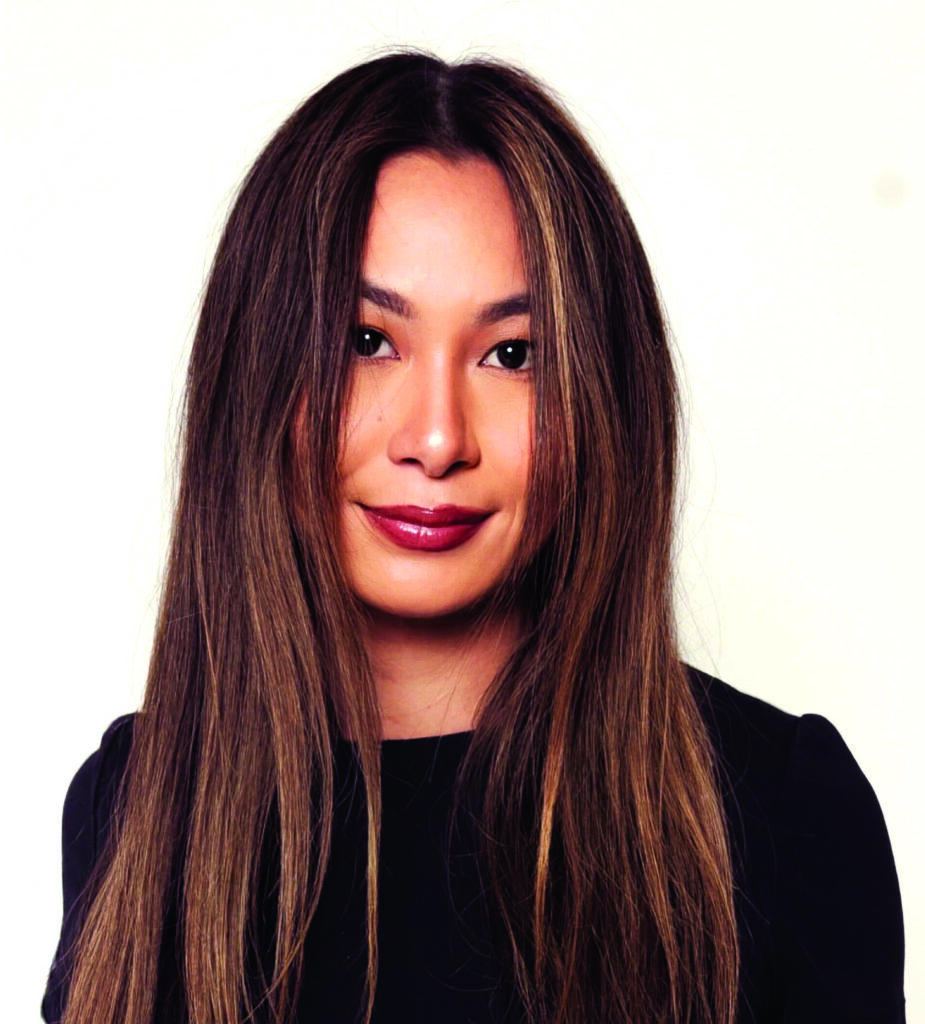

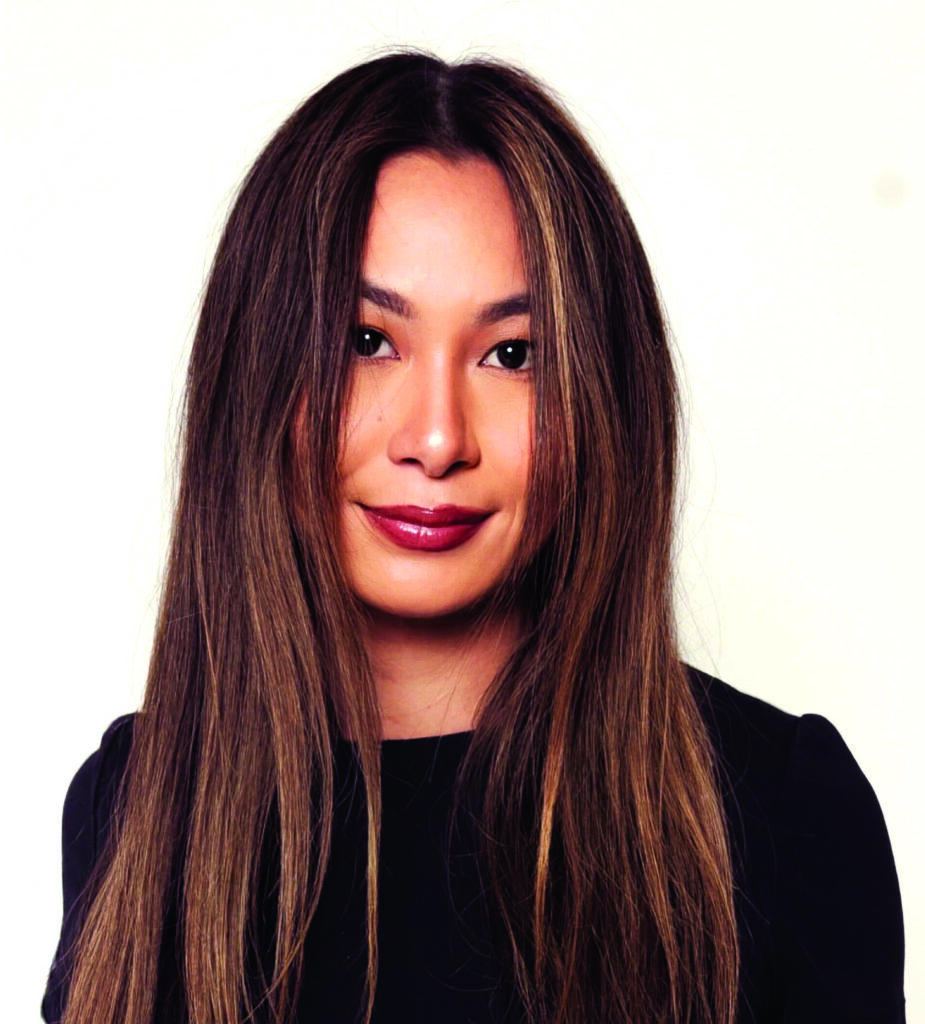

LA500 2025: Key Takeaways From Lucy Guo's Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

LA500 2025: Key Takeaways from Lucy Guo's insightful Analysis

The LA500, a prestigious gathering of leading entrepreneurs and investors, recently concluded, leaving attendees buzzing with new ideas and connections. This year's event saw prominent angel investor and founder, Lucy Guo, share her invaluable insights on the evolving tech landscape and the future of startups. Her analysis offered several key takeaways that are crucial for anyone navigating the ever-changing world of entrepreneurship.

Lucy Guo, known for her sharp intellect and successful investments in companies like [link to a relevant Lucy Guo investment, e.g., a portfolio company website], provided a unique perspective on the current market conditions and what founders need to focus on in 2025 and beyond. Her presentation wasn't just about identifying trends; it was about understanding the underlying forces shaping them.

Navigating the Shifting Sands of Venture Capital

One of the most significant takeaways from Guo's analysis focused on the changing dynamics of venture capital. She highlighted:

- Increased scrutiny of unit economics: Gone are the days of rapid growth at all costs. Investors are now placing a much stronger emphasis on profitability and sustainable business models. Guo stressed the importance of demonstrating clear paths to profitability, emphasizing strong unit economics as a crucial factor in securing funding.

- The rise of AI-driven investments: Unsurprisingly, Artificial Intelligence dominated much of the conversation. Guo predicted a continued surge in AI-focused investments, but cautioned against jumping on the bandwagon without a solid understanding of the technology and its potential applications within a specific market. She emphasized the need for differentiated AI solutions, not just another AI-powered app.

- A focus on long-term value creation: Short-term gains are no longer enough. Investors are seeking companies with a long-term vision and the potential for sustained growth. Building a truly valuable company, rather than just chasing quick exits, was a central theme in Guo’s analysis.

Beyond Funding: Building a Resilient Startup

Guo's presentation extended beyond securing funding, emphasizing the importance of building a resilient and adaptable organization. Key points included:

- The power of a strong team: Talent acquisition and retention were highlighted as critical. Building a high-performing team with diverse skills and perspectives is crucial for navigating uncertainty and achieving long-term success. Guo stressed the importance of creating a positive and inclusive company culture.

