Lincoln Financial Raises Tender Offer By $45 Million, Exceeding $800 Million In Securities

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Pot: $45 Million Increase to Tender Offer Exceeds $800 Million

Lincoln Financial Group (LNC) has announced a significant increase to its ongoing tender offer, signaling a heightened commitment to repurchasing its outstanding securities. The company raised the offer by a substantial $45 million, pushing the total value beyond the $800 million mark. This move has sent ripples through the financial markets, sparking renewed interest in LNC stock and prompting analysts to reassess their projections.

This decisive action reflects Lincoln Financial's confidence in its future prospects and its dedication to maximizing shareholder value. The increased tender offer provides a compelling opportunity for investors to capitalize on the current market conditions and potentially realize a strong return on their investment.

Increased Tender Offer Details:

The original tender offer, announced [insert original announcement date], was already substantial. However, this latest increase underscores the company's proactive approach to capital management. The revised offer details include:

- Total Value: Over $800 million, representing a significant increase from the initial offer.

- Purpose: The repurchase program aims to optimize Lincoln Financial's capital structure and enhance shareholder returns.

- Deadline: Investors should refer to the official press release for the updated deadline for tendering their securities. [Link to official press release]

Why the Increase? Analyzing Lincoln Financial's Strategy:

Several factors likely contributed to Lincoln Financial's decision to increase its tender offer. These could include:

- Strong Financial Performance: A robust financial performance in recent quarters might have provided Lincoln Financial with the necessary capital to bolster the offer. The company likely assessed its financial position and determined it could afford a more aggressive repurchase strategy.

- Attractive Valuation: The management team may believe the current market valuation of its securities undervalues the company's intrinsic worth. The increased offer acts as a strategic move to capitalize on this perceived undervaluation.

- Investor Sentiment: The initial tender offer may have garnered a less-than-expected response. Increasing the offer could incentivize more investors to participate, thereby achieving the desired level of securities repurchase.

Impact on Investors and Market Outlook:

This significant increase in the tender offer is likely to have a positive impact on LNC stock price. Many investors view share buybacks as a sign of confidence from management and a potential catalyst for future growth. However, it's important to remember that market conditions and other unforeseen circumstances can impact stock prices.

What this means for you:

This increased tender offer presents a potentially lucrative opportunity for investors holding Lincoln Financial securities. It's crucial to carefully review the terms and conditions of the tender offer and seek professional financial advice before making any investment decisions.

Keywords: Lincoln Financial, LNC stock, tender offer, share repurchase, buyback, shareholder value, capital management, investment, financial news, market outlook, stock price, securities

Call to Action (subtle): Stay informed about Lincoln Financial's developments by following their official investor relations website [link to investor relations website]. For comprehensive financial news and analysis, check out [link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Raises Tender Offer By $45 Million, Exceeding $800 Million In Securities. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roland Garros Upset De Jong Stages Comeback Win Over Passaro

May 29, 2025

Roland Garros Upset De Jong Stages Comeback Win Over Passaro

May 29, 2025 -

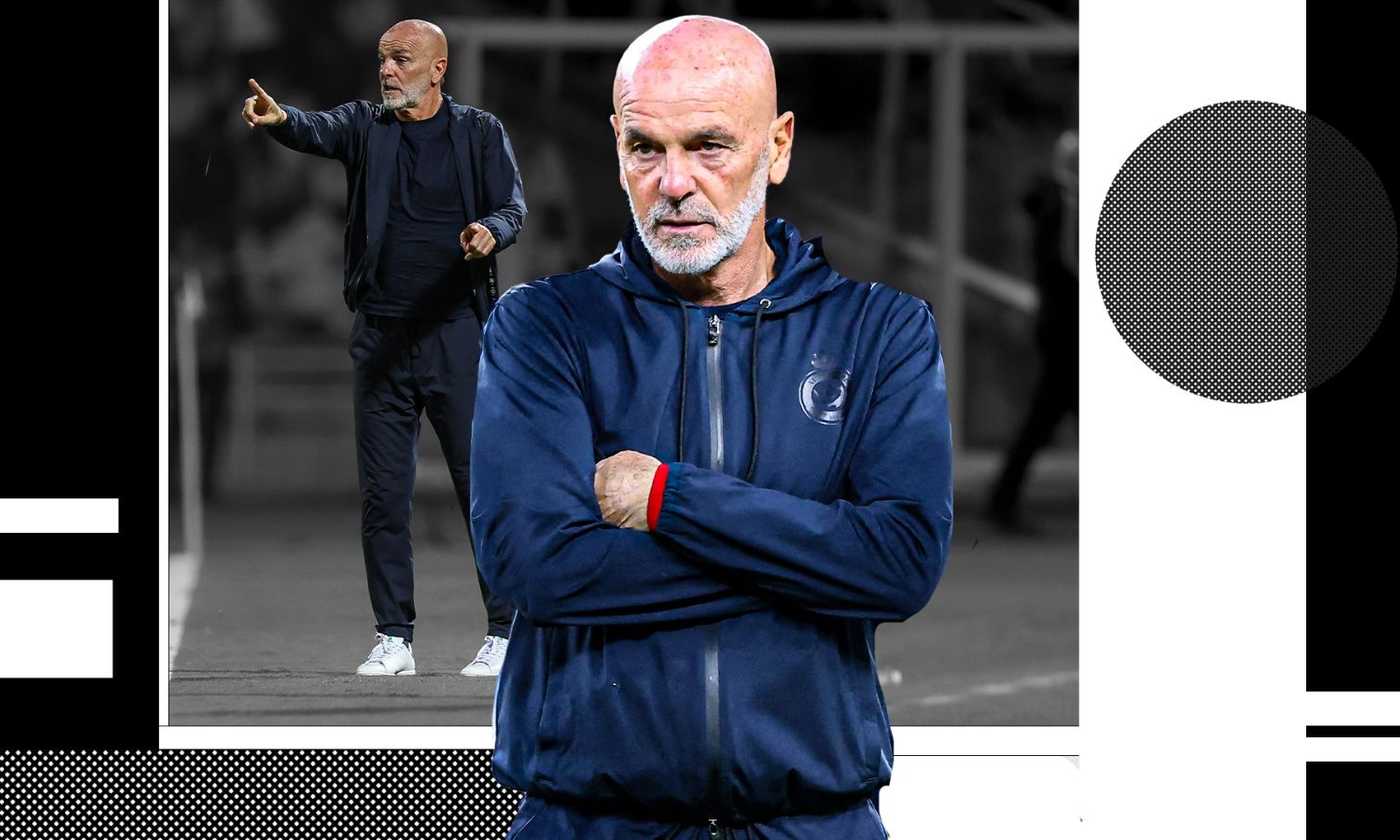

Pioli Ritorna In Serie A L Ex Allenatore E Di Nuovo In Italia

May 29, 2025

Pioli Ritorna In Serie A L Ex Allenatore E Di Nuovo In Italia

May 29, 2025 -

Polemica Influencer Espanola Cuenta Su Agresion A Tom Cruise

May 29, 2025

Polemica Influencer Espanola Cuenta Su Agresion A Tom Cruise

May 29, 2025 -

Pittsburgh Boston Seattle Coaching Searches The Latest Buzz

May 29, 2025

Pittsburgh Boston Seattle Coaching Searches The Latest Buzz

May 29, 2025 -

Panchina Atalanta Pioli Profilo E Probabilita Di Nomina

May 29, 2025

Panchina Atalanta Pioli Profilo E Probabilita Di Nomina

May 29, 2025