June 2nd, 2025: Public Holiday Impact On Chinese And New Zealand Stock Exchanges

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June 2nd, 2025: Public Holiday Impact on Chinese and New Zealand Stock Exchanges

A significant global economic event looms: June 2nd, 2025, marks a public holiday in both China and New Zealand, promising to ripple through international stock markets. This dual closure presents unique challenges and opportunities for investors navigating the global financial landscape. Understanding the potential impact is crucial for anyone with holdings in either region, or those whose portfolios are indirectly affected.

This article will explore the expected effects of this simultaneous market closure, examining potential volatility, trading implications, and the broader economic consequences.

Understanding the Significance of the Dual Closure

The closure of both the Shanghai Stock Exchange (SSE) and the New Zealand Exchange (NZX) on the same day is noteworthy for several reasons:

- Interconnected Markets: While geographically distant, the economies of China and New Zealand are increasingly intertwined through trade, investment, and global supply chains. A simultaneous closure reduces liquidity in both markets, potentially influencing global market sentiment.

- Missed Trading Opportunities: Investors with positions in either market will miss a full day of trading, potentially impacting short-term gains or losses depending on market movements elsewhere. This is particularly relevant for traders employing strategies reliant on daily price fluctuations.

- Increased Volatility Potential: The absence of trading in these two significant markets could lead to increased volatility in other global exchanges. News and events unfolding during the closure period may not be immediately reflected in prices, leading to a potentially sharp adjustment upon reopening.

Potential Impact on Specific Sectors

Specific sectors are expected to be more sensitive to the market closure:

- Commodity Markets: Given New Zealand's significant agricultural exports and China's role as a major consumer of commodities, price fluctuations in these sectors could be amplified during the period of closure. Expect heightened attention on dairy, meat, and other primary goods prices upon market reopening.

- Tourism and Hospitality: Both countries have significant tourism sectors. Any global news affecting tourism sentiment during the closure could have a magnified effect on these stocks once trading resumes.

- Technology and Manufacturing: The interconnected supply chains between China and New Zealand mean any disruptions reported during the closure period could impact manufacturing and technology companies across both nations.

Preparing for the Market Closure

Investors should take proactive steps to prepare for the closure:

- Review Existing Positions: Analyze current holdings and consider any potential risks associated with the closure. Diversification is always a key strategy for mitigating such risks.

- Monitor Global News: Stay informed about global economic developments during the closure period. Major events unfolding could heavily influence market sentiment upon reopening.

- Consider Hedging Strategies: Depending on individual risk tolerance and investment strategies, investors might explore hedging strategies to mitigate potential losses during this period of uncertainty.

Conclusion: Navigating the Uncertainty

The simultaneous closure of the Chinese and New Zealand stock exchanges on June 2nd, 2025, presents a unique scenario requiring careful consideration by investors. While precise prediction of market behavior is impossible, understanding the potential implications and adopting appropriate risk management strategies will be crucial in navigating the uncertainty. Stay informed, remain vigilant, and consult with a financial advisor if you have concerns about your portfolio's exposure to these markets. Remember to always conduct thorough research before making any investment decisions.

(Note: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June 2nd, 2025: Public Holiday Impact On Chinese And New Zealand Stock Exchanges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

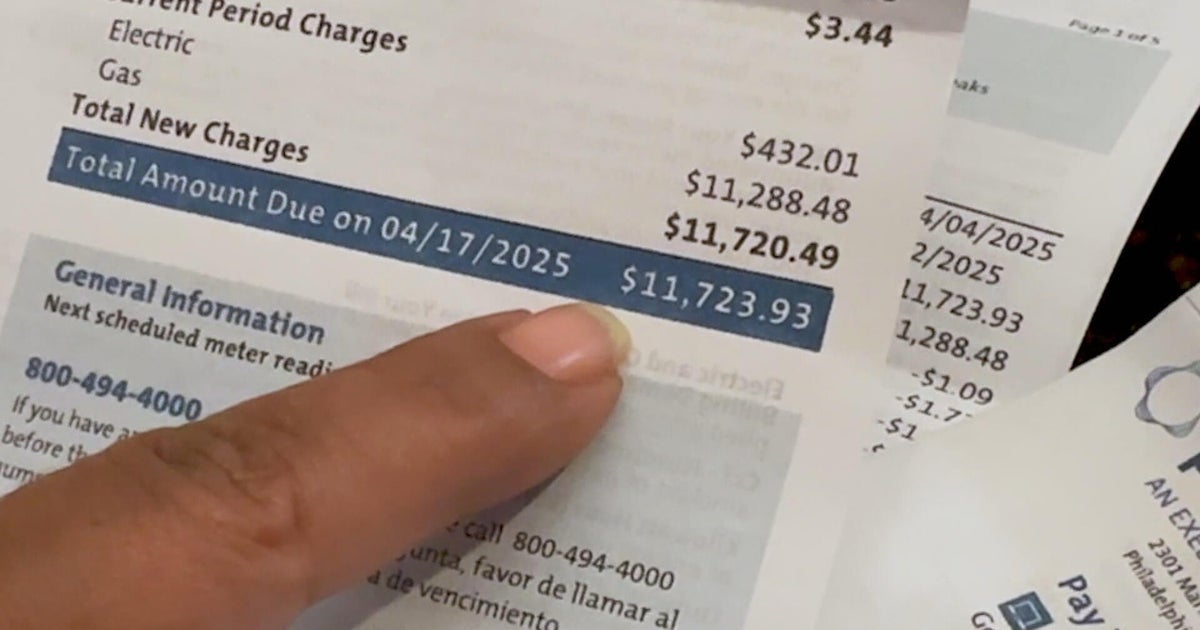

Philadelphia Peco Customers Report Billing Problems One Faces 12 000 Charge

Jun 02, 2025

Philadelphia Peco Customers Report Billing Problems One Faces 12 000 Charge

Jun 02, 2025 -

Piastri Norris And Verstappen A Thrilling Front Row Showdown At The Spanish Gp

Jun 02, 2025

Piastri Norris And Verstappen A Thrilling Front Row Showdown At The Spanish Gp

Jun 02, 2025 -

Oscar Piastri Claims Pole At 2025 Spanish Grand Prix Defeating Lando Norris

Jun 02, 2025

Oscar Piastri Claims Pole At 2025 Spanish Grand Prix Defeating Lando Norris

Jun 02, 2025 -

French Open 2025 Day 8 Live Scoreboard Swiatek Alcaraz Shelton Matches

Jun 02, 2025

French Open 2025 Day 8 Live Scoreboard Swiatek Alcaraz Shelton Matches

Jun 02, 2025 -

Climate Change Action Plan How Businesses Should Prepare For 2 C

Jun 02, 2025

Climate Change Action Plan How Businesses Should Prepare For 2 C

Jun 02, 2025