Lincoln Financial Raises Tender Offer By $45 Million, Surpassing $812 Million In Securities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Pot: $857 Million Tender Offer for Securities

Lincoln Financial Group has significantly increased its tender offer, signaling a bold move in its ongoing strategic restructuring. The company announced a $45 million bump, raising the total offer to a substantial $857 million for its outstanding securities. This aggressive action surpasses the initial offer of $812 million and reflects Lincoln Financial's commitment to streamlining its operations and enhancing shareholder value.

This significant increase underscores the company's confidence in its future prospects and its desire to accelerate the repurchase of its outstanding securities. The move is likely to be well-received by investors, potentially driving up the stock price and further solidifying Lincoln Financial's position in the market.

What Does This Mean for Investors?

The heightened tender offer presents a compelling opportunity for investors holding Lincoln Financial securities. The increased price represents a significant premium compared to the current market value, making this a potentially lucrative exit strategy for some shareholders. The sheer size of the offer also suggests a strong level of confidence within Lincoln Financial's leadership regarding the company's financial health and future growth potential.

This strategic move could signal several key developments:

- Increased Shareholder Returns: By repurchasing its own securities, Lincoln Financial is effectively returning capital to its shareholders. This is a common practice among companies with strong cash flow and a belief in their undervalued stock.

- Debt Reduction Strategy: The tender offer could be part of a broader strategy to reduce the company's overall debt levels, improving its financial flexibility and creditworthiness.

- Streamlined Operations: Repurchasing securities can contribute to simplifying the company's capital structure and potentially making it more efficient to operate.

The Implications for the Financial Sector

Lincoln Financial's ambitious tender offer has sent ripples through the financial sector. The move highlights the ongoing strategic shifts within the insurance and financial services industry, with companies actively seeking ways to optimize their balance sheets and maximize shareholder value in a dynamic and increasingly competitive environment. Analysts will be closely monitoring the impact of this offer on Lincoln Financial's overall financial performance and its effect on investor sentiment in the broader market.

What's Next for Lincoln Financial?

The success of the tender offer will depend on the level of participation from existing shareholders. While the increased offer price is enticing, investors will need to carefully consider their individual investment strategies and objectives before deciding whether to participate. Further announcements and updates from Lincoln Financial are anticipated in the coming weeks. Keep an eye on the company's investor relations section for the latest information.

Keywords: Lincoln Financial, Tender Offer, Securities, Stock Repurchase, Shareholder Value, Financial News, Investment News, Insurance Industry, Financial Services, Market Analysis, Stock Market, Investment Strategy

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Raises Tender Offer By $45 Million, Surpassing $812 Million In Securities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Macron Plane Incident Fact Checking The Viral Video And Speculation

May 29, 2025

Macron Plane Incident Fact Checking The Viral Video And Speculation

May 29, 2025 -

Atlanta Police Arrest R And B Singer Jaheim On Animal Cruelty Charges

May 29, 2025

Atlanta Police Arrest R And B Singer Jaheim On Animal Cruelty Charges

May 29, 2025 -

Cameron Brinks Recovery Stalled Sparks Issue Disappointing Injury Report

May 29, 2025

Cameron Brinks Recovery Stalled Sparks Issue Disappointing Injury Report

May 29, 2025 -

Student Visa Delays Understanding The Trump Administrations Embassy Pause

May 29, 2025

Student Visa Delays Understanding The Trump Administrations Embassy Pause

May 29, 2025 -

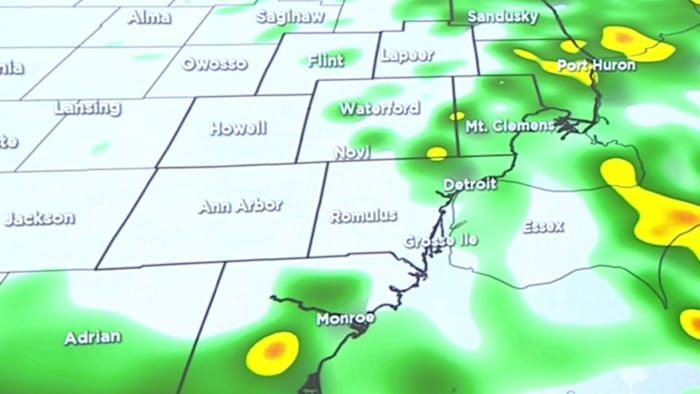

Week Ahead Weather Scattered Showers Predicted For Metro Detroit Area

May 29, 2025

Week Ahead Weather Scattered Showers Predicted For Metro Detroit Area

May 29, 2025