JPMorgan's Dimon Issues Grave Warning About US-China Tariff Standoff

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan's Dimon Issues Grave Warning About US-China Tariff Standoff: Economic Fallout Looms

JPMorgan Chase CEO Jamie Dimon delivered a stark warning about the escalating US-China trade tensions, highlighting the potentially devastating economic consequences of a prolonged tariff standoff. His comments, made during a recent earnings call, sent shockwaves through financial markets already grappling with rising inflation and slowing global growth. Dimon’s warning underscores the increasingly precarious situation and the urgent need for a resolution to the ongoing trade dispute.

The ongoing trade war between the US and China, marked by tit-for-tat tariffs, has created significant uncertainty for businesses worldwide. Dimon's concerns are not merely hypothetical; they’re rooted in the real-world impact these tariffs are having on supply chains, consumer prices, and global economic stability. He painted a bleak picture, emphasizing the potential for further economic downturn if a resolution isn't found swiftly.

Dimon's Key Concerns:

-

Inflationary Pressures: The tariffs, Dimon argued, are significantly contributing to already high inflation rates. Increased costs for imported goods are passed onto consumers, eroding purchasing power and potentially triggering a recession. This is a significant concern given the current fragile state of the global economy.

-

Supply Chain Disruptions: The ongoing trade war has severely disrupted global supply chains. Businesses are struggling to source materials and deliver goods, leading to production delays and increased costs. This ripple effect impacts various sectors, from manufacturing to retail.

-

Geopolitical Instability: The strained relationship between the US and China extends beyond economics. The geopolitical implications of this standoff are far-reaching and contribute to a general sense of global instability, further impacting investor confidence and economic growth.

-

Impact on JPMorgan Chase: While JPMorgan Chase is a powerful financial institution, even it is not immune to the negative effects of the US-China trade war. Dimon acknowledged that the uncertainty created by the ongoing dispute negatively impacts business decisions and investment strategies.

What's Next? The Urgent Need for a Resolution

Dimon's statement serves as a wake-up call, highlighting the urgent need for a diplomatic resolution to the US-China trade conflict. The potential economic consequences are too severe to ignore. Experts are calling for renewed dialogue and a commitment to finding common ground. Failure to address this issue promptly could lead to significant global economic hardship.

The Broader Context: Global Economic Uncertainty

The US-China trade war isn't operating in a vacuum. It's occurring alongside other significant global economic challenges, including the war in Ukraine, rising energy prices, and persistent supply chain bottlenecks. These factors compound the negative impacts of the trade dispute, creating a highly volatile and uncertain global economic landscape.

Moving Forward: A Call for Action

Dimon's warning isn't just a prediction; it's a call for action. Governments, businesses, and individuals need to understand the gravity of the situation and push for a solution. This requires a commitment to diplomacy, a willingness to compromise, and a recognition that a collaborative approach is essential to navigate these turbulent economic times. The future of the global economy may depend on it. Learn more about the impact of global trade disputes by reading .

Keywords: JPMorgan, Jamie Dimon, US-China trade war, tariffs, inflation, supply chain, global economy, recession, geopolitical instability, economic consequences, trade tensions, economic downturn, global trade, international trade.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan's Dimon Issues Grave Warning About US-China Tariff Standoff. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Luxury Enhanced Celebrity Cruises Details 250 Million Solstice Class Refurbishment

Jun 02, 2025

Luxury Enhanced Celebrity Cruises Details 250 Million Solstice Class Refurbishment

Jun 02, 2025 -

Bondi Limits Abas Influence On Trumps Judge Selections

Jun 02, 2025

Bondi Limits Abas Influence On Trumps Judge Selections

Jun 02, 2025 -

Gbi Investigating Burned Body Discovered At Stone Mountain Park

Jun 02, 2025

Gbi Investigating Burned Body Discovered At Stone Mountain Park

Jun 02, 2025 -

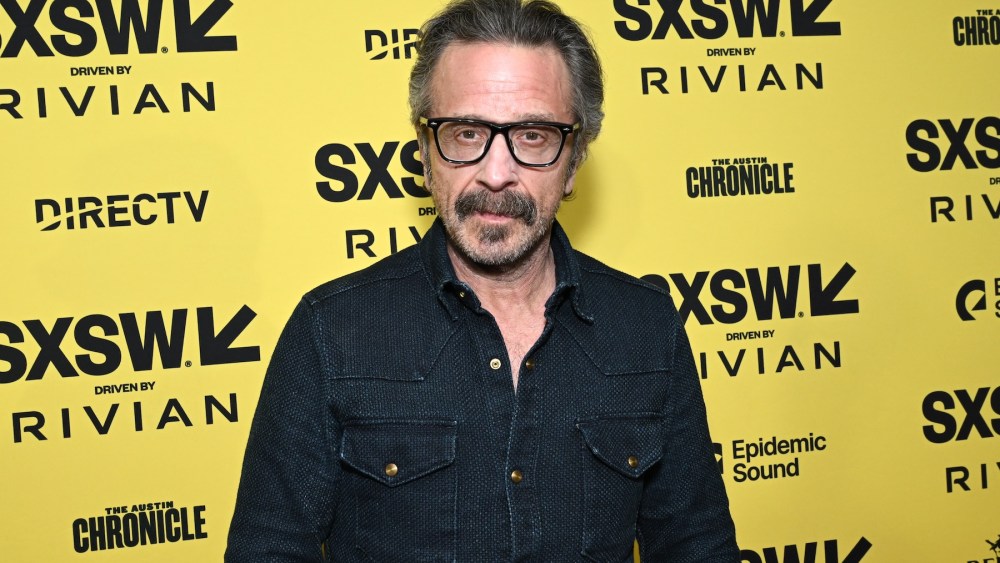

Wtf Podcast To Conclude Marc Marons Long Run Ends

Jun 02, 2025

Wtf Podcast To Conclude Marc Marons Long Run Ends

Jun 02, 2025 -

Actress Sydney Sweeney Selling Used Bathwater Online

Jun 02, 2025

Actress Sydney Sweeney Selling Used Bathwater Online

Jun 02, 2025