JPMorgan CEO Sounds Alarm: Internal Risks Jeopardize US Economic Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan CEO Sounds Alarm: Internal Risks Jeopardize US Economic Stability

Jamie Dimon's stark warning highlights vulnerabilities within the US financial system, urging immediate action to prevent a potential crisis.

JPMorgan Chase CEO Jamie Dimon recently issued a stark warning, asserting that internal risks within the US financial system pose a significant threat to the nation's economic stability. His comments, delivered during a recent earnings call, sent shockwaves through the financial markets and sparked intense debate among economists and policymakers. Dimon, known for his candid assessments of the economic landscape, didn't mince words, highlighting several key areas of concern that require immediate attention.

Beyond Inflation: A Deeper Dive into Systemic Risks

While inflation and geopolitical tensions remain significant headwinds, Dimon emphasized that internal vulnerabilities within the US financial system represent a potentially more dangerous threat. He didn't specify exact details for competitive reasons, but his concerns point towards a confluence of factors contributing to this instability. These factors include:

-

Elevated Debt Levels: The soaring national debt, coupled with increasing household and corporate debt, creates a fragile financial landscape. A sudden economic downturn could trigger widespread defaults, cascading through the financial system. This echoes concerns raised by the regarding the long-term sustainability of the national debt.

-

Geopolitical Uncertainty: The ongoing war in Ukraine and heightened tensions with China add significant uncertainty to the global economy. These factors can easily disrupt supply chains, impact energy prices, and further destabilize already fragile financial markets.

-

Regulatory Overreach (or Lack Thereof): Dimon's comments subtly hinted at potential regulatory gaps or inconsistencies that could exacerbate existing vulnerabilities. While he stopped short of explicitly criticizing specific regulations, the implication was clear: the current regulatory framework might not be sufficient to withstand a major economic shock. This raises questions about the effectiveness of existing banking regulations and the need for potential reforms.

The Need for Proactive Measures

Dimon's message wasn't solely one of doom and gloom. He stressed the importance of proactive measures to mitigate these risks. This includes:

-

Strengthening Regulatory Frameworks: A comprehensive review of existing regulations is crucial to identify and address any gaps that could leave the financial system exposed to unforeseen risks. This might involve strengthening capital requirements for banks and other financial institutions.

-

Fiscal Responsibility: Addressing the nation's soaring debt levels is paramount. Implementing responsible fiscal policies, including reducing government spending and increasing revenue, is essential for long-term economic stability.

-

Investing in Infrastructure: Investing in infrastructure projects can boost economic growth and create jobs, helping to bolster the economy's resilience against external shocks.

What Does This Mean for the Average American?

Dimon's warning should serve as a wake-up call for all Americans. The potential for an economic crisis stemming from internal vulnerabilities is a serious concern. While it's impossible to predict the exact timing or severity of such a crisis, being informed and aware of the risks is crucial. Staying informed about economic news and understanding the implications of these internal risks can help individuals and families make informed financial decisions.

The future stability of the US economy hinges on addressing these systemic risks. The question is not if action is needed, but when and how decisively we will respond. This requires collaboration between policymakers, regulators, and the private sector to ensure a resilient and stable financial system for years to come. Stay tuned for further developments and analysis on this critical issue.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan CEO Sounds Alarm: Internal Risks Jeopardize US Economic Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Saharan Dust A Colossal Cloud Moves From Caribbean To The United States

Jun 03, 2025

Saharan Dust A Colossal Cloud Moves From Caribbean To The United States

Jun 03, 2025 -

Ro Khanna Leads Union Protest Against Federal Job Cuts

Jun 03, 2025

Ro Khanna Leads Union Protest Against Federal Job Cuts

Jun 03, 2025 -

2 C World A Companys Urgent Guide To Climate Change Preparedness

Jun 03, 2025

2 C World A Companys Urgent Guide To Climate Change Preparedness

Jun 03, 2025 -

After 16 Years Marc Maron Cancels Popular Wtf Podcast

Jun 03, 2025

After 16 Years Marc Maron Cancels Popular Wtf Podcast

Jun 03, 2025 -

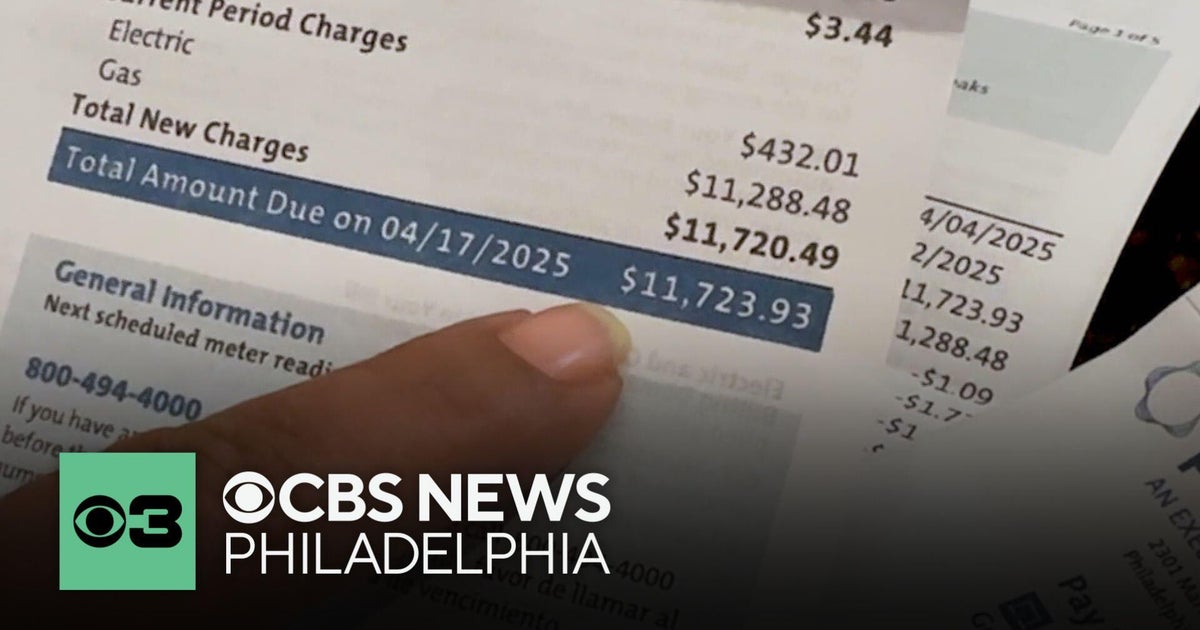

Months Of Missing Bills Lead To 12 000 Peco Surprise For Pennsylvania Customer

Jun 03, 2025

Months Of Missing Bills Lead To 12 000 Peco Surprise For Pennsylvania Customer

Jun 03, 2025