JPMorgan Chase CEO Jamie Dimon's Stark Warning On China Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan Chase CEO Jamie Dimon Issues Stark Warning on China Tariffs: Economic Fallout Looms

JPMorgan Chase & Co.'s CEO, Jamie Dimon, has issued a stark warning regarding the ongoing trade tensions between the United States and China, emphasizing the potentially devastating economic consequences of escalating tariffs. Dimon's comments, delivered during a recent earnings call, underscore growing concerns amongst business leaders about the unpredictable nature of the trade war and its impact on global markets. His warning serves as a potent reminder of the interconnectedness of the global economy and the far-reaching effects of protectionist policies.

Dimon's Concerns: Beyond the Headlines

Dimon's concerns extend beyond simple trade imbalances. He highlighted the potential for a significant downturn in the global economy if the tariff war intensifies. He specifically pointed out the detrimental effects on consumer confidence and business investment, both crucial drivers of economic growth. The uncertainty surrounding future trade policies, he argued, creates a chilling effect, discouraging companies from making long-term investments and hindering overall economic expansion. This uncertainty, Dimon stressed, is arguably the most damaging aspect of the ongoing trade dispute.

The Impact on Businesses and Consumers:

The ramifications of escalating tariffs are multifaceted and far-reaching. For businesses, increased import costs translate directly to higher prices for consumers. This can lead to reduced consumer spending, potentially triggering a recessionary spiral. Furthermore, supply chains, already complex and globalized, become increasingly fragile and vulnerable to disruptions. Companies face the difficult choice of absorbing higher costs, reducing profit margins, or raising prices and risking a decline in sales. This precarious situation necessitates proactive risk management and strategic planning for businesses of all sizes.

A Call for De-escalation and Dialogue:

While Dimon didn't offer specific policy recommendations, his comments clearly advocate for a de-escalation of tensions and a renewed commitment to constructive dialogue between the US and China. He implicitly underscored the need for a more predictable and stable global trading environment. The current climate of uncertainty, he implied, is not conducive to sustainable economic growth. This sentiment echoes the concerns of numerous economists and business leaders who believe that prolonged trade conflict will ultimately harm both the US and China, and the global economy as a whole.

Looking Ahead: Navigating Uncertain Waters:

The implications of Dimon's warning are significant. Investors are closely monitoring developments in the trade war, and market volatility reflects the ongoing uncertainty. Businesses are actively reassessing their supply chains and developing contingency plans to mitigate the risks associated with escalating tariffs. Consumers, too, are bracing for potential price increases on various goods. The coming months will be crucial in determining whether the US and China can find a path towards a more stable and cooperative trade relationship. The global economy hangs in the balance.

Keywords: Jamie Dimon, JPMorgan Chase, China tariffs, trade war, US-China trade, economic impact, global economy, recession, supply chain disruption, business investment, consumer confidence, economic uncertainty.

Related Articles: (Links to relevant articles on the topic - replace these with actual links)

- [Link to an article on the impact of tariffs on specific industries]

- [Link to an article on alternative economic forecasts]

- [Link to an article on previous statements by Jamie Dimon]

Call to Action: (Subtle CTA) Stay informed about the evolving US-China trade situation by following reputable news sources and economic analyses. Understanding the potential consequences is crucial for both businesses and consumers.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan Chase CEO Jamie Dimon's Stark Warning On China Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Miley Cyruss Mature Response To Billy Ray Cyrus And Elizabeth Hurleys Romance

Jun 02, 2025

Miley Cyruss Mature Response To Billy Ray Cyrus And Elizabeth Hurleys Romance

Jun 02, 2025 -

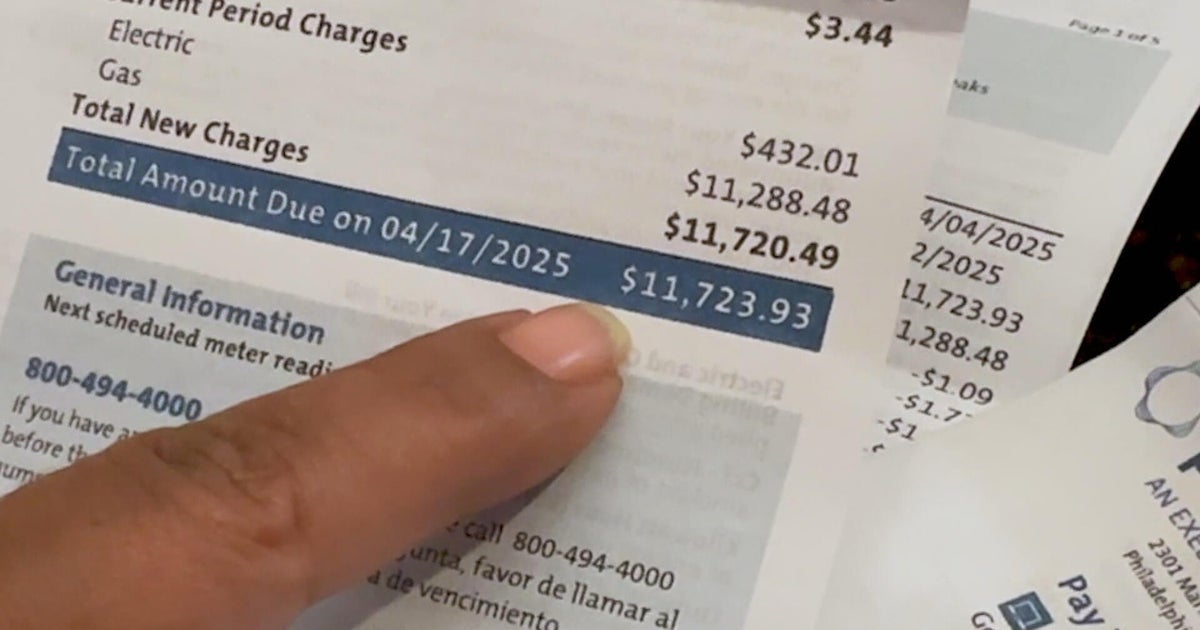

Philadelphia Peco Customers Report Billing Problems One Faces 12 000 Charge

Jun 02, 2025

Philadelphia Peco Customers Report Billing Problems One Faces 12 000 Charge

Jun 02, 2025 -

Joni Ernsts Controversial Medicaid Cut Justification A Closer Look

Jun 02, 2025

Joni Ernsts Controversial Medicaid Cut Justification A Closer Look

Jun 02, 2025 -

Ben Shelton Frances Tiafoe Tommy Paul A New Era For Us Mens Tennis At The French Open

Jun 02, 2025

Ben Shelton Frances Tiafoe Tommy Paul A New Era For Us Mens Tennis At The French Open

Jun 02, 2025 -

Sergio Garcia Makes Progress Towards Ryder Cup Participation

Jun 02, 2025

Sergio Garcia Makes Progress Towards Ryder Cup Participation

Jun 02, 2025