JPMorgan's Dimon Sounds Alarm: Internal Factors Jeopardize US Economic Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan's Dimon Sounds Alarm: Internal Factors Jeopardize US Economic Stability

JPMorgan Chase CEO Jamie Dimon's latest warning paints a concerning picture for the US economy. Dismissing the current calm as a "lull before the storm," Dimon highlighted significant internal factors that could trigger a significant economic downturn. His stark assessment, delivered during a recent earnings call, sent shockwaves through financial markets and has sparked intense debate among economists. This isn't simply about external pressures like inflation or geopolitical tensions; Dimon's concern centers on vulnerabilities within the American economic system itself.

The Internal Threats to US Economic Stability

Dimon’s warning wasn't a vague prediction; he specifically cited several key internal factors threatening US economic stability:

-

Government Spending and Debt: The staggering US national debt and continued high levels of government spending are unsustainable, according to Dimon. He argues that this fiscal recklessness could lead to higher interest rates, inflation, and ultimately, a recession. This concern is echoed by many economists who are increasingly worried about the long-term implications of the nation's fiscal trajectory. [Link to relevant government debt statistics]

-

The Federal Reserve's Actions: While acknowledging the Fed's efforts to combat inflation, Dimon expressed concern that their actions might inadvertently trigger a deeper economic slowdown than anticipated. The delicate balance between controlling inflation and avoiding a recession remains a major challenge. The effectiveness of the Fed's quantitative tightening policies is also a subject of ongoing debate amongst experts. [Link to a recent Federal Reserve statement]

-

The Banking Sector's Resilience: Although the banking sector weathered the recent regional bank crisis relatively well, Dimon warned about potential vulnerabilities that remain. He stressed the importance of continued vigilance and robust regulatory oversight to prevent future crises. The long-term impact of the recent banking turmoil on credit availability and economic growth is still unfolding.

-

Geopolitical Uncertainty and Supply Chain Issues: While technically external factors, Dimon emphasized their direct impact on the US economy. Ongoing geopolitical instability and lingering supply chain disruptions contribute to inflationary pressures and economic uncertainty. These factors exacerbate the existing internal weaknesses, making the economy more vulnerable to shocks.

What Does This Mean for the Average American?

Dimon's warning carries significant implications for ordinary Americans. A potential economic downturn could lead to:

- Higher Unemployment: A recession often translates into job losses across various sectors.

- Increased Inflation: While the Fed is aiming to curb inflation, internal factors could reignite inflationary pressures.

- Reduced Consumer Spending: Economic uncertainty can lead to decreased consumer confidence and spending, impacting businesses and the overall economy.

Looking Ahead: Preparing for Potential Economic Headwinds

While Dimon's assessment is undoubtedly concerning, it's not a call for panic. Instead, it serves as a wake-up call, highlighting the need for proactive measures to mitigate potential risks. This includes:

- Fiscal Responsibility: Addressing the nation's debt and promoting sustainable government spending is crucial.

- Prudent Monetary Policy: The Federal Reserve needs to carefully navigate the challenges of inflation and economic growth.

- Strengthening the Financial System: Continued vigilance and robust regulation are essential to maintaining the stability of the banking sector.

The future of the US economy remains uncertain. However, by understanding the internal vulnerabilities highlighted by Jamie Dimon, individuals and policymakers can better prepare for potential economic headwinds and work towards building a more resilient and stable economy. Staying informed about economic developments and adapting financial strategies accordingly is crucial in navigating these uncertain times. What are your thoughts on Dimon's warning? Share your perspective in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan's Dimon Sounds Alarm: Internal Factors Jeopardize US Economic Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Report Positive Developments In Miley And Billy Ray Cyrus Relationship

Jun 02, 2025

New Report Positive Developments In Miley And Billy Ray Cyrus Relationship

Jun 02, 2025 -

Best French Open In Decades Shelton Tiafoe And Pauls Quest For Us Tennis Glory

Jun 02, 2025

Best French Open In Decades Shelton Tiafoe And Pauls Quest For Us Tennis Glory

Jun 02, 2025 -

Miley Cyrus Addresses Father Billy Rays Relationship With Elizabeth Hurley

Jun 02, 2025

Miley Cyrus Addresses Father Billy Rays Relationship With Elizabeth Hurley

Jun 02, 2025 -

Jamie Dimons Dire Warning An Enemy Within Threatens The Us Economy

Jun 02, 2025

Jamie Dimons Dire Warning An Enemy Within Threatens The Us Economy

Jun 02, 2025 -

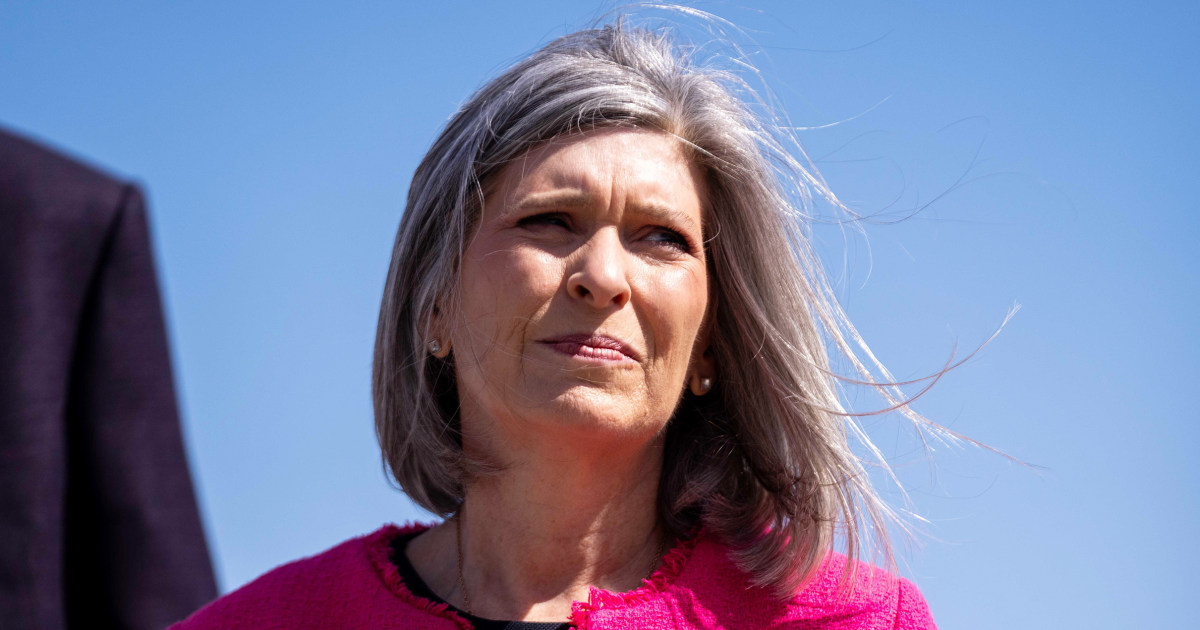

Joni Ernst Faces Backlash Over Proposed Medicaid Cuts Death Remark Sparks Outrage

Jun 02, 2025

Joni Ernst Faces Backlash Over Proposed Medicaid Cuts Death Remark Sparks Outrage

Jun 02, 2025