JPMorgan's Dimon Sounds Alarm: US China Tariff Policy And Economic Repercussions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan's Dimon Sounds Alarm: US-China Tariff Policy and Looming Economic Repercussions

JPMorgan Chase CEO Jamie Dimon recently issued a stark warning about the potential economic fallout from the ongoing US-China trade relationship, particularly focusing on the lingering effects of past tariff policies. His comments, delivered during a crucial period of economic uncertainty, highlight the significant and potentially long-lasting consequences of escalating trade tensions between the world's two largest economies. The impact, Dimon argues, extends far beyond simple trade figures and threatens global economic stability.

Dimon's Concerns: More Than Just Tariffs

Dimon's concerns aren't solely focused on the direct impact of tariffs on specific goods. While he acknowledges the immediate costs to consumers and businesses, he emphasizes the broader implications for global supply chains, investment decisions, and overall economic growth. The uncertainty created by fluctuating trade policies, he suggests, discourages long-term planning and investment, hindering innovation and economic expansion.

This isn't just about immediate costs; it's about the chilling effect on future growth. The uncertainty makes it difficult for businesses to make long-term investments, impacting job creation and overall economic prosperity. Dimon's warning serves as a potent reminder that the economic consequences of trade wars extend far beyond headline numbers.

The Ripple Effect: Global Supply Chain Disruptions

One of the key areas of concern highlighted by Dimon is the disruption to global supply chains. Years of trade tensions have forced companies to re-evaluate their sourcing strategies, leading to increased costs and complexity. This restructuring, while sometimes necessary, represents a significant drag on economic efficiency. The resulting inefficiencies translate into higher prices for consumers and reduced competitiveness for businesses.

- Increased Costs: Tariffs directly increase the cost of imported goods, impacting both businesses and consumers.

- Supply Chain Disruptions: The uncertainty surrounding trade policy leads to complex and costly adjustments in global supply chains.

- Reduced Investment: The lack of clarity and stability discourages long-term investments in businesses and infrastructure.

Looking Ahead: Navigating Uncertainty and Promoting Stability

Dimon's comments underscore the urgent need for a more predictable and stable trade relationship between the US and China. While the immediate impacts of past tariff policies are felt across various sectors, the long-term consequences could be far more damaging. His call for greater stability isn't just a plea for corporate interests; it's a warning about the potential for wider economic instability.

The current economic climate, already grappling with inflation and potential recessionary pressures, is particularly vulnerable to the added uncertainty generated by trade tensions. Experts suggest that a more collaborative approach, focusing on predictable and transparent trade policies, is crucial to mitigating these risks. This requires a shift away from reactive measures towards a more strategic and long-term vision for managing the US-China economic relationship.

Call to Action: Understanding the complexities of global trade and the interconnectedness of national economies is crucial for informed decision-making. Stay informed on the latest developments in US-China trade relations and their impact on the global economy. Further research into the specifics of impacted industries and supply chains will provide a more complete understanding of the challenges and opportunities presented by this dynamic relationship. [Link to a reputable source on US-China trade relations].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan's Dimon Sounds Alarm: US China Tariff Policy And Economic Repercussions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sergio Garcias Controversial Dp World Tour Comeback A Detailed Look