- Embracing adaptability and pivoting: The ability to adapt to changing market conditions and customer needs is paramount. Guo encouraged founders to embrace experimentation and be willing to pivot their strategies when necessary.

- The importance of data-driven decision making: Relying on gut feeling alone is insufficient. Guo advocated for making decisions based on data and analytics, using metrics to track progress and identify areas for improvement.

The Future of Entrepreneurship According to Lucy Guo

Guo's concluding remarks painted a picture of a future where entrepreneurship requires more than just a brilliant idea. It necessitates a deep understanding of market dynamics, a commitment to building a sustainable business, and the ability to adapt and thrive in a constantly evolving landscape. She emphasized the importance of continuous learning, networking, and seeking mentorship.

In conclusion, Lucy Guo's analysis at LA500 2025 provided invaluable insights for entrepreneurs and investors alike. By focusing on unit economics, AI's strategic application, building resilient teams, and embracing adaptability, founders can position themselves for success in the increasingly competitive tech market. Her advice serves as a roadmap for navigating the complexities of the modern startup world and building truly valuable, long-lasting companies. Are you ready to apply these key takeaways to your own entrepreneurial journey? [Link to a relevant resource, e.g., a startup resource website or Guo's own website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on LA500 2025: Key Takeaways From Lucy Guo's Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kashmirs Football Prodigy Suhail Ahmad Bhats Remarkable Success Story

Jun 05, 2025

Kashmirs Football Prodigy Suhail Ahmad Bhats Remarkable Success Story

Jun 05, 2025 -

Beloved Actor Jonathan Joss Dead At 59 Remembering His Roles In King Of The Hill And Beyond

Jun 05, 2025

Beloved Actor Jonathan Joss Dead At 59 Remembering His Roles In King Of The Hill And Beyond

Jun 05, 2025 -

Ufc Atlanta Kris Moutinho Steps Up Meets Explosive Opponent On Short Notice

Jun 05, 2025

Ufc Atlanta Kris Moutinho Steps Up Meets Explosive Opponent On Short Notice

Jun 05, 2025 -

Citigroups Gun Policy U Turn A Response To Trumps Criticism

Jun 05, 2025

Citigroups Gun Policy U Turn A Response To Trumps Criticism

Jun 05, 2025 -

Points Of Light Recognizes Deltas Commitment To Community For Eighth Consecutive Year

Jun 05, 2025

Points Of Light Recognizes Deltas Commitment To Community For Eighth Consecutive Year

Jun 05, 2025