June 2, 2025 Holiday: Trading Halted In Chinese And New Zealand Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June 2nd, 2025: Dragon Boat Festival Shuts Down Markets in China and New Zealand

A global market pause: The Dragon Boat Festival, a significant holiday in many East and Southeast Asian countries, caused trading halts in both the Chinese and New Zealand stock markets on Monday, June 2nd, 2025. This public holiday, rich in tradition and cultural significance, resulted in a temporary standstill for investors in these key economies. Understanding the impact of this holiday on global finance is crucial for anyone involved in international trading.

The Dragon Boat Festival: A Celebration with Market Consequences

The Dragon Boat Festival, also known as Duanwu Jie (端午节), commemorates the life and death of the Chinese poet Qu Yuan. Celebrated annually on the fifth day of the fifth month of the lunar calendar, this year it fell on June 2nd, 2025. The festival is characterized by vibrant traditions, including dragon boat races, the consumption of zongzi (sticky rice dumplings), and various cultural events. While a time of joyous celebration, its observance significantly impacts business operations across several countries.

This year's closure affected not just the mainland Chinese markets, including the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), but also surprisingly impacted the New Zealand market. This unexpected ripple effect highlights the increasingly interconnected nature of global finance and the importance of staying informed about international holidays and their potential economic consequences.

Impact on Global Markets: A Ripple Effect

The closure of the Chinese and New Zealand markets, even if temporary, had a noticeable ripple effect on global markets. Many international investors and traders rely on these markets for a significant portion of their portfolios. The absence of trading activity from these major players resulted in reduced overall market liquidity and potentially impacted price discovery for certain assets. Analysts are currently assessing the full extent of this impact, looking for any significant deviations from pre-holiday trends.

Key areas impacted included:

- Reduced trading volume: The absence of Chinese and New Zealand markets significantly decreased overall global trading volume.

- Potential for price volatility: Upon reopening, markets often experience increased volatility as traders react to any news or developments that occurred during the closure.

- Impact on derivatives markets: Derivatives tied to Chinese and New Zealand assets also experienced reduced trading activity.

This underscores the significance of considering international holiday calendars when planning trading strategies and managing investment portfolios.

Looking Ahead: Preparing for Future Holiday Closures

The closure of the Chinese and New Zealand markets serves as a reminder of the importance of staying informed about global events and their impact on financial markets. Investors and traders should incorporate international holiday calendars into their planning to avoid potential disruptions and mitigate associated risks. Tools and resources are available online to help track these crucial dates, minimizing unexpected market interruptions.

[Link to a reliable international holiday calendar resource]

By proactively anticipating these closures, investors can optimize their trading strategies and minimize potential negative impacts on their portfolios. This includes careful consideration of asset allocation, risk management techniques, and a well-informed understanding of global market dynamics. Stay tuned for further analysis of the long-term effects of this holiday closure on the global financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June 2, 2025 Holiday: Trading Halted In Chinese And New Zealand Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Son Of The Wire Actor Seriously Injured In Devastating Henry County Tornado