Jun 02, 2025

Sergio Garcias Controversial Dp World Tour Comeback A Detailed Look

Jun 02, 2025 -

Doubled Tariffs On Steel And Aluminum Trumps Justification Faces Sharp Rebuke

Jun 02, 2025

Doubled Tariffs On Steel And Aluminum Trumps Justification Faces Sharp Rebuke

Jun 02, 2025 -

The Truth Behind The Miley And Billy Cyrus Reconciliation Rumors

Jun 02, 2025

The Truth Behind The Miley And Billy Cyrus Reconciliation Rumors

Jun 02, 2025 -

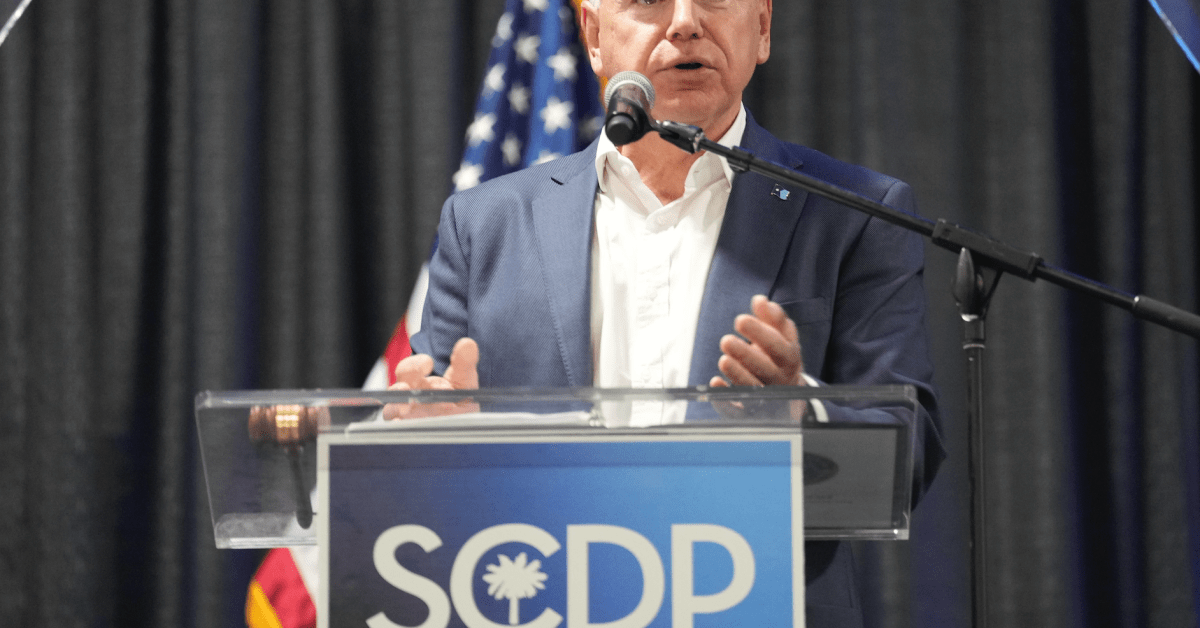

Walz Calls For More Aggressive Democratic Approach Condemns Trumps Actions

Jun 02, 2025

Walz Calls For More Aggressive Democratic Approach Condemns Trumps Actions

Jun 02, 2025 -

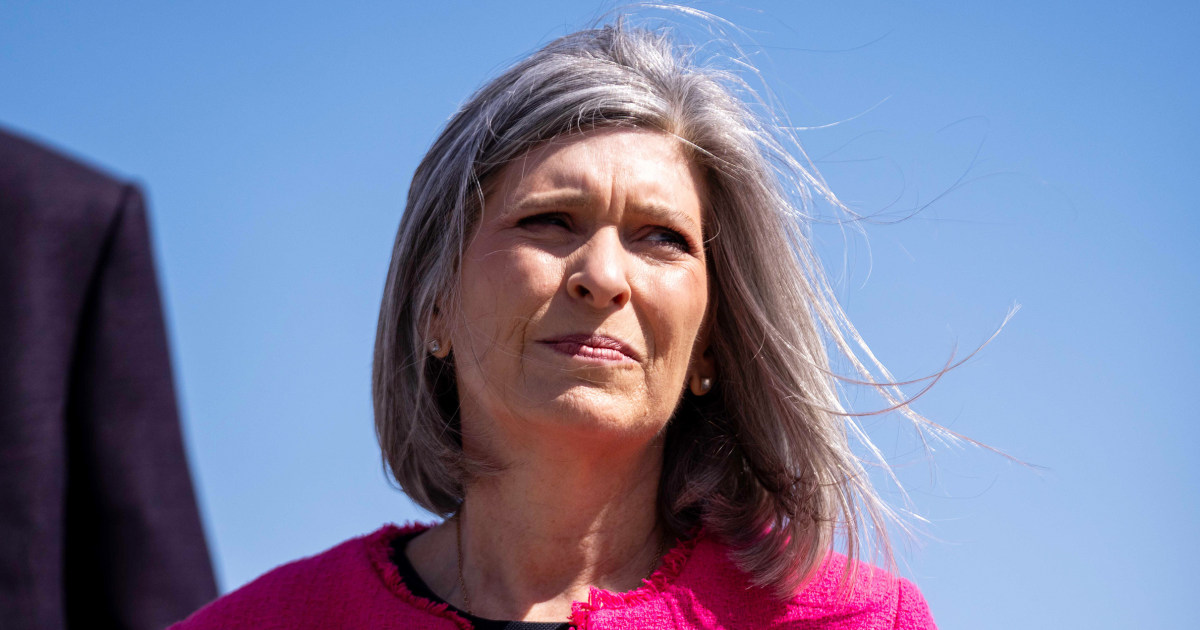

Ernsts Justification For Medicaid Cuts Sparks Outrage We All Are Going To Die

Jun 02, 2025

Ernsts Justification For Medicaid Cuts Sparks Outrage We All Are Going To Die

Jun 02, 2025