JPMorgan Chase CEO Highlights Key Area For Trump Administration

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan Chase CEO Highlights Key Area for Trump Administration: Tax Reform

JPMorgan Chase & Co.'s CEO, Jamie Dimon, recently pinpointed tax reform as a crucial area needing immediate attention from the Trump administration. His comments, delivered during a high-profile business conference, sparked renewed debate on the economic implications of current tax policies and their impact on corporate investment and job creation. Dimon's emphasis on this issue underscores its significance for both the financial sector and the broader US economy.

<h3>Tax Reform: A Cornerstone of Economic Growth</h3>

Dimon argued that a comprehensive overhaul of the US tax code is vital for stimulating economic growth and boosting American competitiveness on the global stage. He emphasized that the current system, characterized by high corporate tax rates and complex regulations, discourages investment and hinders businesses from expanding and creating jobs. This sentiment echoes concerns voiced by many business leaders who believe that a simplified and more competitive tax structure is essential for attracting foreign investment and fostering domestic growth.

The CEO's comments come at a time when the US economy is facing increasing global competition and navigating periods of economic uncertainty. Experts believe that streamlining the tax code could provide much-needed relief for businesses, allowing them to reinvest profits, expand operations, and ultimately contribute to job creation. A more favorable tax environment, Dimon suggested, could lead to increased capital expenditures, higher wages, and a stronger overall economy.

<h3>Dimon's Call for Action: What's Next?</h3>

Dimon's public call for tax reform isn't just a suggestion; it's a powerful statement from a leading figure in the American financial world. His influence and the weight of JPMorgan Chase's position in the market add significant pressure on the Trump administration to prioritize tax reform initiatives. While specifics on the desired reforms weren't detailed in his comments, the overall message is clear: the current tax landscape is a significant impediment to economic progress.

This isn't the first time Dimon has weighed in on crucial economic policy matters. He's known for his outspoken views and his willingness to engage in public discourse on issues affecting the financial industry and the broader economy. His past pronouncements on various economic topics have often influenced policy discussions and market reactions.

<h3>The Broader Context: Economic Uncertainty and Global Competition</h3>

The call for tax reform comes amidst growing concerns about global economic uncertainty and increased competition from other nations. Many economists believe that a modernized and competitive tax system is essential for the US to maintain its economic leadership. This requires not only lowering corporate tax rates but also simplifying the tax code to reduce compliance costs and administrative burdens on businesses.

Furthermore, the issue of tax reform is closely tied to broader questions of income inequality and social justice. Some argue that a more progressive tax system, alongside tax reforms beneficial to businesses, is necessary to address wealth disparities and create a more equitable society. This complex interplay of economic, social, and political factors makes the debate surrounding tax reform even more significant.

<h3>Looking Ahead: The Path to Tax Reform</h3>

While the specifics of potential tax reforms remain to be seen, Dimon's forceful advocacy for this issue signals a potential shift in the policy landscape. His influence within the business community and his direct appeal to the Trump administration could significantly impact the trajectory of future tax policy discussions. The coming months will be crucial in determining how the administration responds to this call for action and what specific proposals emerge to address the need for comprehensive tax reform. This is a story we will continue to follow closely.

Want to stay updated on the latest developments in financial news and economic policy? Subscribe to our newsletter! (This is a subtle CTA)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan Chase CEO Highlights Key Area For Trump Administration. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Metal Tariffs Surge Trumps Explanation And The Warnings From Critics

Jun 03, 2025

Metal Tariffs Surge Trumps Explanation And The Warnings From Critics

Jun 03, 2025 -

Scientists Baffled By Strange Stars Pulsating Light

Jun 03, 2025

Scientists Baffled By Strange Stars Pulsating Light

Jun 03, 2025 -

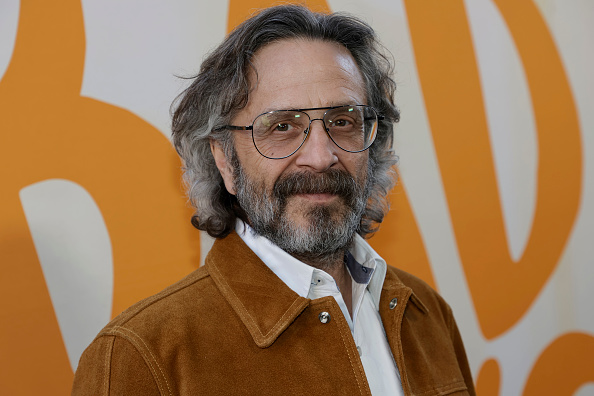

Longtime Podcast Wtf With Marc Maron To Conclude After Successful 16 Year Run

Jun 03, 2025

Longtime Podcast Wtf With Marc Maron To Conclude After Successful 16 Year Run

Jun 03, 2025 -

Chinese Ev Maker Nios Q1 Earnings Preview Delivery Numbers And Tariff Concerns

Jun 03, 2025

Chinese Ev Maker Nios Q1 Earnings Preview Delivery Numbers And Tariff Concerns

Jun 03, 2025 -

Al Rokers Lasting Weight Loss Diet Exercise And Mindset

Jun 03, 2025

Al Rokers Lasting Weight Loss Diet Exercise And Mindset

Jun 03, 2025