Jun 02, 2025

Son Of The Wire Actor Seriously Injured In Devastating Henry County Tornado

Jun 02, 2025 -

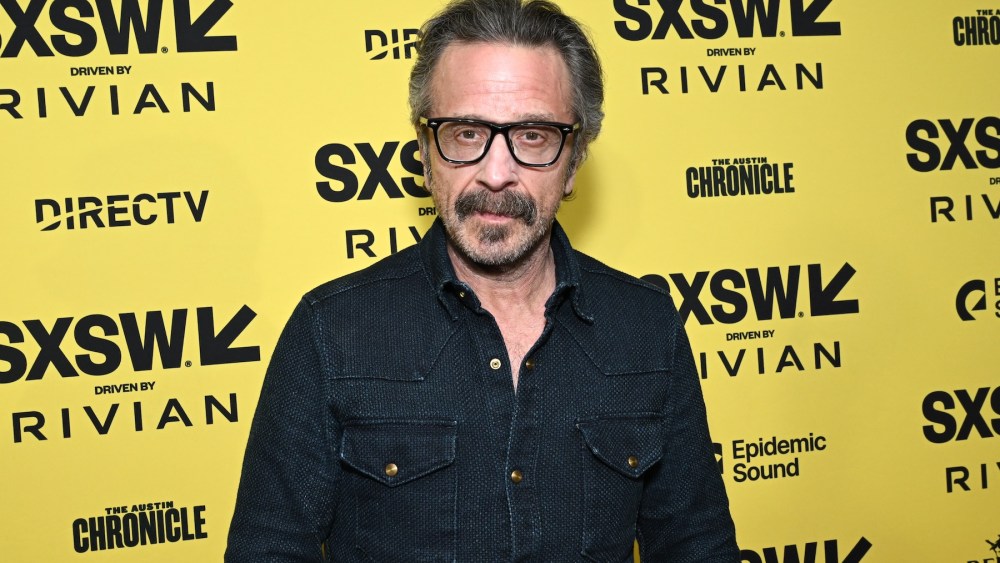

Marc Marons Wtf Podcast Ending After 16 Groundbreaking Years

Jun 02, 2025

Marc Marons Wtf Podcast Ending After 16 Groundbreaking Years

Jun 02, 2025 -

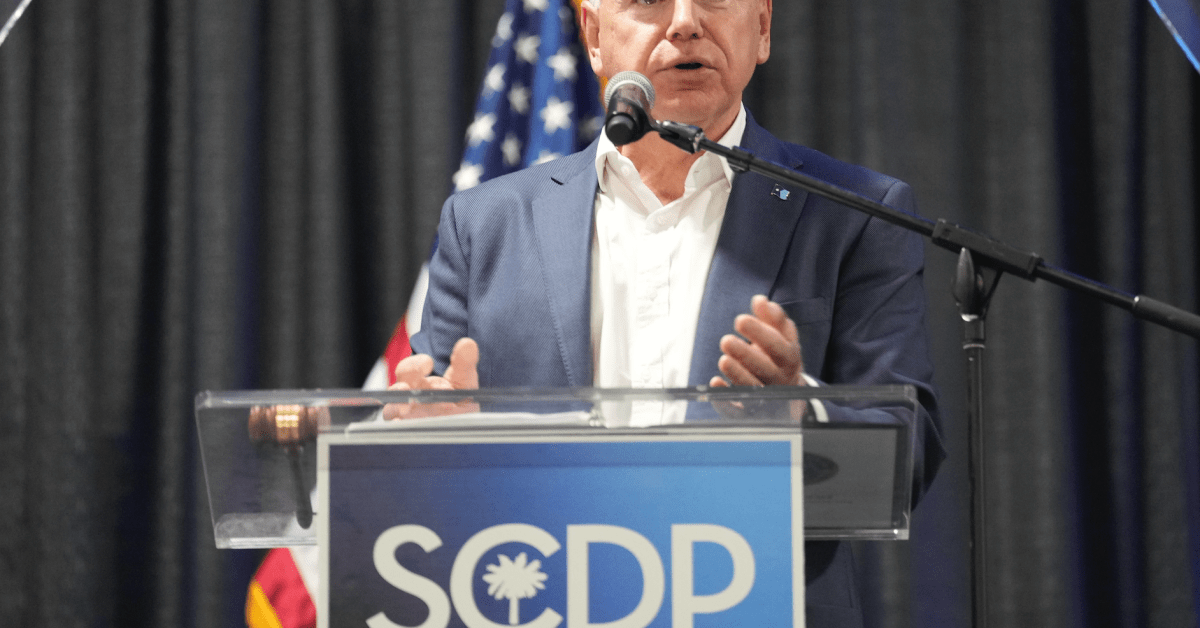

Governor Walz Criticizes Trump Advocates For A More Aggressive Democratic Strategy

Jun 02, 2025

Governor Walz Criticizes Trump Advocates For A More Aggressive Democratic Strategy

Jun 02, 2025 -

Miley Cyrus Maturation How Age Altered Her View Of Her Mother And Father

Jun 02, 2025

Miley Cyrus Maturation How Age Altered Her View Of Her Mother And Father

Jun 02, 2025 -

Actor Tray Chaneys Son Hospitalized Following Devastating Georgia Tornado

Jun 02, 2025

Actor Tray Chaneys Son Hospitalized Following Devastating Georgia Tornado

Jun 02, 2025