Lincoln Financial Boosts Tender Offer: $45 Million Increase, $812 Million In Securities Submitted

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lincoln Financial Sweetens the Pot: $45 Million Tender Offer Boost Signals Confidence

Lincoln Financial Group (NYSE: LNC) has significantly increased its tender offer, signaling a strong vote of confidence in the company's future. The insurance and retirement planning giant announced a $45 million boost to its existing offer, bringing the total to a substantial $812 million in securities submitted. This strategic move is generating significant buzz within the financial industry and has investors closely watching the company's next steps.

This substantial increase in the tender offer represents a compelling development for Lincoln Financial and highlights several key aspects of the company's current financial strategy. Let's delve into the details:

H2: A Deeper Dive into the Increased Tender Offer

The original tender offer, already substantial, has now been augmented by a significant $45 million. This upward revision suggests that Lincoln Financial is actively seeking to repurchase a larger volume of its outstanding securities. Why the increase? Several factors could be at play:

- Strong Financial Performance: The increased offer might reflect exceptionally strong financial performance, exceeding initial projections and providing Lincoln Financial with the financial flexibility to enhance its buyback program. This demonstrates confidence in the company’s future earnings and profitability.

- Strategic Capital Allocation: The move could be part of a broader strategic capital allocation plan. By repurchasing its securities, Lincoln Financial reduces the number of outstanding shares, potentially increasing earnings per share (EPS) and boosting investor returns. This is a common tactic among companies aiming to maximize shareholder value.

- Undervaluation Belief: The company's management may believe that its stock is currently undervalued in the market. The increased tender offer could be a strategic attempt to capitalize on this perceived undervaluation and return value to shareholders.

H2: Implications for Investors

The increased tender offer carries several implications for investors:

- Increased Shareholder Value: The reduction in outstanding shares, driven by the buyback, can lead to higher EPS, potentially resulting in a greater return on investment for existing shareholders.

- Signal of Confidence: The significant increase in the tender offer serves as a strong signal of confidence from Lincoln Financial's management in the company’s future prospects and financial health.

- Market Reaction: The market's reaction to this announcement will be crucial. A positive response could indicate investor agreement with the company’s strategic move, leading to a potential stock price increase.

H2: Looking Ahead for Lincoln Financial

The enhanced tender offer marks a significant strategic step for Lincoln Financial. It remains to be seen how the market will react in the coming weeks and months. Analysts are keenly watching the impact of this move on the company's financial performance and share price. Further announcements from Lincoln Financial regarding its long-term strategies and future capital allocation plans are anticipated with considerable interest.

H3: Stay Informed

For further updates on Lincoln Financial Group and other financial news, be sure to check back regularly for the latest information. Staying informed is key to making sound investment decisions. [Link to relevant financial news website].

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lincoln Financial Boosts Tender Offer: $45 Million Increase, $812 Million In Securities Submitted. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

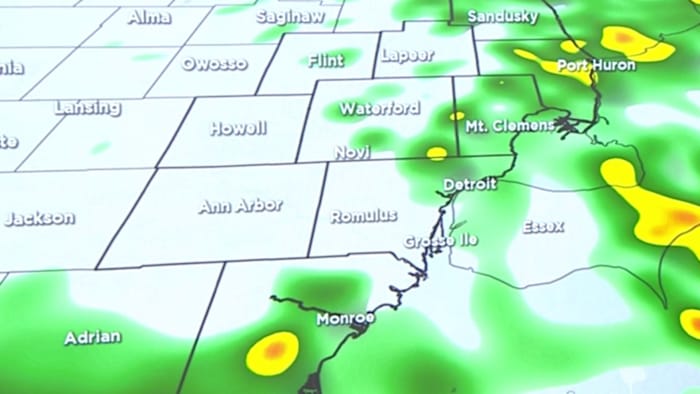

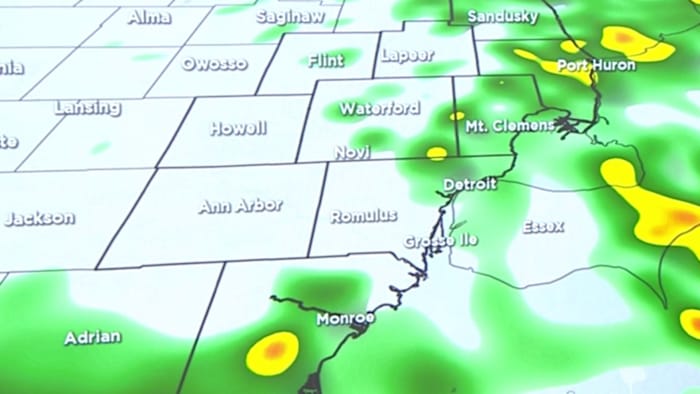

Cooler Temperatures Expected In Metro Detroit After Mild Spell

May 28, 2025

Cooler Temperatures Expected In Metro Detroit After Mild Spell

May 28, 2025 -

150 Gain In 60 Days This Ai Stock Challenges Palantirs Growth

May 28, 2025

150 Gain In 60 Days This Ai Stock Challenges Palantirs Growth

May 28, 2025 -

Weekly Weather Outlook Scattered Showers Predicted For Metro Detroit

May 28, 2025

Weekly Weather Outlook Scattered Showers Predicted For Metro Detroit

May 28, 2025 -

Thousands Seek Food Aid In Gaza As Distribution Center Struggles To Keep Up

May 28, 2025

Thousands Seek Food Aid In Gaza As Distribution Center Struggles To Keep Up

May 28, 2025 -

Metro Detroit Weather Alert Scattered Showers Likely This Week

May 28, 2025

Metro Detroit Weather Alert Scattered Showers Likely This Week

May 28, 2025