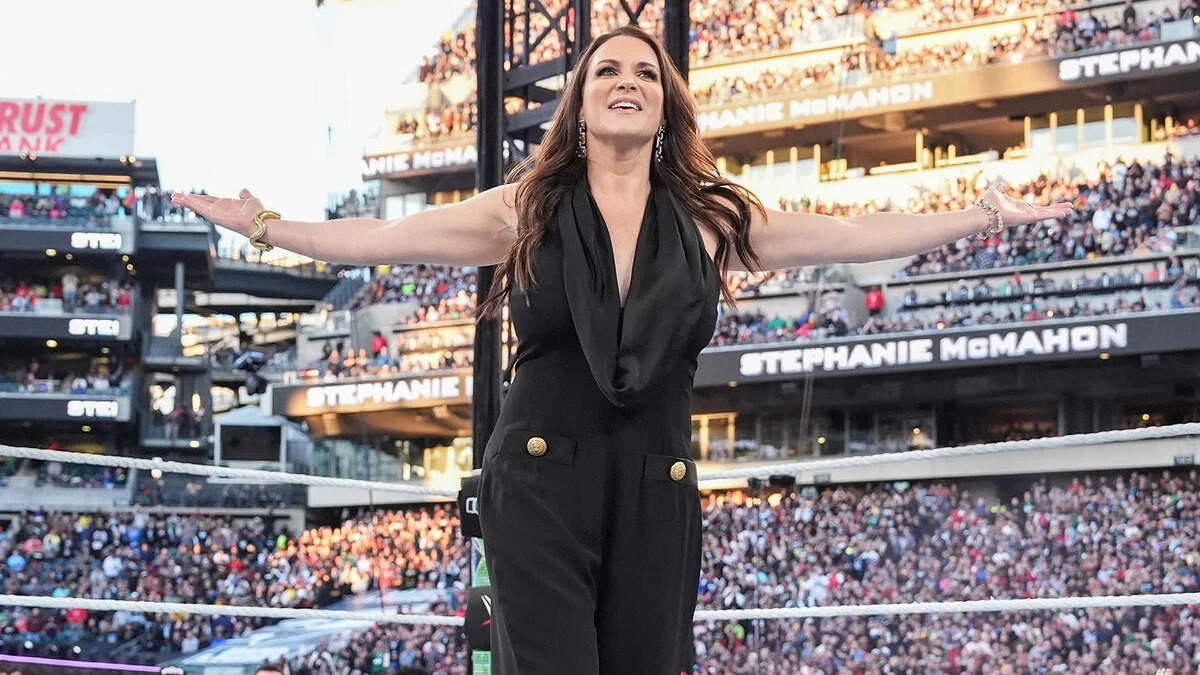

Thank God I Didn T Stephanie Mc Mahon On A Tattoo She Avoided

May 28, 2025

Thank God I Didn T Stephanie Mc Mahon On A Tattoo She Avoided

May 28, 2025 -

Orlando Forecast High Temperatures High Humidity And Rising Storm Threats

May 28, 2025

Orlando Forecast High Temperatures High Humidity And Rising Storm Threats

May 28, 2025 -

French Presidential Couples Plane Dispute Unpacking The Recent Incident

May 28, 2025

French Presidential Couples Plane Dispute Unpacking The Recent Incident

May 28, 2025