JPMorgan's Dimon Sounds Alarm: Internal Risks Threaten US Economic Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan's Dimon Sounds Alarm: Internal Risks Threaten US Economic Stability

JPMorgan Chase CEO Jamie Dimon's recent warning about internal US economic risks has sent shockwaves through financial markets. His comments, delivered during a widely-watched earnings call, paint a concerning picture beyond the usual external pressures like inflation and geopolitical uncertainty. Dimon highlighted a growing list of internal vulnerabilities that could significantly destabilize the US economy, prompting analysts and experts to reassess the nation's financial outlook.

Beyond Inflation: Dimon Pinpoints Internal Threats

While acknowledging the persistent challenges of inflation and the ongoing war in Ukraine, Dimon focused his concerns on several critical internal factors. He didn't shy away from using strong language, emphasizing the potential for a "hard landing" – a sharp economic downturn – if these issues aren't addressed effectively.

Key internal risks highlighted by Dimon include:

-

The looming debt ceiling crisis: The ongoing political stalemate surrounding the US debt ceiling presents a major threat to economic stability. Failure to raise the debt ceiling could lead to a government default, triggering a cascade of negative consequences for the global economy. [Link to reputable source on debt ceiling crisis]

-

Geopolitical uncertainties and their spillover effects: While external, the escalating geopolitical tensions and their impact on global supply chains and energy markets exacerbate existing domestic vulnerabilities, making the US economy more susceptible to shocks.

-

The resilience of the consumer: Dimon expressed concerns about the resilience of the American consumer, suggesting that the current economic strength might be masking underlying weaknesses. The impact of high inflation and rising interest rates on consumer spending remains a significant unknown.

-

The banking sector's health: While acknowledging the resilience of the banking sector following recent regional bank failures, Dimon cautioned about potential future stresses stemming from lingering uncertainties and economic downturns. [Link to reputable article about recent banking sector instability]

A "Hard Landing" Scenario: What it Means for the US Economy

Dimon's warning of a "hard landing" isn't simply hyperbole. Such a scenario would involve a significant economic contraction, potentially leading to:

- Increased unemployment: A sharp economic downturn would likely lead to job losses across various sectors.

- Falling asset prices: Stock markets and real estate values could experience significant declines.

- Reduced consumer spending: Consumers, facing economic hardship, would likely cut back on spending, further dampening economic activity.

What to Watch For: Key Indicators and Future Outlook

Investors and economists are now closely monitoring several key economic indicators to gauge the likelihood of a "hard landing." These include:

- Inflation rates: Continued high inflation could further strain consumer budgets and trigger more aggressive interest rate hikes by the Federal Reserve.

- Unemployment figures: Rising unemployment would be a clear sign of weakening economic activity.

- Consumer confidence indices: Falling consumer confidence suggests reduced spending and economic uncertainty.

Dimon's stark warning serves as a crucial reminder of the complex interplay of internal and external factors influencing the US economy. While the future remains uncertain, proactive policy responses and a careful monitoring of key economic indicators are crucial to mitigating the risks and navigating the potential challenges ahead. The coming months will be critical in determining whether the US can avoid a "hard landing" and maintain economic stability. Stay informed and keep up-to-date with the latest economic news for a clearer understanding of the evolving situation.

Call to Action: Follow reputable financial news sources for the latest updates and analysis on the US economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan's Dimon Sounds Alarm: Internal Risks Threaten US Economic Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

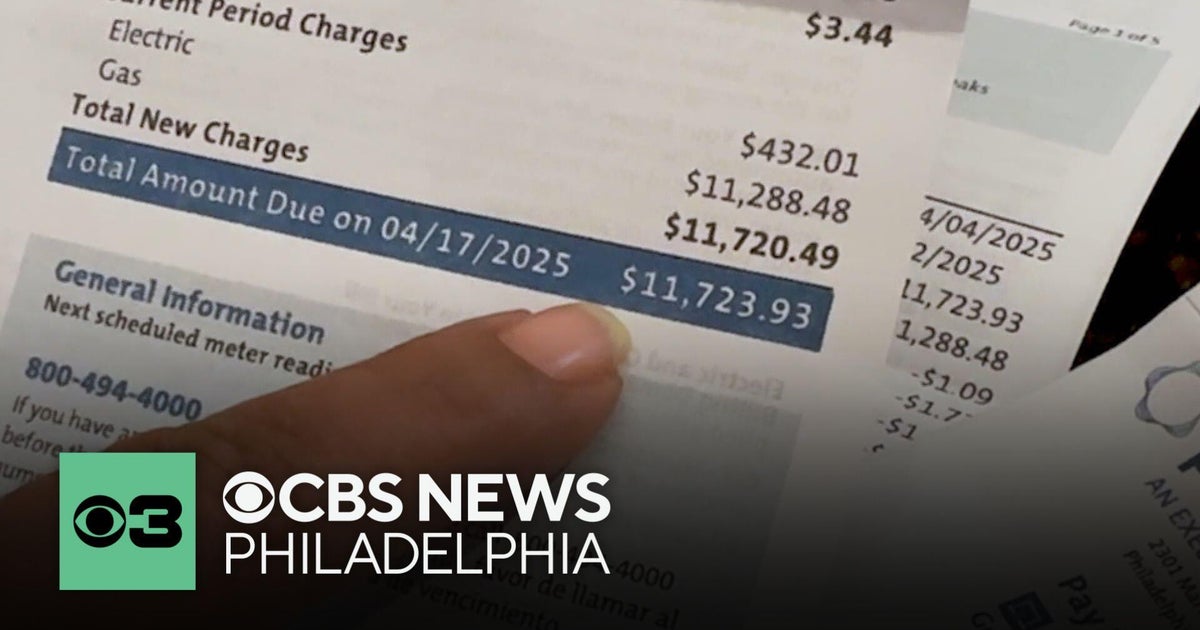

Months Of Missing Bills Lead To 12 000 Peco Energy Bill For Pennsylvania Resident

Jun 02, 2025

Months Of Missing Bills Lead To 12 000 Peco Energy Bill For Pennsylvania Resident

Jun 02, 2025 -

Celebrity Cruises Ship Upgrades A Comprehensive Look

Jun 02, 2025

Celebrity Cruises Ship Upgrades A Comprehensive Look

Jun 02, 2025 -

Minnesota Governor Walz Urges Democrats To Adopt Tougher Stance Criticizes Trump

Jun 02, 2025

Minnesota Governor Walz Urges Democrats To Adopt Tougher Stance Criticizes Trump

Jun 02, 2025 -

Harvards Israeli Jewish Community Under Pressure The Impact Of Trumps Antisemitism Accusations

Jun 02, 2025

Harvards Israeli Jewish Community Under Pressure The Impact Of Trumps Antisemitism Accusations

Jun 02, 2025 -

Backlash Over We Re All Going To Die Remark Joni Ernsts Apology Video

Jun 02, 2025

Backlash Over We Re All Going To Die Remark Joni Ernsts Apology Video

Jun 02, 2025