Lincoln Financial Raises Tender Offer By $45 Million, Reaching $812 Million In Securities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Pot: $812 Million Tender Offer for Securities

Lincoln Financial Group (LNC) has significantly increased its tender offer, signaling a renewed commitment to acquiring its outstanding securities. The company announced a $45 million boost, bringing the total tender offer to a substantial $812 million. This move has sent ripples through the financial markets, prompting analysts to reassess the company's strategic direction and sparking increased investor interest.

The increased tender offer aims to repurchase a significant portion of the company's outstanding securities. This strategic maneuver is not uncommon among large corporations looking to optimize their capital structure and potentially increase shareholder value. But the significant jump in the offer amount raises questions about Lincoln Financial's intentions and the potential implications for investors.

Why the Increased Offer?

Several factors could be contributing to this substantial increase in the tender offer. Analysts suggest that Lincoln Financial may be aiming to:

- Simplify its Capital Structure: Reducing the outstanding securities can lead to a more streamlined and efficient capital structure, potentially lowering borrowing costs in the long run.

- Increase Shareholder Value: By repurchasing its own securities, Lincoln Financial can potentially boost earnings per share (EPS), a key metric for investors.

- Signal Confidence: The increased offer could be interpreted as a strong signal of confidence in the company's future performance and prospects. This could reassure investors and bolster market sentiment.

Impact on Investors

The increased tender offer presents a potentially lucrative opportunity for eligible investors holding Lincoln Financial securities. However, it's crucial to understand the terms and conditions of the offer before making any decisions. Investors should carefully review the offer documents and consult with a financial advisor to determine if participating is in their best interest. The deadline for acceptance should be carefully noted.

Market Reaction and Analyst Predictions

The market has reacted positively to the news, with LNC stock showing a modest increase following the announcement. Several analysts have upgraded their price targets for Lincoln Financial stock, reflecting a more optimistic outlook on the company's future performance. However, some analysts remain cautious, highlighting potential risks associated with the large-scale repurchase. Further analysis of the company's financial statements will be crucial in assessing the long-term implications of this significant financial maneuver.

Looking Ahead

The increased tender offer marks a significant development for Lincoln Financial Group. Its success will depend on several factors, including investor participation and the overall market environment. The coming weeks will be critical in observing the market's reaction and determining the ultimate impact of this bold financial strategy. Investors should continue to monitor the situation closely and stay informed about any further developments. For the latest updates, check the official Lincoln Financial Group investor relations website.

Keywords: Lincoln Financial, LNC, tender offer, securities repurchase, stock buyback, shareholder value, capital structure, investment, financial news, market reaction, analyst predictions, EPS, corporate finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Raises Tender Offer By $45 Million, Reaching $812 Million In Securities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Juan Manuel Cerundolo Vs Hamad Medjedovic 2025 French Open Picks And Analysis

May 28, 2025

Juan Manuel Cerundolo Vs Hamad Medjedovic 2025 French Open Picks And Analysis

May 28, 2025 -

Us Aid In Gaza Day One Marred By Widespread Clashes Amidst Severe Food Shortages

May 28, 2025

Us Aid In Gaza Day One Marred By Widespread Clashes Amidst Severe Food Shortages

May 28, 2025 -

Oklo Stock Risks And Rewards Of A Sustainable Energy Investment

May 28, 2025

Oklo Stock Risks And Rewards Of A Sustainable Energy Investment

May 28, 2025 -

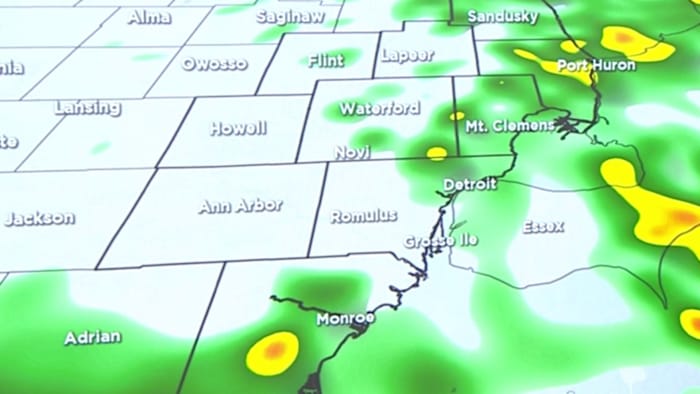

Metro Detroit Forecast One More Mild Day Before Temperatures Drop

May 28, 2025

Metro Detroit Forecast One More Mild Day Before Temperatures Drop

May 28, 2025 -

This Weeks Weather In Metro Detroit Preparing For Scattered Showers

May 28, 2025

This Weeks Weather In Metro Detroit Preparing For Scattered Showers

May 28, 2025